TLDR;

The speaker discusses their Robinhood account's progress towards a $1 million goal, highlighting recent gains and key positions. They provide a market overview, focusing on potential rate cuts and upcoming economic data releases. A significant portion of the discussion is dedicated to Unity Software, analyzing its potential for a short squeeze due to loaded options chains and the possible influence of Roaring Kitty. The speaker also reviews various stocks, expressing bullish sentiments on companies like Amazon, Alibaba, Duolingo, and Grab, while also sharing insights on HIMS, NEO, Tesla, and others. They touch on the undervaluation of Upwork and potential strategies for hedging positions as the market approaches potentially volatile periods.

- The account closed at $25,574.63, up over $1,000 on the day.

- Unity Software is showing signs of a potential squeeze due to options activity.

- The speaker is bullish on Amazon, Alibaba, Duolingo and Grab.

- Market volatility is expected around the FOMC meeting.

Account Overview and Recent Performance [0:00]

The speaker reviews the Robinhood account, which is on a journey from $3,000 to $1 million. On Friday, September 5th, the account closed at $25,574.63, marking a gain of over $1,000 for the day and nearly $15,000 over the last three months. The speaker mentions protecting the account by selling covered calls against positions due to September typically being a weak month. They remain bullish on Alibaba and note that HIMS is experiencing a short squeeze, with 35% of its float being shorted.

Market Analysis and Economic Outlook [3:10]

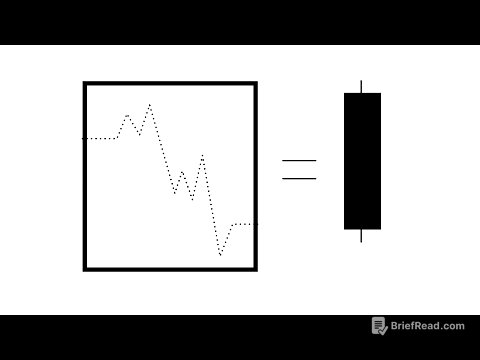

The speaker provides a market overview, noting the SPY's gap up on Friday following lower-than-expected job numbers, which led to a sell-off. The unemployment rate increased to 4.3% from 4.1%, causing some market participants to worry about a potential recession. The odds of a rate cut have increased, with a 100% chance of a cut in September. The speaker anticipates a 25 basis point cut in September and a 75% chance of an additional 25 basis point cut in October. Important economic data releases are scheduled for the upcoming week, including non-farm payroll, PPI, and inflation data. The speaker expects market volatility and choppiness leading up to the FOMC meeting on September 17th and advises caution, suggesting buying puts or taking profits on shorter-dated positions.

Unity Software: A Potential Squeeze Play [6:33]

The speaker focuses on Unity Software, which was up almost 10% on Friday, closing at $43.82. They believe Unity could push towards $50 if it holds above the $43.52 level, potentially triggering a squeeze. The speaker attributes this potential squeeze to the loaded options chain, particularly the January 30 call contracts, which they believe were bought by Roaring Kitty. There are over 639,000 call options and 271,000 put options on Unity. The speaker explains how market makers hedge their positions by buying shares of the underlying stock as the price moves higher, further driving up the price. They suggest strategies for playing Unity, such as short-term spreads or buying far-out-of-the-money calls for January or March expiration.

Stock Analysis: Apple, AMD, Amazon, and Alibaba [16:24]

The speaker shares insights on several stocks, starting with Apple and its upcoming event. AMD is entering a gap, presenting a potential buying opportunity between $144 and $150 with later-dated contracts. Amazon is expected to follow Google to all-time highs, potentially reaching $250-$260 by year-end, driven by automation, robotics, and increasing data center revenue. Alibaba crushed earnings and is starting to break to the upside, with a potential profit-taking area around $143-$144 and a longer-term target of filling the gap up to $157-$164.

Stock Analysis: Duolingo, Dvita, Ethereum, and Grab [19:18]

The speaker expresses bullish sentiment on Duolingo, citing its focus on the education market and potential benefits from AI, with a buy zone around $251-$265 and a target of $300-$310. Dvita, a kidney dialysis company, is expected to push towards $147, with potential for further gains if it breaks through that level. Ethereum is likely to push back towards all-time highs, and Litecoin is expected to have a massive move as ETFs get approved. Grab is finally starting to break out and is a core holding in the portfolio, with a target of $5.53 to fill a gap and potentially move higher if it holds above $5.67.

Stock Analysis: HIMS, Hood, NEO, and Tesla [24:30]

HIMS has a 35% short interest and is growing rapidly, with potential for an explosive squeeze. The speaker believes HIMS will eventually be added to the S&P 500. Hood may rally after being added to the S&P 500. NEO is consolidating, and the speaker is selling covered calls, with potential for a breakout towards $6.40 and longer-term targets of $8-$10. Tesla is starting to break out, with potential to push back towards $360-$400, as it is lagging behind other Mag 7 stocks.

Stock Analysis: United Healthcare, Upwork, VIX, and Zeta [29:16]

United Healthcare is breaking out, with potential targets at $341 and $328. Upwork is very undervalued, with potential for significant growth driven by AI and the changing landscape of contingent workforces. The speaker will be cautious when VIX is under 13 and will consider hedging positions. Zeta is growing and benefiting from changes in privacy laws, with potential to push back towards $22.73 and potentially break out to the upside. The speaker remains bullish overall into the end of the year but advises caution and preparedness for a potential market downturn.