TLDR;

This video provides a market analysis for July 30, 2025, noting the day's market struggles and eventual positive close. It covers key resistance and support levels, sector performance, and reactions to Donald Trump's statements on trade deals and mediation between India and Pakistan. The video also previews the expected outcomes of an FMC meeting and their potential impact on the market, as well as the performance of Asian Pacific markets.

- Market closed positive at 24,855 points with a gain of 0.14%.

- Donald Trump hinted at imposing 20-25% tariff on India.

- Outcome of the FMC meeting is expected.

Market Analysis and Key Levels [0:34]

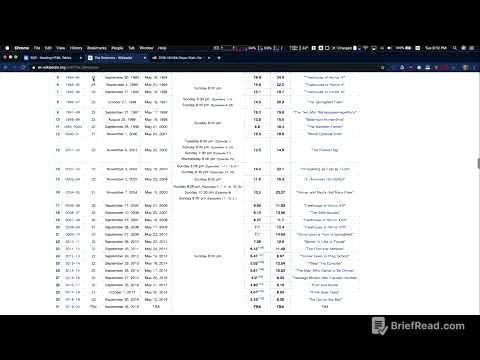

The market initially struggled but closed positively at 24,855 points, a 0.14% gain. Resistance was expected between 24,950 and 25,000, with support at 24,750. The opening was strong at 24,890, reaching an intraday high of 24,902 and a low of 24,771. Bank Nifty closed lower at 56,150 points, down by 0.13%, facing resistance around 56,300-350 based on an indicator.

Sector Performance [2:03]

Most sectors, excluding Bank Nifty, closed positively, minimizing portfolio movement. IT, pharmaceuticals, financial services, FMCG, MAC, services, and energy sectors were positive, while realty and PSU banking saw slight declines. The auto sector experienced a decline due to Tata Motors, and there were minor corrections in the metal and media sectors.

Trump's Statements on Trade and Mediation [3:01]

Donald Trump stated that a trade agreement with India has not been finalized, despite earlier indications of progress. He hinted at potential 20-25% tariff rates for India and claimed India imposes higher tariffs than other countries. Trump also reiterated his claim of mediating between India and Pakistan, which was previously refuted by Modi.

FMC Meeting and US Market Update [8:16]

The outcome of the FMC meeting is anticipated, with expectations of a possible rate cut. US futures showed volatility but were slightly positive. The Indian currency's valuation dropped significantly following Trump's tariff remarks, and continued sell-offs by FIIs are expected.

Asian Pacific Markets Overview [10:38]

Most Asian Pacific markets closed positively, with Japan and China showing gains. Hong Kong was weak, while South Korea performed well. The Indian market was flat. Taish and Australian markets were strong, while New Zealand, Malaysia, and Singapore saw slight corrections.

![Robert Sapolsky: Justice and morality in the absence of free will | Full [Vert Dider] 2020](https://wm-img.halpindev.com/p-briefread_c-10_b-10/urlb/aHR0cDovL2ltZy55b3V0dWJlLmNvbS92aS9uaHZBQXZ3Uy1VQS9ocWRlZmF1bHQuanBn.jpg)