TLDR;

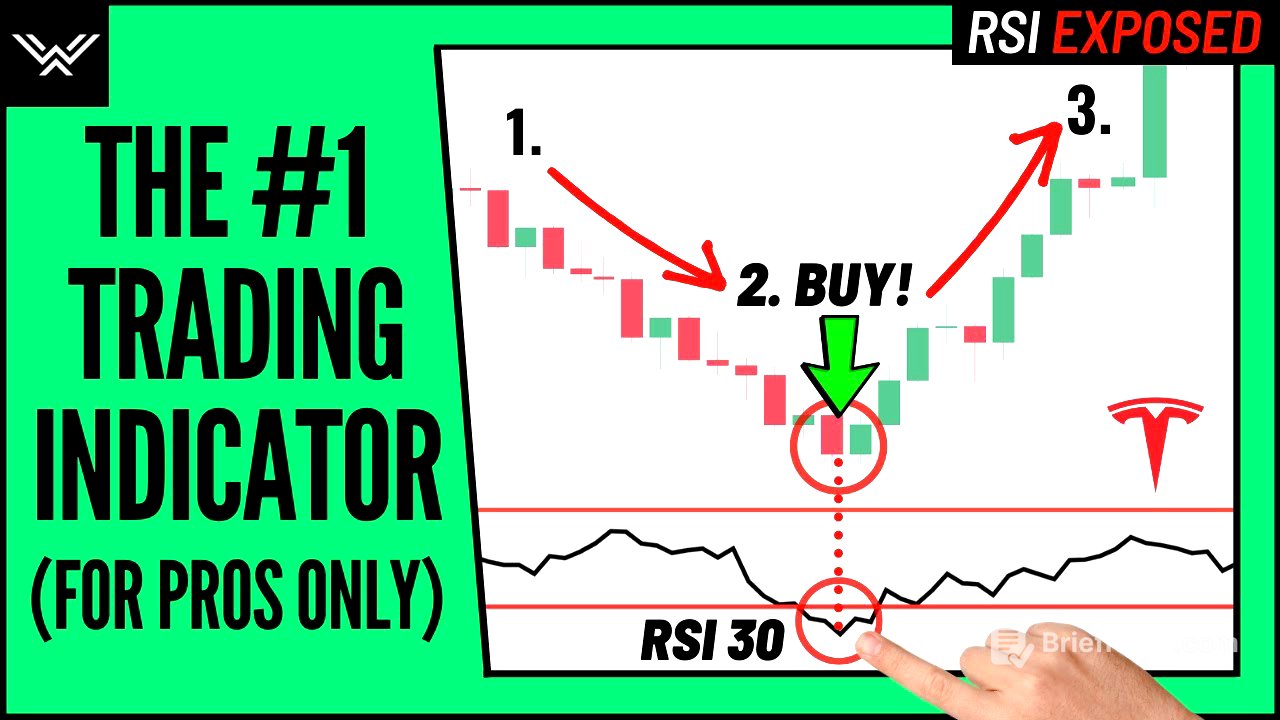

This video provides an in-depth guide to using the Relative Strength Index (RSI) indicator in combination with price action for trading stocks, crypto, and currencies. It covers core concepts, strategies, and real-world examples, including identifying divergences, understanding wide and tight divergences, and using confirmation signals to improve trade entries. The video also explains how to combine divergences with key levels and correlations to enhance trading strategies, using examples from Tesla and Apple trades during a market pullback.

- RSI indicator is used to support price action, not as a standalone tool.

- Divergence between price and RSI can indicate potential trend changes.

- Combining divergence with key levels and correlations improves trade quality.

Introduction [0:00]

The video introduces an in-depth exploration of the RSI indicator trading strategy, emphasizing its use in conjunction with price action. The presenter thanks viewers for their support and encourages them to like, subscribe, and turn on notifications for more frequent content. It's highlighted that indicators are not magic and should always be used to support price action, which applies across currency, stock, and crypto trading.

Core Concepts of RSI Indicator [1:04]

The RSI, or Relative Strength Index, is used to identify overbought and oversold market conditions. An RSI value of 70 or above indicates an overbought market, suggesting the asset is relatively expensive, while a value of 30 or below indicates an oversold market, suggesting the asset is relatively cheap. Traditionally, traders buy when the RSI enters oversold territory and sell when it enters overbought territory, but this approach can be problematic in trending markets.

Problems with Traditional RSI Usage [2:38]

Using the RSI indicator in trending markets can lead to significant losses because the RSI can remain in overbought or oversold regions for extended periods. Taking trades solely based on the RSI, expecting immediate reversals, is risky. The presenter transitions to discussing how to use the RSI indicator more effectively to enhance overall analysis.

Combining RSI with Divergences [4:03]

The presenter explains that the RSI indicator is most effectively used when combined with divergences. Divergence occurs when the price of an asset moves in the opposite direction of the RSI, signaling a potential trend change. For example, if the price makes a higher high while the RSI makes a lower high, it creates a divergence that may lead to a price reversal.

RSI vs. MACD for Divergence [5:19]

The presenter prefers using the RSI indicator over the MACD because the RSI provides clearer and more precise divergence formations, leading to higher quality trade entries. While both indicators can be used to spot divergences, the RSI often offers a more distinct signal. The choice between RSI and MACD depends on individual trading strategies, as indicators are merely tools to support price action analysis.

