TLDR;

This video discusses the current state and potential future of XRP, highlighting the significant trading volume, the impact of Wall Street's interest in altcoins, and the potential for substantial growth as altcoin season approaches. The speaker emphasizes the importance of the upcoming Federal Reserve decisions and the potential for XRP to reach new heights, possibly even matching Bitcoin's valuation, driven by ETF inflows and overall market sentiment.

- XRP is experiencing high trading volumes, signaling potential for a 2-3x rally.

- Wall Street's financial engineering is expanding to altcoins, driving inflows into cryptocurrencies like XRP.

- The upcoming Federal Reserve decisions and the potential approval of a spot trading ETF could further fuel XRP's growth.

Introduction: XRP's High Trading Volume [0:00]

The video begins by noting the exceptionally high trading volume of XRP, reaching $7.42 billion on a Sunday, which is typically a low-volume trading day. This level of activity is the highest seen since the 2021 cycle, suggesting strong interest and potential for significant inflows, especially with the approval and live trading of the 2x leveraged ETF on Monday. The speaker anticipates even greater inflows, potentially pushing trade volume into the double or even triple-digit billions.

Market Overview and Profitability [1:01]

The cryptocurrency market is currently showing positive trends, with Bitcoin aiming to close above $118K-$119K for the week and Ethereum breaking its 180-day high. XRP's trade volume is notably high, representing a sixth of Bitcoin's volume despite its market cap being less than a tenth of Bitcoin's. This suggests a potential for a 2 to 3x rally for XRP in the near future. The speaker notes that most crypto investors who entered the market in the last 3 to 6 months are now in profit, with nearly all top 100 cryptocurrencies showing gains.

News Affecting XRP and Market Expectations [2:37]

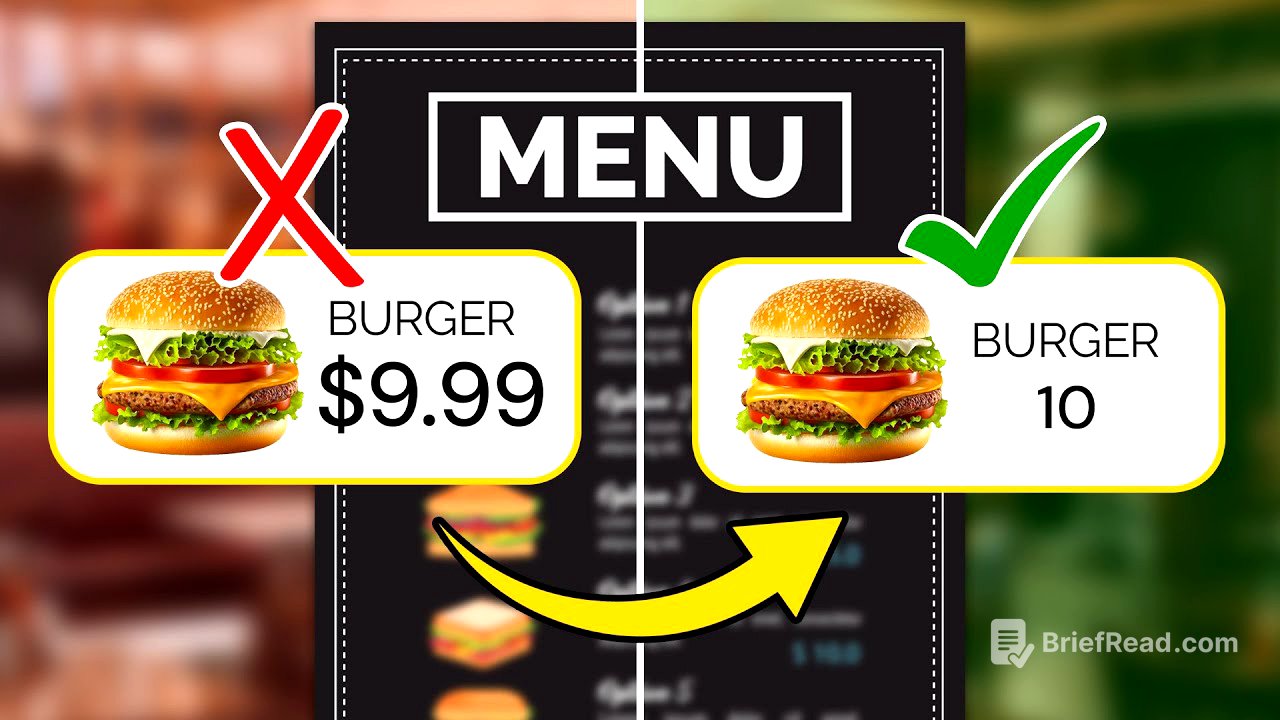

The video shifts to discussing news impacting XRP, highlighting Wall Street's increasing interest in altcoins. A CoinDesk article suggests that Wall Street's financial engineering is now a key strategy in the crypto market, using crypto treasury strategies. The speaker points out that the high trading volume on a Sunday, when Wall Street is typically offline, indicates significant potential for even greater volume during the week. Companies like Micro Strategy are using convertible notes and equity to finance crypto purchases, creating a cycle that boosts share prices and facilitates further capital raises, now expanding to altcoins.

Bitcoin Dominance and Altcoin Season [5:07]

The speaker believes that sustained weekend volume indicates continued volume into the next week. The potential ETF approval expected in August or September aligns with the dropping Bitcoin dominance. Bitcoin dominance peaked at 66% and has since dropped to 60%, with Ethereum at 11.7%, signaling inflows into ETH and the beginning of altcoin season. Ethereum still needs to increase by 20-25% to reach its all-time high of $4,800, and once it approaches this level, altcoin season will intensify.

Risk-On Markets and Federal Reserve Decisions [6:21]

The video emphasizes the importance of risk-on markets, which historically occur when the Federal Reserve switches from quantitative tightening to quantitative easing. The next rate decision is scheduled for July 30th, where Jerome Powell will speak, potentially signaling a shift to a 100% risk-on market. Currently, there are hints of institutions flowing into crypto beyond Bitcoin. For XRP to catch up to Bitcoin and Ethereum's growth, ETH needs to reach $9,600, and XRP needs to reach $7.50 to $8.

Potential for XRP's Future Growth [7:47]

As altcoin season begins, Bitcoin dominance is expected to continue to fall, potentially leading XRP to reach $10, $15, or even $20 in the short term. If ETF inflows exceed expectations, XRP could potentially reach $50, $100, or more. While a high market cap may not make sense today, various catalysts could shift overall sentiment and grow the crypto industry from a $4 trillion industry to $40 trillion or more. If Bitcoin reaches a $20 trillion valuation, XRP could potentially match BTC's valuation, driven by its role in running banking systems and settling transactions. The speaker expresses excitement about XRP, noting their early investment and continued belief in its potential.