TLDR;

This video provides a market analysis for the week of October 18th, focusing on Hong Kong stocks, US stocks, and the Chinese stock market. It discusses the impact of US-China trade relations, potential US interest rate cuts, and economic indicators on market trends. The analysis includes insights into fund flows, market volatility, and key levels to watch in the Hong Kong stock market.

- US-China trade relations and economic indicators influence market trends.

- Potential US interest rate cuts are expected to impact the market.

- Fund flows and market volatility are key factors to monitor in the Hong Kong stock market.

US Stock Market Analysis [0:56]

The US stock market has seen some recovery, primarily due to a significant drop in volatility. The recovery is correlated across the three major indexes, with the index experiencing the largest drop in volatility showing the most substantial downward trend. Economic indicators and statements from the Federal Reserve officials are creating uncertainty in the market. Concerns about the US economy persist, and upcoming industry data releases could further unsettle investors. While there has been a rise in US stocks, a full market rebound is necessary for sustained upward movement.

Interest Rate Expectations and Market Impact [4:29]

The market anticipates a US interest rate cut, with a high probability expected at the Federal Reserve meeting on October 29th. Expectations for further rate cuts persist into the following months. The interest rate direction is largely predictable, leading to a decline in strange debt and a drop in two-year interest rates. Funds are flowing into the yuan, and while the US-China relationship may influence fund movements, the demand for risk assets remains.

Market Volatility and Investor Sentiment [7:56]

Market volatility has increased, but the market managed to close without further declines. The use of options as hedging tools has decreased, and high volatility is expected to return. Insecurity in the market remains relatively high, and the market is unlikely to break through the top in the short term. The dollar's demand is temporarily low, with funds flowing into cash assets, including dollars.

Currency Market Dynamics and Japanese Yen [11:11]

The currency market is shifting, with the relationship between currencies expected to realign. The Japanese Yen's weakness is attributed to continued monetary easing, which is pushing inflation higher. A strong inflation may lead to the economy lost. The Yen's potential to rebound is limited, and its weakness depends on the performance of specific industries like electric vehicles and high-end semiconductor packaging.

US-China Trade Relations and RMB [14:33]

Concerns about a potential currency war have subsided, but the possibility of the US closing remains a concern. Unilateral actions by the US would negatively impact consumers and push inflation higher. Economic operations are constantly evolving, and policies must adapt accordingly. Short-term fluctuations in the RMB are expected, influenced by recently released data.

Hong Kong Stock Market Analysis [16:44]

The Hong Kong stock market has strengthened from a level of 7.85, testing resistance. A significant inflow of funds is needed for the currency to reach 7.75. Current fund inflows are primarily from mainland enterprises returning to Hong Kong. The recent high of 27381 has been tested, with the market rebounding from a low of 1497.

Fund Flows and Market Trends in Hong Kong [20:34]

The opening side of the Hong Kong stock market has not seen significant fund inflows recently. While there was an inflow of funds earlier in the week, Thursday and Friday saw no inflows. Short-term market trends are influenced by fund flows, but these are not indicative of long-term deployments. The closing funds are decreasing, indicating reduced momentum.

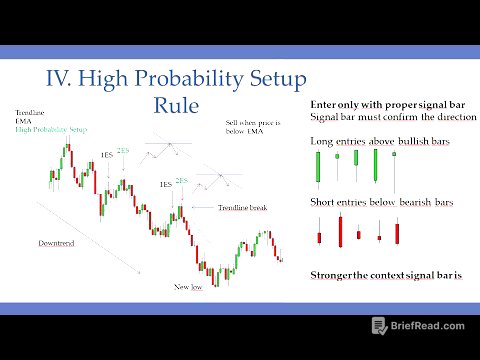

Short-Term Market Analysis and Key Levels [24:13]

The market is currently digesting short-term amounts, with the lowest point reaching 45 points. The overall market is in a defensive zone between 25000 two and 5000, and staying above this area is crucial. The market rebounded by six hundred points, reflecting strength at the 25,000 two positions.

Technical Analysis and Future Expectations [26:34]

The Hong Kong stock market has broken through the M50, confirming its support. A potential downside target is 24000, representing a 38.2% retracement. The key range to watch is between 25000 two and 25000 five. The weekly line chart indicates that the market has not yet triggered a significant decline.

Option Market Analysis and Hedging Strategies [28:31]

Enlightenment Rights and micro-installation warehouses are being used for hedging. The reduction in micro-installation suggests that investors believe the index will not fall below 5000. Pessimistic sentiment prevails, with investors expecting lower prices. However, there is potential for the market to rise to 26,000.

Market Sentiment and Future Outlook [32:27]

More people are investing in next month's options, indicating a shift in sentiment. The market is starting to turn, with investors looking at the 200,000 five level. The US stock market's performance will influence the Hong Kong market. Key levels to watch include 25800 and 26000 five.

Economic Data and Market Predictions for the Coming Week [37:22]

The coming week will see the release of economic data from mainland China, including production and consumption figures. The US will also release CPI and PPI data. The overall market is expected to remain volatile, with a potential trading range between 25000 two and 4 to 0 to 2.