TLDR;

This video discusses the state of the stock market, drawing parallels to the speculative environment of 1929. It explores the dominance of speculation over fundamental investment, examines potential market scenarios, and critiques the optimistic "long boom" thesis. The video also touches on the complexities of global diversification and concludes with five key principles for successful investing: invest, give yourself time, have rational expectations, rely on simplicity, and stay the course.

- Speculation is driving the market, similar to 1929.

- The market is priced for only the best of times.

- Diversifying globally has complexities and risks.

- Five principles for successful investing are provided.

Market Overview and Historical Parallels [0:13]

The current stock market is characterized by high valuations and speculative behavior, reminiscent of 1929. Mutual funds, despite holding a significant portion of stocks, have limited ownership in major companies like Coca-Cola, Procter & Gamble, GE, Microsoft, and Merck. These five firms, with a substantial market capitalization, have outperformed the broader market index. The issue isn't index funds themselves, but rather non-indexed funds that are struggling to keep pace.

Echoes of the Past [0:55]

The video draws parallels between the current market and the environment preceding the 1929 crash, highlighting similar optimistic sentiments. Quotes from President Calvin Coolidge in 1928 and financial articles from 1929 reflect a belief in continuous prosperity and the limitless potential of mutual funds. This mirrors today's market, where speculation seems to be prioritized over fundamental investment principles like dividend yields and earnings growth.

Speculation vs. Fundamentals [1:59]

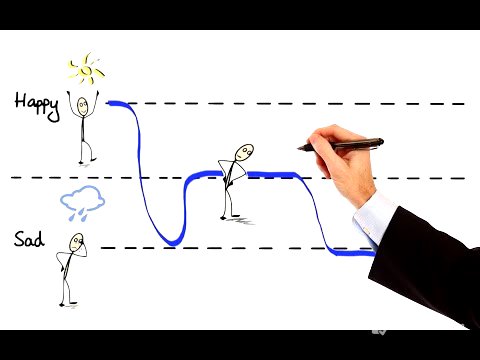

Currently, speculation is the primary driver of stock returns, overshadowing the importance of fundamental factors. History shows that in the long run, fundamentals determine returns. The video presents two possible scenarios: a market correction of 35% to normalize price-to-earnings ratios, or a "new era" of sustained high returns, driven by strong earnings growth and a low dividend yield.

The "Long Boom" Thesis [4:00]

The video critiques the "long boom" thesis, popularized by an article in Wired magazine, which predicts 25 years of prosperity, freedom, and environmental improvement. This optimistic view is based on the triumph of the United States, the end of major wars, new technology, a global market, corporate restructuring, and high economic growth. The article uses the term "meme," defined as a contagious idea that spreads like a virus, to describe this radically optimistic outlook.

Global Stock Markets and Diversification [6:30]

The video questions the idea that global diversification provides higher risk-adjusted returns. While foreign stocks performed well in the 70s and 80s, U.S. stocks have outperformed in the 90s. Foreign returns are heavily influenced by the value of the U.S. dollar, which is difficult to predict. The speaker expresses skepticism that corporations in other major economies will outpace those in the U.S., but acknowledges the potential for diversification, recommending a small international position of 5-20% of equities.

Five Principles of Investing [9:31]

The video concludes with five principles for investing:

- Invest: The biggest risk is not investing and missing out on long-term returns.

- Give Yourself Time: Start investing early and adjust your portfolio based on your age, with a mix of stocks and bonds.

- Have Rational Expectations: Be prepared for market declines and remember that market conditions are temporary.

- Rely on Simplicity: Focus on basic investing principles, such as asset allocation, diversification, and cost management, and consider low-cost index funds.

- Stay the Course: Stick to your investment plan, regardless of market fluctuations.