TLDR;

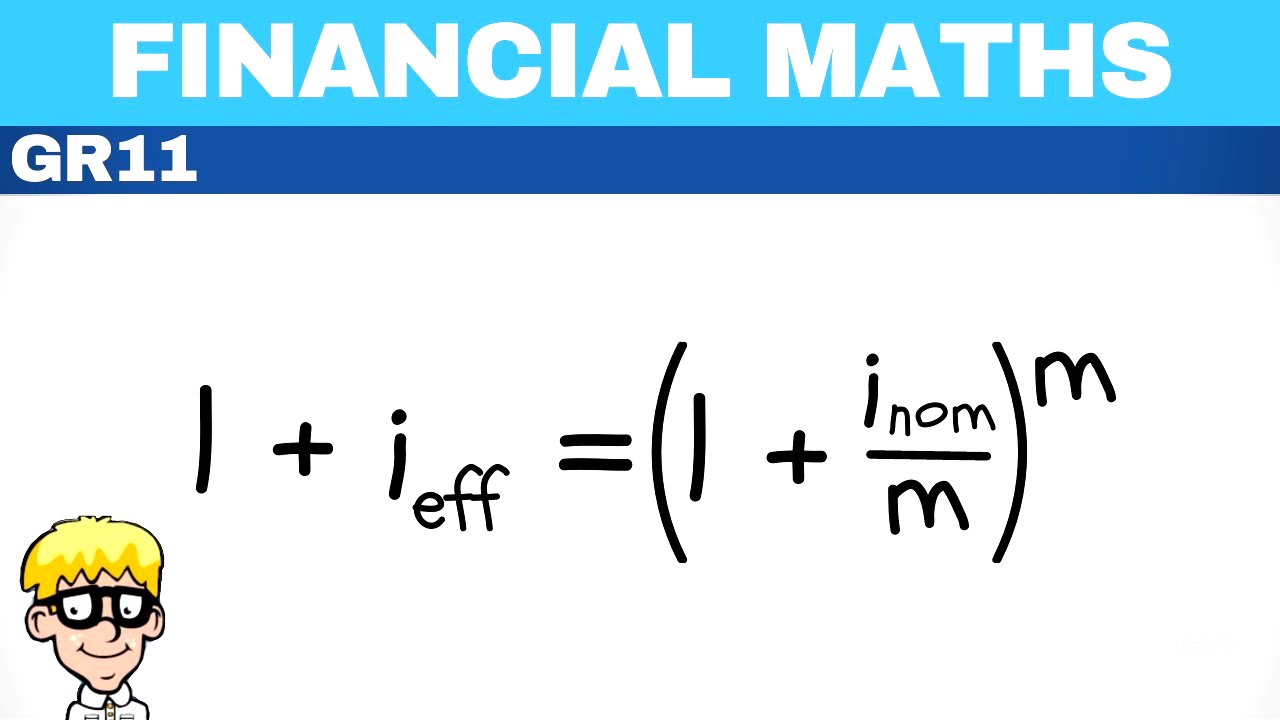

This video explains how to convert an effective interest rate to a nominal interest rate. It provides a step-by-step guide with examples for different compounding periods (monthly, quarterly, semi-annually, and daily). The key is to understand the formula and apply the correct order of operations, including taking roots and isolating the nominal interest rate variable.

- Converting effective interest rate to nominal interest rate.

- Step-by-step guide with examples.

- Different compounding periods (monthly, quarterly, semi-annually, and daily).

Introduction [0:00]

The video focuses on converting an effective interest rate to a nominal interest rate. The presenter emphasizes the importance of this skill in financial calculations.

Compounded Monthly [0:19]

The presenter begins with an example where interest is compounded monthly. The effective interest rate is given as 7% (0.07). The goal is to find the nominal interest rate. The formula involves raising (1 + nominal rate/12) to the power of 12, which equals (1 + effective rate). To solve for the nominal rate, the presenter advises taking the 12th root of (1 + 0.07), subtracting 1, and then multiplying by 12. The calculated nominal interest rate is 6.78%.

Compounded Quarterly [1:36]

Next, the presenter addresses a scenario with quarterly compounding. The effective interest rate remains at 7%. The setup involves using 4 as the compounding period. After performing similar calculations, the nominal interest rate is found to be 6.82%. The presenter shares a tip: the effective interest rate should always be slightly higher than the nominal interest rate.

Compounded Semi-Annually [2:03]

The video proceeds to demonstrate the conversion when interest is compounded semi-annually. The effective interest rate is still 7%. The equation is set up with a compounding period of 2. The presenter walks through the steps: taking the square root of (1 + 0.07), subtracting 1, and multiplying by 2. The resulting nominal interest rate is 6.88%.

Compounded Daily [3:05]

Lastly, the presenter tackles daily compounding. The effective interest rate is 7%. The compounding period is 365. The process involves taking the 365th root of (1 + 0.07), subtracting 1, and multiplying by 365. The nominal interest rate is calculated to be 6.77%.