Types of Divergences: Wide and Tight [6:51]

The presenter details two main types of divergences: wide and tight. Wide divergence involves easily visible, broad swings in price and RSI, indicating a high-quality divergence. Tight divergence, on the other hand, features closely spaced swings that may be harder to spot. Both types have subtypes based on whether the divergence occurs within or close to the overbought/oversold regions.

Wide Divergence Explained [7:34]

Wide divergence is characterized by its obvious and broad swings, making it easy to identify on charts. It is considered high quality because it often occurs when price moves sideways, indicating that the dominant trend's control is weakening. The two subtypes include divergences occurring within the overbought/oversold regions and those occurring close to these regions but not touching them.

Tight Divergence Explained [9:03]

Tight divergence involves closely spaced swings that can be more challenging to identify. To spot tight divergences, the presenter suggests switching to a line chart to clearly see the price and RSI movements. This type also has two subtypes: divergences occurring within the overbought/oversold regions and those occurring close but not touching these regions.

Divergence Hierarchy [11:32]

The presenter recaps wide and tight divergences, emphasizing their importance in identifying potential reversals. A divergence hierarchy is introduced to rank the quality of divergences, aiding traders in assessing trade opportunities.

Combining Divergence with Confirmation [12:05]

To avoid false signals, divergence should be combined with confirmation through price action. After spotting a divergence, traders should look for price action that confirms the reversal is real. A dynamic trend line can be applied to the immediate trend, and a breakthrough of this trend line confirms the divergence and potential reversal.

Examples of Divergence with Confirmation [13:43]

The presenter provides examples using downtrends and uptrends, illustrating how to apply trend lines and wait for breakouts to confirm divergences. Examples include Disney and Pinterest stocks, showing how trend line breaks validate potential trade entries. The importance of confirmation is highlighted with a Walmart stock example, where a divergence without a trend line break led to a false signal.

Strategy Foundation: Divergence with Key Levels [17:39]

The foundation of the trading strategy involves combining divergences with key levels or areas of confluence for high-quality trade entries. Key levels are areas watched by many traders, increasing the likelihood of reversals. The presenter outlines three variations of this strategy.

Type 1: Divergence at a Key Level [18:40]

Type 1 strategy involves identifying divergence forming at a key level using a single time frame. The presenter illustrates this with examples of key resistance and support levels, showing how to apply trend lines and look for breakouts to confirm trade entries. An example using Euro Kiwi is provided.

Type 2: Candlestick Price Action and Divergence [21:50]

Type 2 strategy uses two time frames: identifying candlestick patterns at a key level on a higher time frame and looking for divergence within those candlesticks on a lower time frame. The presenter explains the premise of this strategy and provides examples using 12-hour and 4-hour time frames.

Time Frame Combinations for Type 2 [25:14]

Any combination of time frames can be used for Type 2 strategy, depending on the trader's style and speed of trade. The presenter shows examples using daily and 4-hour time frames, as well as 8-hour and 4-hour time frames, to illustrate different applications. Examples include crypto trend trades and pound dollar setups.

Type 3: Divergence and Trend Change in Leg 2 Head [30:22]

Type 3 strategy involves finding divergence at a key level and then looking inside the leg 2 head of that divergence for price action that signals a trend change. This is used when there isn't good price action on the main time frame or when seeking an earlier entry. The presenter details two reasons for using Type 3.

Type 3a: No Good Price Action [31:42]

Type 3a is used when there is no good price action on the main time frame. The presenter provides an example using daily and 4-hour time frames, showing how to look inside the divergence leg 2 head for price action that indicates a trend change.

Type 3b: Earlier Entry [33:22]

Type 3b is used when traders want an earlier entry right at the leg 2 head of divergence. The presenter illustrates this with 12-hour and 4-hour time frames, showing how to identify wedge patterns and breakouts to confirm the end of the leg 2 head.

Divergence Combined with Correlations [34:46]

The presenter explains how divergence can be combined with correlations to enhance trade entries, using examples from Tesla and Apple trades during a market pullback. Correlations involve how different assets move in relation to each other. Positive correlation means assets move in the same direction, while inverse correlation means they move in opposite directions.

Correlations in Trading [35:04]

Correlations in trading refer to how different assets move in relation to each other. A positive correlation means that when one asset moves in a specific direction, a positively correlated asset will move in the same direction. An inverse correlation means that assets move in opposite directions. Examples include the S&P 500's positive correlation with U.S. stocks and the VIX index's inverse correlation with the S&P 500.

Tesla Trade Example [39:29]

The presenter details how divergence combined with correlations was used to enter trades on Tesla during a recent market pullback. The analysis starts with tracking the S&P 500 on the monthly time frame to establish a bullish bias. This bias is then confirmed on the daily time frame with a trend change. The positive correlation between the S&P 500 and U.S. stocks, including Tesla, is used to increase the trade quality.

Apple Trade Example [41:32]

The presenter provides another example using Apple stock, showing how the same concepts of divergence and correlation with the S&P 500 were applied. The analysis involves identifying key levels on the monthly and weekly time frames, confirming a trend change on the daily time frame, and using the correlation with the S&P 500 to enhance the trade quality.