TLDR;

This episode of the Joseph Carlson show covers several key areas: a portfolio update highlighting significant gains and strategic diversification, an analysis of potential undervalued companies like ASML, Salesforce, and Adobe, and a discussion on the possible merger of Paramount and Warner Bros. Discovery as a competitor to Netflix. Additionally, the episode includes a humorous segment on financial TikTok, featuring unconventional job interview advice.

- Portfolio update shows strong gains, with a focus on diversification and recurring revenue models.

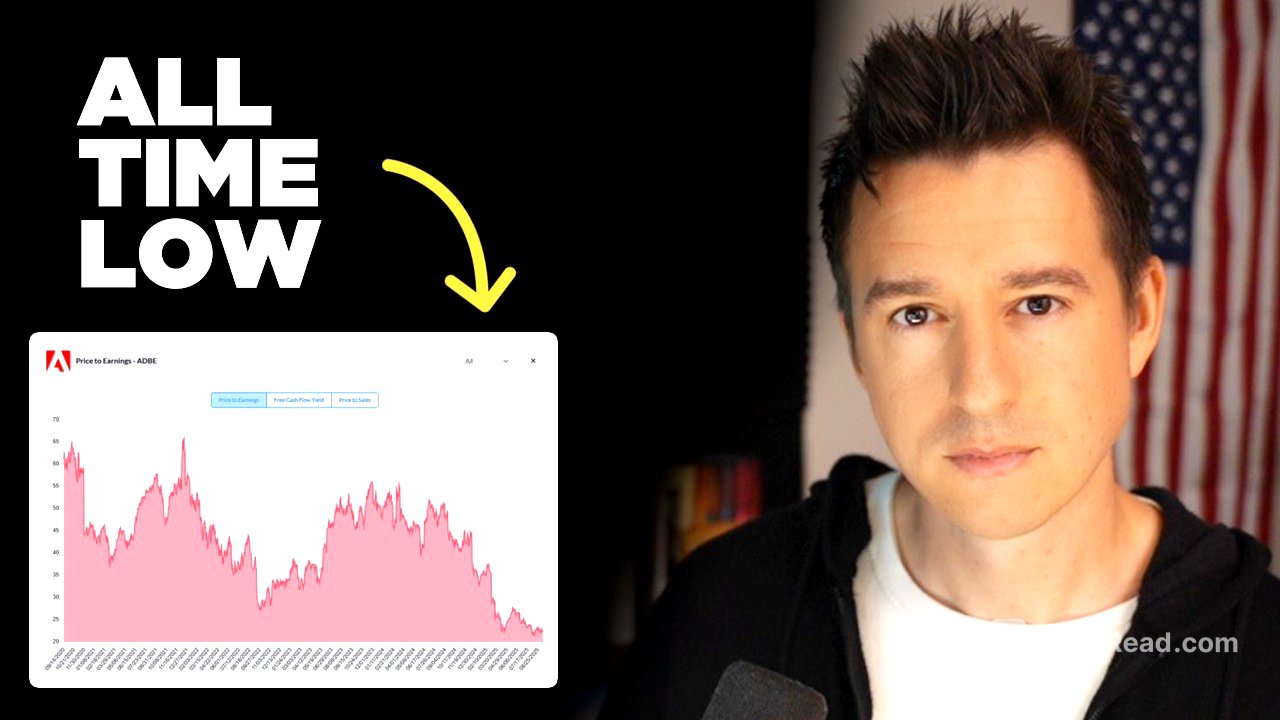

- Analysis of undervalued companies, including ASML, Salesforce, Adobe, and United Health Group.

- Discussion of the potential merger of Paramount and Warner Bros. Discovery and its implications for Netflix.

Portfolio Update [0:00]

The presenter updates his portfolio, noting that the August document will be updated for September with current compositions and performances. The portfolio includes a passive income portfolio and a story fund, with the latter outperforming due to concentrated investments in companies like Netflix, Amazon, and Google during their lows in 2022. The story fund has grown at approximately 21% per year, significantly outperforming benchmarks like the S&P 500 and QQQ. The combined portfolio has a value of $1,343,000 in gains, not including sold holdings or dividends, with total gains throughout the portfolio's lifetime around $530,000. Key positions include S&P Global, Google, and Amazon, with Google potentially becoming the top position due to continuous buying and stock appreciation.

The presenter emphasizes the importance of portfolio allocation, highlighting that his holdings are diversified across different industries to minimize overlapping risks, focusing on companies with wide moats and reoccurring revenue models. The passive income portfolio shows an all-time gain of $358,000, including dividends, while the Story Fund has gained $169,000, resulting in a combined gain of $528,000. The goal is to double these portfolios over the next 5 years through continued compounding.

Paramount, Warner Bros, And Netflix [21:10]

The Wall Street Journal reported that Skyance and Paramount, led by David Ellison, are considering acquiring Warner Bros. Discovery to form a massive media conglomerate that could rival Netflix and Disney. This new entity would combine the content libraries and resources of all four companies, potentially impacting the media landscape. The bid would include Warner Bros.' cable networks and movie studios, aiming to preempt bidding wars from tech companies like Amazon and Apple. The combined company would include properties like Barbie, DC Comics, Harry Potter, HBO Max, and Paramount Plus, along with cable news networks like CNN, TBS, and TNT.

The presenter views this potential merger as a negative development for Netflix, as it reduces Netflix's ability to license content from these studios and strengthens the bargaining power of the combined entity. While Netflix has a substantial budget for producing its own content, the merger could limit its access to licensed content. Despite these changes, Netflix has historically withstood competitive pressures and continues to adapt.

TikTok Interview [24:45]

The presenter reviews a TikTok video featuring an individual's unconventional approach to a customer service job interview. The interviewee, named John Cena, uses theme music and dramatic monologues to highlight his qualifications and express his desperation for the job. Despite the interviewee's humorous and creative presentation, the interviewer remains serious and professional, explaining that the approach is not suitable for a client-facing role. The presenter finds the TikTok video amusing and acknowledges the interviewee's articulate and well-timed performance, while also recognizing the interviewer's professionalism.

![한국 돌발행동에 트럼프 당황? "이게 아닌데"…정부, 서명 대신 25% 상호관세 검토 [PICK] / 연합뉴스TV(YonhapnewsTV)](https://wm-img.halpindev.com/p-briefread_c-10_b-10/urlb/aHR0cDovL2ltZy55b3V0dWJlLmNvbS92aS91dGpfbFpxeTVaWS9ocWRlZmF1bHQuanBn.jpg)