TLDR;

This video explains liquidity in trading, emphasizing its importance in identifying market movements and avoiding losses. It covers three main forms of liquidity: equal highs and lows, trend liquidity, and range liquidity. The video details how to identify and use these liquidity forms to improve trading strategies, set targets, and determine entry points, with practical examples.

- Liquidity refers to orders or money that drive market movements.

- Three forms of liquidity: equal highs and lows, trend liquidity, and range liquidity.

- Understanding liquidity helps in setting targets, identifying reversal points, and avoiding losses.

Introduction [0:00]

The video introduces the concept of liquidity in trading, highlighting its importance in identifying market magnet areas and potential reversal points. Understanding liquidity can lead to better trades with clear targets and fewer losses. The lesson will cover three forms of liquidity, aiming to equip viewers with the knowledge to trade liquidity effectively.

What is Liquidity? [0:36]

Liquidity refers to orders or money that drive market movements. Markets move based on order flow: more buying leads to upward movement, while more selling leads to downward movement. Significant moves require substantial orders, often found at swing highs and lows, where traders place stop losses and take profits, causing market reactions and reversals.

3 forms of Trading Liquidity [1:57]

There are three identifiable forms of liquidity: equal high and equal low liquidity, trend liquidity, and range liquidity. Equal high and equal low liquidity are the most common and easiest to trade. Identifying liquidity involves determining where the majority of orders are likely placed, which is crucial for effective trading.

Equal High & Equal Low Liquidity [2:40]

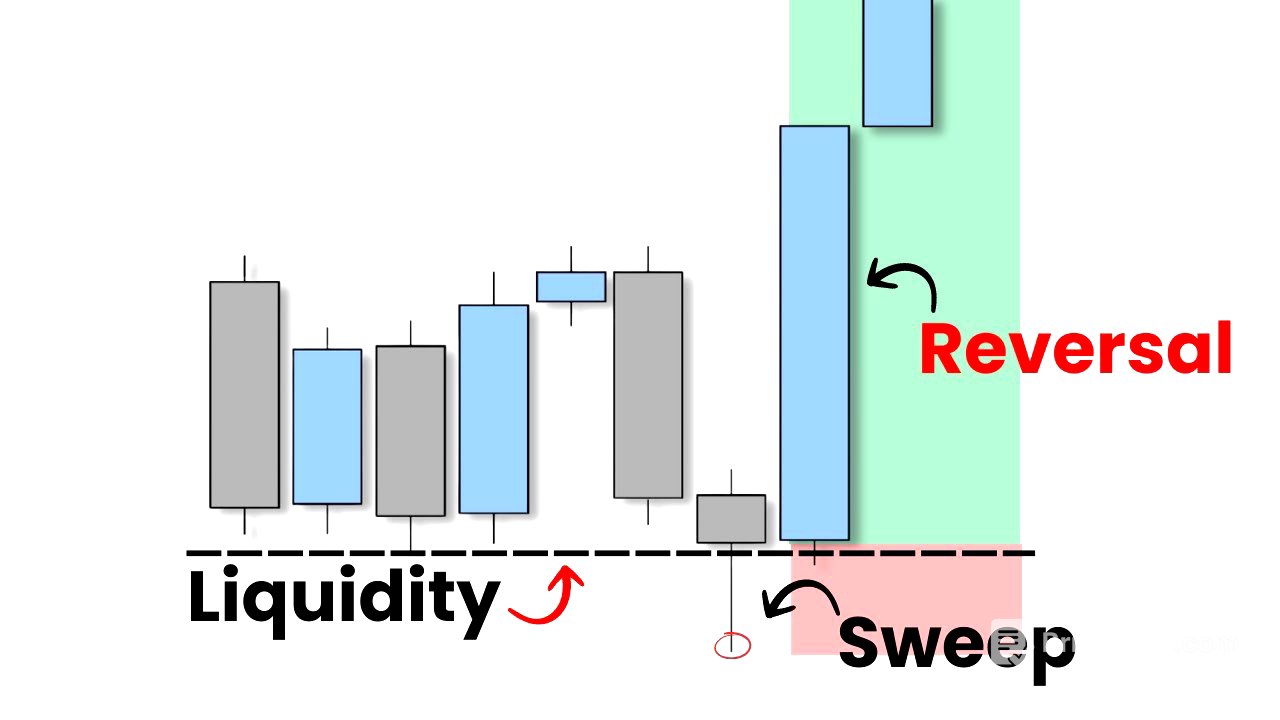

Equal highs represent resistance, while equal lows represent support. Traders often place stop losses above resistance and below support, creating liquidity pools. Breakout traders add to this liquidity with buy stops above equal highs and sell stops below equal lows. Equal highs and lows can be used as targets, as markets tend to trade toward these areas. It's advisable to avoid selling at equal highs or buying at equal lows; instead, use the sweep of liquidity to enter positions.

EQH EQL trading strategy [6:45]

The presenter analyzes the AUDUSD chart, identifying equal lows as an obvious support level. Knowing buyers are active at this support, stop losses and sell stops are likely below this level, creating an area of liquidity. The strategy involves avoiding buying at the support and waiting for a sweep of the level before anticipating an upward movement. Equal highs are also identified, forming a range with liquidity above and below, which can be strategically traded.

Trend Liquidity trading strategy [11:16]

Trend liquidity involves identifying areas with a high concentration of orders, often around trend lines. Traditional trend line trading involves waiting for retests to sell or breaks to buy. However, a trend line break doesn't always signify a trend reversal until structural highs are broken. Liquidity forms from sellers with stops above the trend line, breakout traders with buy stops, and manual execution buyers awaiting a retest.

Trend Liquidity trade example [16:51]

Trend liquidity can enhance confidence in setting targets. In a short position example, the presenter considered taking profits at the first demand area but extended the target due to trend line liquidity. Observing multiple retests of a trend line indicated a concentration of buyers with stop losses below, making it likely for the market to sweep this liquidity. This understanding allowed for a more confident and extended trade.

Range Liquidity Trading Strategy [18:08]

Range liquidity formulates around ranges or swing highs and lows. Markets often sweep these highs and lows before significant reversals due to the concentration of transactions at these points. Buyers below swing lows and sellers above swing highs place orders, creating liquidity. The presenter suggests avoiding trading in scrambled markets with constant sweeps. Alternatively, wait for a sweep of liquidity followed by a trend change to enter a buy or sell position.

How to go full time with liquidity trading [22:25]

Liquidity can be a powerful tool for trading, and the presenter offers further resources for those interested in learning more. He promotes his Trading Academy, which includes systems and strategies for profitable trading and funding. Additionally, he recommends exploring other videos and free courses for continued learning.