TLDR;

This video explores the growing issue of elderly poverty in South Korea, particularly among women, and challenges traditional cultural norms that exacerbate the problem. It highlights the stories of elderly individuals struggling with financial hardship due to factors like divorce, lack of retirement planning, and a strong emphasis on investing in their children's futures. The video also presents potential solutions, such as housing pensions and mindful consumption habits, to encourage proactive retirement planning and financial independence in old age.

- Elderly poverty is a growing issue, especially among women.

- Traditional Korean culture of investing heavily in children contributes to lack of retirement savings.

- Housing pensions and mindful consumption are presented as potential solutions.

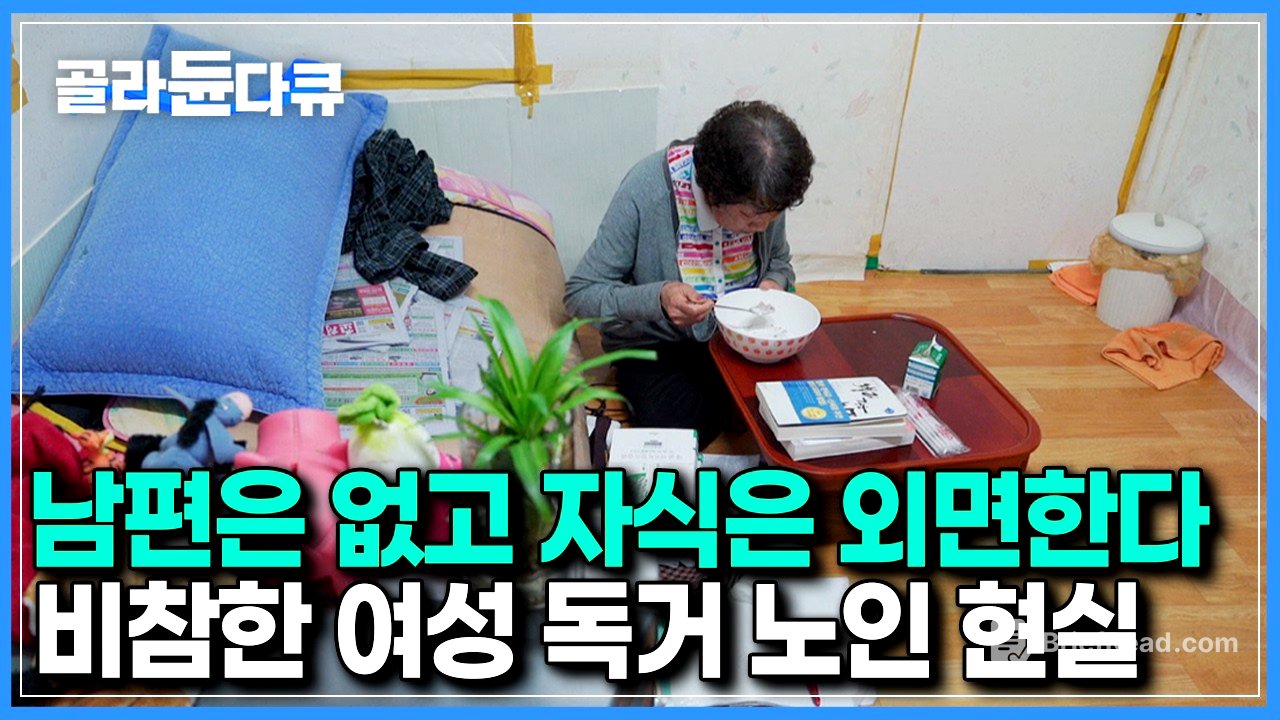

The Plight of Elderly Women in Single-Person Households [0:01]

The video begins by highlighting the increasing number of elderly individuals, particularly women, living alone and facing financial difficulties. It presents the story of 80-year-old Kyung-sook Cho, a former kindergarten teacher who now lives in poverty after a divorce and lack of retirement planning. Despite her past success, she struggles to make ends meet, relying on basic living expenses and often skipping meals. This situation underscores the vulnerability of elderly women, who are more likely to experience poverty due to their longer life expectancy and the need to care for themselves without sufficient retirement funds.

The Bankruptcy Crisis Among the Elderly [3:18]

The video shifts to the rising bankruptcy rates among the elderly, linking it to unique aspects of Korean culture. It introduces an elderly couple in their 80s, Jang Bok-nyeo and her husband, who earn a meager living by collecting scrap paper. Despite owning a small villa, they are ineligible for basic livelihood security benefits and struggle to afford necessities, including medical care. Jang Bok-nyeo expresses her aversion to receiving handouts and her sadness at not being able to afford simple comforts.

The Burden of Child-Centric Investment [6:07]

The video identifies the heavy investment in children's success as a major factor contributing to elderly poverty in Korea. It shares stories of elderly individuals who spent significant amounts of money on their children's education, housing, and weddings, leaving them with insufficient retirement funds. This cultural norm, where parents prioritize their children's well-being and future over their own retirement security, is contrasted with practices in foreign countries. The tendency to hold onto real estate to pass it down to future generations further exacerbates the problem, leading to a situation of "old-old inheritance" where assets are transferred too late to benefit anyone significantly.

Housing Pensions as a Solution [8:56]

The video presents housing pensions as a viable solution for elderly individuals lacking retirement funds. It introduces a couple in their mid-70s, Go Eun-shim and Lee Ki-yong, who are using their house as collateral to receive a monthly pension. This allows them to maintain their independence and avoid becoming a financial burden on their children. The couple emphasizes the importance of advance planning and expresses satisfaction with the financial security provided by the housing pension.

Strategies for Retirement Planning [10:40]

The video concludes by offering practical strategies for retirement planning, categorizing them as "addition" and "subtraction." "Addition" involves increasing income through continued work and pension investments, while "subtraction" focuses on reducing unnecessary consumption. Examples include selling a mid-sized car to save on maintenance costs and adopting the "cafe latte effect" by cutting back on small daily expenses. The video stresses that with the decline of traditional family support systems, thorough retirement preparation is essential to avoid poverty in old age.