TLDR;

This video explains how to read candlestick patterns to understand market dynamics, make informed trading decisions, and avoid potential losses. It introduces three main types of candlesticks: strength candles, control shift candles, and indecision candles, detailing what each reveals about the balance between buyers and sellers. The video emphasizes that understanding these patterns and the stories they tell about market psychology is crucial for successful trading.

- Candlesticks reflect the battle between buyers and sellers.

- Strength candles indicate clear control by buyers or sellers.

- Control shift candles signal potential reversals.

- Indecision candles show equal buying and selling pressure.

- Context is crucial when interpreting candlestick patterns.

WHY Candles matter [0:00]

Understanding candlesticks is essential for interpreting the market, making accurate trades, avoiding losses, and staying aligned with market trends. Each candlestick tells a story, and mastering them allows traders to read the market effectively. While candlesticks may appear different, they can be categorized into three main types: strength candles, control shift candles, and indecision candles.

'Strength' Candles [0:42]

Strength candles indicate clear control by either buyers or sellers. A bullish strength candle opens lower and closes higher, featuring a large body and a small upper wick, signifying strong buying pressure. Conversely, a bearish strength candle opens higher and closes lower, with a large body and a small lower wick, indicating strong selling pressure. The small wicks suggest uninterrupted buying or selling, with minimal resistance from the opposing side. Bullish candles with no upper wick and bearish candles with no lower wick are even stronger signals, showing complete dominance by buyers or sellers. When these candles appear, traders should align with the strength and avoid trading against it. The size of the candle body also matters, with larger bodies indicating stronger control. An engulfing pattern, where one candle engulfs multiple previous candles, is a type of strength candle that signifies a takeover in control by buyers or sellers.

'Control Shift' Candles [6:09]

Control shift candles signal a potential reversal in the market. These candles have large wicks that show rejected price action. A large upper wick indicates that buyers attempted to push the price higher, but sellers reversed the move, suggesting a potential selling opportunity. Conversely, a large lower wick shows sellers trying to push the price lower, but buyers took control, hinting at a possible buying opportunity. The color of the candle body (bullish or bearish) is not as important as the wick, which tells the story of the control shift. A pin bar is a type of control shift candle. The key is to understand the battle between buyers and sellers rather than just recognizing the pattern.

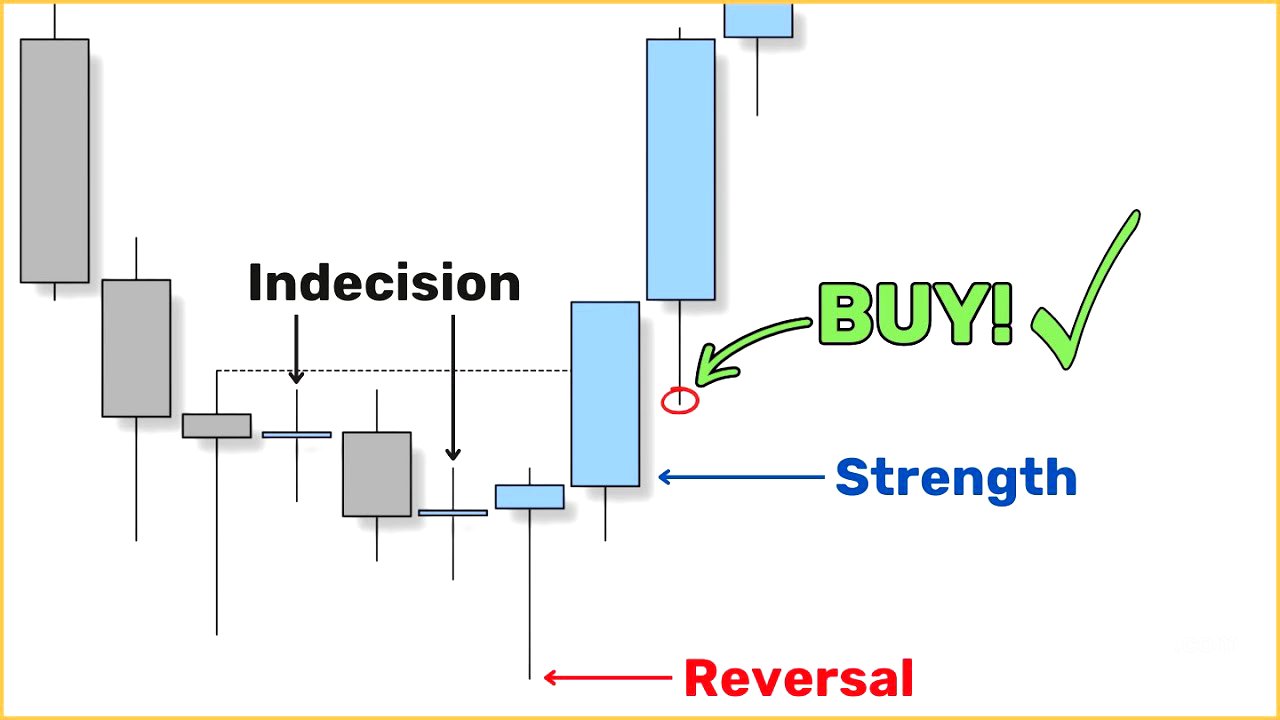

'Indecision' Candles [9:21]

Indecision candles, also known as "dogees," indicate that neither buyers nor sellers are in control, with buying and selling pressure being equally weighted. These candles have relatively equal wicks on both sides and an open and close price that are close together, showing little movement. While indecision candles are not directly tradable, they can be used to gauge potential reversals or to identify breakout opportunities. If the market breaks out of the range established by an indecision candle, traders can look for pullbacks to buy or sell in the direction of the breakout. Indecision candles can also signal a potential slowdown in momentum at key points of interest, such as supply or demand zones, suggesting a possible reversal.

Candlesticks in real market context [12:15]

In real market scenarios, strength candles drive upward and downward movements, control shift candles indicate potential reversals, and indecision candles signal market slowdowns. Demand zones, where significant buying has occurred, can be identified by looking at indecision candles followed by strength candles. If the market returns to these demand zones, another wave of buying may occur. Analyzing the speed of price movements, or multi-candle momentum, can provide insights into the strength of buyers and sellers. Faster movements indicate stronger control.

Building a trade idea with Candlestick reading [22:00]

To build a trade idea, consider the bigger picture narrative, looking at the speed and strength of buying and selling movements. Identify high-interest buying points and watch for control shifts and indecision candles, which can signal potential buying opportunities. Confirm these signals with strength candles and look for closures above notable structure points. For example, if the market is generally bullish with strong, fast buying moves and slower, choppier selling moves, look for areas where major buying started. If the market returns to these areas and shows control shifts and indecision, followed by strength candles, it may be a good opportunity to buy.

Free System building course [27:14]

The video promotes a free course on building a trading system, simplifying trading, improving trades, and finding success. A link to the course is provided in the video description.