TLDR;

This video explains key price action trading rules based on market behavior reflecting human psychology. It emphasizes understanding raw price movements over relying on indicators, which only show past data and clutter charts. The core rules covered include trendline analysis, avoiding counter-trend trading, trading range strategies, identifying high-probability setups, and using signal bars for confirmation. These rules aim to help traders align with market trends, manage risk, and improve entry timing.

- Focus on raw price action over indicators.

- Follow trendline rules to anticipate market movements.

- Avoid counter-trend trading to increase probability of success.

- Trade breakouts of trading ranges on pullback.

- Use high-probability setups for better entry points.

- Confirm entries with proper signal bars.

Introduction to Price Action Rules [0:00]

The video introduces the concept of price action rules, highlighting their importance in trading. These rules are effective because markets reflect human behavior, specifically greed and fear, which remain constant. Most retail traders are unaware of how price moves, often misled by initial information that promotes ineffective strategies like indicator-based systems. Indicators only reflect past performance and clutter charts, hindering the understanding of true price movement. Focusing on raw, naked price action is essential to understanding market dynamics.

Trendline Rule [1:15]

The trendline rule states that after a trendline is broken, and candles close outside of it, a new extreme is likely to form. Following this, a correction phase or a reversal is expected. In a downtrend, traders should look for patterns confirming the trend. A break of the channel doesn't mean the trend is over; instead, expect a new low before considering long positions. This rule applies to both major and minor trends, ensuring traders align with the prevailing market direction.

Don't Counter Trend Trade [5:59]

Counter-trend trading involves trading against the prevailing trend, which is generally discouraged. Beginner traders often try to pick tops and bottoms, leading to frustration and losses. Regardless of how appealing a setup looks, trading against the trend has low probability of success. It's crucial to use trendline rules to identify and follow the trend, avoiding the temptation to counter-trade. Markets are designed to make counter-trend entries look attractive, but these often fail.

Trading Range Rule [8:25]

The trading range rule emphasizes that most breakouts from trading ranges fail, at least temporarily. Many beginner traders lose money trying to trade breakouts directly. Instead, traders should look to buy low and sell high within the range, fading the breakouts. Congestion is considered a micro trading range and should be avoided. Identifying support and resistance levels is crucial for trading ranges effectively, allowing traders to capitalize on failed breakouts.

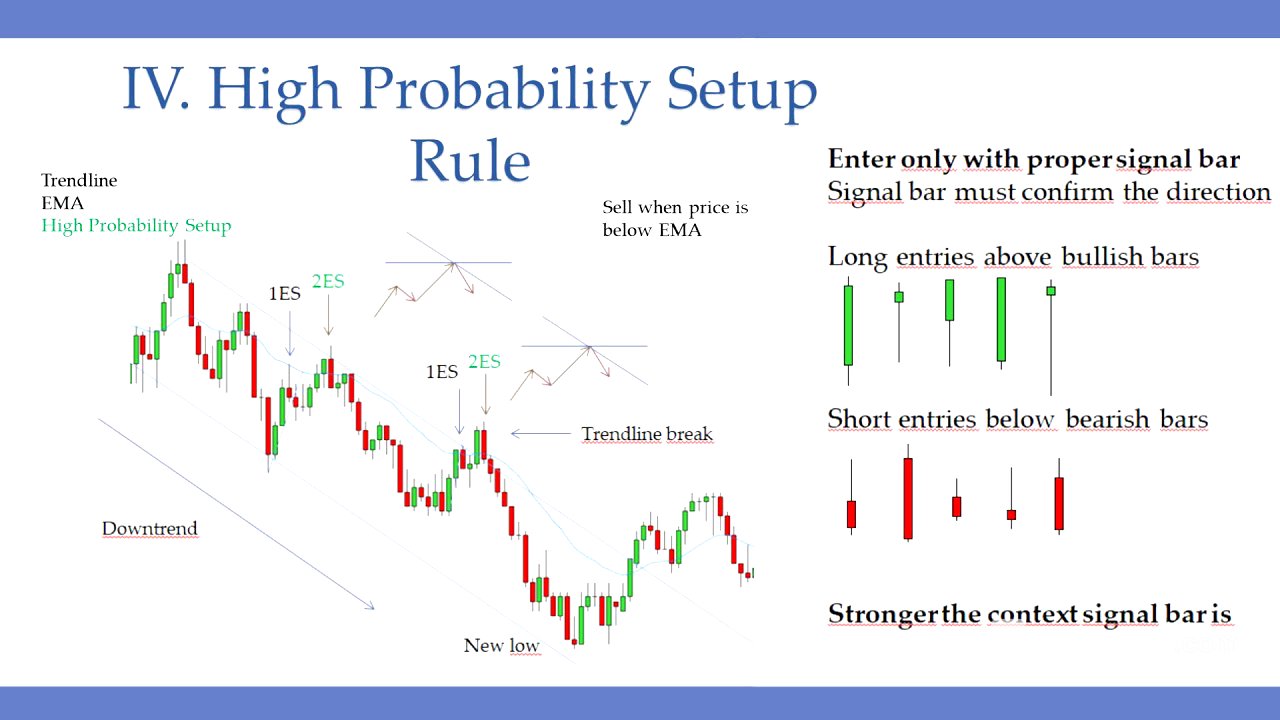

High Probability Setup Rule [12:46]

A high probability setup is a second entry at a key entry point in the direction of the trend. Key entry points include trendlines, support/resistance lines, and exponential moving averages (EMA). These setups increase the odds of a successful trade. A high probability setup can also be a failed second entry that goes against the current trend. Combining these setups with key entry points maximizes the chances of success.

Signal Bar Rule [17:23]

The signal bar rule states that traders should only take long positions above bullish bars and short positions below bearish bars. The signal bar should confirm the direction and momentum of the market. Combining the high probability setup rule with the signal bar rule maximizes the chances of a trade succeeding. While context can sometimes allow for less ideal signal bars, sticking to this rule is generally recommended.

Rules For Trading Trading Ranges [18:26]

When trading trading ranges, it's important to identify the structure, locate key support and resistance levels, and identify short-term trendlines. Traders should avoid trading in the middle of the range and look for setups to fade breakouts, buying low and selling high. Patience is crucial; traders should wait for high-probability setups and avoid chasing entries. Entries should align with exponential moving averages, good signal bars, and second entries with or against short-term trends.

Rules For Trading Uptrends [23:14]

When trading uptrends, it's essential to identify the structure, follow the trend, and avoid counter-trend trading. Traders should identify key entry points and high-probability setups, avoiding entries at the very highs of the move. Drawing short-term trendlines for bearish corrections helps identify long opportunities. After a new high is reached, buying is on hold until more confirmation is received. Multiple new extremes may indicate a new, larger channel in play.

Rules For Trading Downtrends [26:47]

The rules for trading downtrends are the same as for uptrends, but in reverse. Traders should look for short opportunities, identifying the structure and following the trend. Waiting for price to pull back to key entry points is crucial. Even with a range-like structure, a bearish bias should be considered if highs and lows are consistently lower. Lower high confirmation setups below the EMA can provide better entry points.