TLDR;

This YouTube video features a detailed discussion on personal finance, tailored for Gen Z and young millennials in India. Shahan Hirani simplifies complex financial concepts, emphasizing the importance of financial literacy, smart investment strategies, and adapting to the dynamic economic landscape. The conversation covers common financial mistakes, effective use of credit cards, tax planning, and the significance of financial discipline. It also addresses the changing definition of a "dream life" in the face of inflation and social media influence, offering practical advice on managing money, increasing income, and making informed financial decisions.

- Financial literacy and smart investment strategies are crucial for financial success.

- Adapt to the dynamic economic landscape.

- Financial discipline is key.

Intro: Pop Sugar Financial Advice [0:00]

The host introduces the episode as a "Pop Sugar financial advice ultimatum" or "Jenzi money manual" for Indian YouTube, aiming to simplify finance for a broad audience. He shares his initial intimidation with finance at a younger age and expresses the goal of making the subject digestible for everyone, especially those in their early twenties. The discussion promises to be deep but accessible, intending to benefit both younger and older generations.

Life Update and Money Mindset [5:42]

Shahan shares a life update, dividing his focus into money, health, and relationships, noting that while money and relationships are good, he's focusing on health due to physical pain from podcasting. He emphasizes that money is mathematics, focusing on the flow of money in and out of one's life. He highlights the common focus on earning more money (salary) but stresses the importance of multiple income sources like passive income from rent and investments.

Optimizing Expenses and Financial Planning [8:56]

Shahan discusses strategies to retain as much money as possible, including tax planning and expense optimization. He notes that 99% of people don't analyze their bank statements to understand where their money goes. He suggests saving 10-20% by using the right financial tools and planning for worst-case scenarios like medical emergencies, advocating for health insurance coverage of 25-50 lakhs.

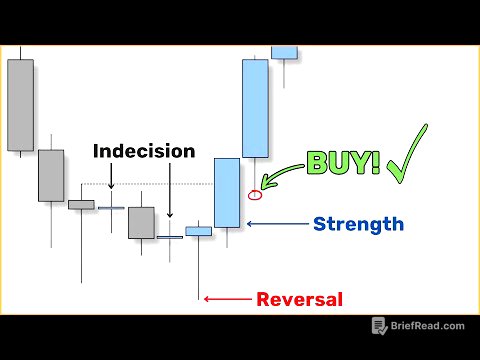

Growing Your Money and Understanding Leverage [11:01]

Shahan advises against sticking to traditional options like FDs and gold, suggesting investments in assets with potential growth of 15-25%. He explains that with understanding and active monitoring, higher returns are possible. He introduces the concept of leverage using FNO (futures and options) trading as an example, where a small capital can control a larger exposure, increasing potential profits but also risks.

Financial Literacy and Avoiding Scams [12:20]

Shahan emphasizes understanding the mathematics behind financial decisions and recognizing scams by financial companies pushing incorrect products. He estimates that less than 0.1% of people fully understand these concepts, even chartered accountants often have a limited focus on taxes. He stresses the importance of learning from smarter people and highlights that most of his learnings come from conversations with individuals with generational wealth.

Dream Life and the Impact of Inflation [15:29]

Shahan discusses the changing definition of a "good life" due to inflation, noting that what was once considered a comfortable income (e.g., 30 lakhs per annum) is now seen as insufficient by some on social media. He points out that the cost of living has increased significantly, especially for urban Indians, with inflation rates much higher than the government's reported figures. He estimates that a single person needs to spend ₹1.5 to ₹2 lakhs per month to feel financially secure in India today.

Urban Indian Challenges and Questioning the Status Quo [19:42]

The conversation shifts to the challenges faced by urban Indians, including high rent-to-income ratios, poor air quality, and time wasted in traffic. Shahan encourages Gen Z to question these conditions and not just focus on social media experiences. He suggests visiting foreign countries to gain perspective and recognize the different realities of life outside urban India.

