TLDR;

Michael Burry, known for predicting the 2008 financial crisis, has made a significant investment move by putting 100% of his portfolio into Estée Lauder (EL). This decision is particularly noteworthy because Burry sold all his previous holdings, including his positions in Chinese stocks, to focus solely on this beauty and personal care company. While Estée Lauder's stock is down significantly from its all-time high and has shown some positive momentum recently, its high valuation and lack of growth raise questions about the rationale behind Burry's investment.

- Michael Burry invested 100% of his portfolio in Estée Lauder.

- Estée Lauder's stock is down significantly from its all-time high.

- The company's high valuation and lack of growth raise questions about the investment.

Michael Burry's Bold Move: All-In on Estée Lauder [0:00]

Michael Burry, known for his successful bet against the subprime mortgage crisis, has revealed in the latest 13F filings that he has placed 100% of his portfolio in Estée Lauder (EL). This move is particularly surprising as he liquidated all his previous holdings, including positions in Chinese companies like PDD, BABA, and JD.com. Burry was one of the few hedge fund managers who saw gains this quarter, making his concentrated bet even more noteworthy.

Estée Lauder: Company Overview [1:22]

Estée Lauder is a major player in the beauty and personal care industry, with a focus on makeup, skincare, fragrance, and hair care. Despite being a large company with a $23 billion market cap, its fundamentals raise concerns. The stock is down over 80% from its all-time high, showing potential signs of capitulation and a shift in momentum with higher highs and higher lows. A recent earnings beat also contributed to a gap up in the stock price.

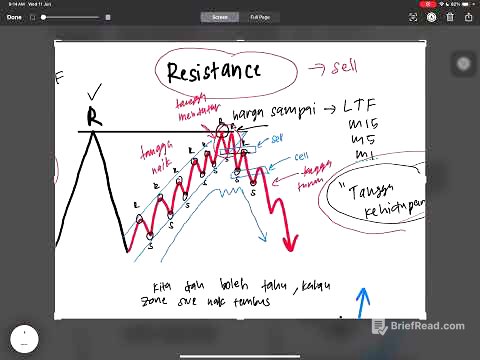

Technical and Fundamental Analysis of Estée Lauder [2:29]

From a technical perspective, Estée Lauder shows some promise with a green tag on a lower time frame and the stock holding above the EMA. A breakout above the trend line resistance could signal a more significant bullish move. However, fundamentally, the stock appears overvalued with a forward PE of 44, which is double the S&P 500 average. Additionally, the company's growth is negative, with projected losses in the coming years.

Valuation and Profitability Concerns [4:22]

Estée Lauder's valuation metrics are concerning, with a high PEG ratio of 8.7, indicating it is not undervalued when growth is considered. Despite a gross profit margin of 74%, the company struggles to translate this into bottom-line profits, suggesting issues with operating expenses. Revenue is declining year-over-year, impacting profitability, and the company has not effectively managed expenses in response to slowing growth.

Future Outlook and Analyst Revisions [6:47]

Analysts covering Estée Lauder have outlined a strategic return to growth next year through their "beauty reimagined" initiative, which aims to make the company leaner and more consumer-centric. While there have been more up revisions than down revisions in earnings estimates, the presence of down revisions suggests some uncertainty. The company's solid gross margins and expansion in non-travel retail business provide some positive signals.

Industry Context and Investment Strategy [7:37]

The beauty industry is highly competitive, and factors like tariffs could significantly impact companies like Estée Lauder. Unlike growth-oriented companies such as ELF and Honest, Estée Lauder is a mature company facing challenges in achieving further growth. The primary avenues for growth would be through margin improvement and share buybacks, as multiple expansion is unlikely given its already high valuation.

Final Thoughts on Estée Lauder's Potential [9:16]

Technically, Estée Lauder is showing initial signs of a potential turnaround with higher highs, higher lows, and a gap up following strong earnings. However, more confirmation is needed, such as a breakout with strong volume and green momentum indicators. While the stock may present a decent trading opportunity, further investigation into the company's fundamentals and earnings calls is warranted before considering it as a long-term investment. Michael Burry's 100% allocation to Estée Lauder reflects a high level of conviction, but it remains to be seen whether this bet will pay off.