Brain Drain and the Responsibility of Urban Indians [28:00]

The discussion addresses the "brain drain" issue, with the host sharing his past decision to stay in India and contribute to the nation. However, he notes that the foreign minister has stated that Indians abroad are valuable for pumping money back into the country and helping with soft power. Shahan suggests that urban Indians who can speak English have a responsibility to build global businesses, which are more likely to succeed with a base abroad.

Financial Advice for Gen Z [29:05]

Shahan provides financial advice for Gen Z, dividing them into two categories: those from upper-middle-class backgrounds who can ask their parents for investment money and those from middle-class backgrounds. For the former, he suggests learning how to grow money by starting with a small investment. For the latter, he emphasizes increasing income sources and avoiding greed-driven, high-leverage trading.

Character Traits for Financial Freedom and Increasing Income [30:41]

Shahan describes the character traits needed for financial freedom, including a hunger to be financially independent. He notes that those from business families often have a better understanding of money management. For those without a privileged background, he advises increasing income sources, solving problems at work, and becoming irreplaceable to command higher salaries.

Minimizing Lifestyle and the Reality of Saving [38:49]

The discussion explores the difficulty of minimizing lifestyle in today's glamour-driven world. Shahan points out that the ways to spend money have increased, and what were once wants have become needs. He notes that many young professionals save very little due to high rents, EMIs, and social media-driven desires. He suggests that those earning ₹50,000 per month should focus on increasing their income rather than just saving.

Strategies for Saving and Increasing Income [42:56]

Shahan shares his personal example of saving while earning a modest salary by minimizing expenses and living frugally. He emphasizes the importance of knowing one's market value and switching jobs to increase income significantly. He also suggests living with parents to save on rent and build a financial foundation quickly.

Game Taping Your Career and the Importance of Hunger [49:00]

The host asks Shahan to "game tape" his career, reflecting on his mentality and progress. Shahan notes that the same hunger he saw in the host five years ago is still present. He attributes this hunger to childhood trauma and highlights that many people in their age group have lost this drive.

Mindset for Success and the Value of Mentors [52:13]

Shahan defines the mindset needed for success as constantly seeking a better way of living in all aspects of life. He emphasizes the importance of learning from people who are better than you and surrounding yourself with those who are where you want to be. He suggests having multiple mentors and being open to new ideas and perspectives.

Generational Differences and the Impact of Social Media [56:30]

The discussion explores the differences between millennials and Gen Z, noting that Gen Z is less willing to accept boring work and more focused on the quality of their life. Shahan suggests that social media has accelerated these differences, leading to increased FOMO (fear of missing out) among Gen Z.

Wedding Budgets and Business Partnerships [1:00:26]

The conversation touches on wedding budgets, with Shahan expressing his desire for a simple wedding. He advises against starting businesses with close friends or family due to the risk of damaging relationships.

The Ugly Side of Success and Prioritizing Relationships [1:02:50]

Shahan discusses the trade-offs of pursuing financial success, including neglecting relationships. He realizes that love and family are equally important and that money alone cannot bring fulfillment.

Lifestyle at Different Income Levels and Savings Targets [1:05:10]

Shahan describes the lifestyle one can afford at different income levels, noting that a comfortable life in a metro city requires spending ₹7-8 lakhs per month. He estimates that a corpus of ₹15 crores is needed to maintain this lifestyle indefinitely, while ₹30 crores is necessary to provide a luxurious life for children, including private education and expensive weddings.

Common Financial Mistakes: Credit Cards and Buying Houses Too Early [1:17:02]

Shahan lists four common Indian financial mistakes: buying a house too early, starting investments too late, not understanding taxation, and misusing credit cards. He explains how to use credit cards effectively to get 20% returns through free flights and hotels. He estimates that only 10,000 people in India know how to use credit cards properly.

Taxation and the Role of a Chartered Accountant [1:20:46]

Shahan explains how to save on taxes through profit and loss harvesting, noting that most people don't utilize these techniques. He describes the traits of a great CA, emphasizing that they should provide investment advice and help clients plan for the future. He notes that most CAs don't care about salaried individuals due to the low fees they charge.

AI in Finance and the Importance of Starting Early [1:27:14]

Shahan discusses the potential role of AI in personal finance, noting that AI is not yet good at mathematics and can provide outdated advice. He estimates that fantastic financial AI agents are 5 years away. He emphasizes the importance of starting investments early and learning how money works.

Lottery Winners and the Inability to Manage Money [1:29:14]

Shahan shares that most lottery winners end up losing their money due to a lack of financial literacy. He also mentions that many people with high salaries are in debt because they don't know how to control their expenses or evaluate financial products.

Financial Advice and the Importance of Asking Questions [1:32:10]

The host shares his strategy of asking finance experts for advice and making them explain things in simple terms. Shahan emphasizes the importance of giving people option B, providing alternatives that align with their desires while being financially sound.

Buying a Car and Financial Engineering [1:33:17]

Shahan shares his experience of buying a Range Rover, demonstrating how he used financial engineering to save money. He bought a three-year-old car, took a loan against his FD, and used his credit card to pay a portion of the car, earning rewards points.

The Importance of Financial Savvy and Emotional Control [1:37:10]

The host notes that most people won't follow Shahan's exact strategy but can still benefit from his advice. Shahan emphasizes that a car is an emotional purchase and that many people buying expensive cars cannot afford them. He stresses the importance of looking at monthly outflows and avoiding depreciating assets.

The Role of Emotion in Financial Decisions [1:39:29]

Shahan emphasizes that emotion is the biggest enemy of financial discipline. He advises running large financial decisions by multiple financial experts. He shares his personal practice of consulting his co-founder, parents, and wealthier friends before making any significant financial decisions.

Creating a Base in the Hills or Goa and Breaking Time Constraints [1:55:44]

The host asks for advice on creating a base in the hills or Goa. Shahan suggests breaking free from time constraints by finding companies with flexible work policies. He notes that living in these locations can significantly reduce the cost of living.

Homeschooling and the Future of Urban Cities [1:59:51]

Shahan mentions the growing trend of homeschooling and suggests that urban cities should be seen as stepping stones rather than permanent residences. He believes that urban cities will not improve significantly in the next 10 years and that people who can speak English should consider marketing themselves abroad.

The Power of AI and the Importance of Knowledge [2:05:11]

Shahan emphasizes that the problem is not a lack of opportunities but procrastination. He notes that AI tools have made it easier for people to become rich. He believes that even if he lost all his money and fame, he could make it back within five years due to his knowledge.

The Role of AI Agents in Personal Finance [2:06:40]

Shahan discusses the potential role of AI agents in personal finance, noting that the right approach is to first make AI understand everything about your finances. He explains the account aggregator framework, which allows AI to access financial data. He stresses the importance of telling AI the purpose of your investing and answering smart questions to create a personalized financial plan.

The Limitations of AI and the Value of Human Advisors [2:09:36]

Shahan notes that AI will not be able to handle emotions well and that a human advisor will still be important. He believes that AI will not be able to solve the emotional and behavioral management of individuals when the market goes down.

The Value of Fintech Startups and the Credit Score Myth [2:12:19]

Shahan argues that fintech apps have not added any value to Indian consumers' lives. He explains that these apps make money by pushing trading and personal loans, often leading to losses for users. He also debunks the myth that one needs to take a loan to improve their credit score.

Good Loans vs. Bad Loans and the Importance of Financial Planning [2:19:58]

Shahan differentiates between good loans and bad loans, noting that any interest rate less than 8% is a good loan. He emphasizes that all loans are not bad and that even the richest people borrow money to invest in the right places. He advises against paying for education upfront, even if you have the money, and encourages taking advantage of low-interest education loans.

Financial Advice for the Future and Building a Cushion [2:20:54]

Shahan advises building a cushion for the future, assuming the worst-case scenario of job obsolescence. He suggests building an emergency corpus and upskilling to avoid long-term unemployment. He also recommends investing in inevitable sectors like AI and green energy but keeping the majority of money in safe assets.