TLDR;

This video provides a comprehensive guide to price action trading, emphasizing its role as a leading indicator compared to lagging indicators. It covers key concepts such as market structure, key levels, supply and demand zones, trend analysis, momentum, chart patterns, and time frame confluence. The video also addresses trade management, including identifying high-quality trade setups, managing stop-loss orders, and maximizing profits.

- Price action is a leading indicator based on real-time price formations.

- Key levels, supply/demand zones, and trend analysis are crucial for identifying trading opportunities.

- Momentum, chart patterns, and time frame confluence enhance trade accuracy.

- Proper trade management is essential for maximizing profits and minimizing losses.

Market Structure and Key Levels [0:43]

Key levels are significant price points where reversals are likely to occur. Resistance levels are areas where the price is expected to reverse downwards, making them potential short trade setups. When the price approaches a recently formed resistance level, it is considered "expensive," leading to decreased buying activity and a potential reversal. Conversely, support levels are areas where the price is expected to reverse upwards, offering long trade setups. When the price drops to a recently formed support level, it is deemed "cheap," attracting value buyers and triggering an upward reversal.

Supply and Demand and Multiple Reversals of Price [2:06]

Supply zones are areas where the price has repeatedly failed to break through, indicating a level the market deems "expensive." This leads buyers to close long positions and sellers to open new short positions, creating downward momentum. Demand zones, on the other hand, are areas where the price has repeatedly bounced off, suggesting the market considers this level "cheap." Sellers close short positions, and buyers open new long positions, resulting in upward momentum.

Extreme Swing Highs and Lows [3:42]

Swing highs represent the highest resistance levels, while swing lows represent the lowest support levels. Short trade setups off swing highs are considered higher quality due to the increased likelihood of a reversal, as the price is deemed very expensive. Similarly, long trade setups off swing lows are of higher quality because the price is considered very cheap, increasing the probability of an upward reversal.

Higher Time Frame Key Levels [4:32]

Key levels identified on weekly and monthly time frames are considered major key levels. These levels indicate a higher probability of significant price reversals. Major key levels are slower to form and are closely watched by large institutions for unloading or initiating positions. To use these levels, label them on higher time frames and monitor them on lower intraday time frames to identify high-probability trade opportunities.

Longwick Candles [6:13]

Longwick candles can signal potential reversals when the price approaches a key level. In an uptrend, if candles have wicks sticking out above a key level, it indicates that buyers attempted to push through but failed, presenting short trade opportunities. Conversely, in a downtrend, if candles have wicks sticking out below a key level, it suggests that sellers tried to push through but failed, offering long trade opportunities. After observing longwick candles, traders should seek intraday trend change confirmation before entering trades.

Trends, Reversals, and Ranges [7:34]

An uptrend is characterized by higher highs and higher lows, indicating bullish momentum and buyer control. Traders should lean towards long entries, taking advantage of pullbacks at resistance levels that turn into new support. A trend change from uptrend to downtrend can be identified when a lower low forms, followed by a lower high pullback before a full trend change breakout. Conversely, a downtrend consists of lower highs and lower lows, indicating bearish momentum and seller control. Traders should consider short entries, using pullbacks at support levels that become new resistance. A trend change from downtrend to uptrend occurs when a higher high forms, followed by a higher low pullback before a full trend change breakout. In sideways or ranging markets, where the price makes similar highs and lows, traders can confidently take trades in both directions.

Fresh Trends Versus Trend Exhaustion [11:18]

A fresh trend occurs when a trade is entered close to the start of a price movement, offering ample room for the price to move. Fresh trends or reversals are higher-quality trade entries because traders can capture a larger portion of the move. In contrast, trend exhaustion happens when a trade is entered after the price has already moved significantly. During trend exhaustion, the market may lose momentum, chop sideways, or reverse if enough traders lock in profits.

Momentum Gain Versus Momentum Loss [12:41]

Momentum gain can be identified through tight price movement without large swings and by observing candles growing in size. Tight price movement in an uptrend indicates strong buyer control, while in a downtrend, it shows strong seller control. Increasing candle size in an uptrend signifies growing bullish momentum, whereas in a downtrend, it indicates increasing bearish momentum. Momentum loss can be identified through wide swings in price, sideways price movement, shrinking candles, and candle color changes. Wide swings and sideways movement suggest that buyers or sellers are losing control, potentially leading to a reversal. Shrinking candles and candle color changes near key levels also signal a loss of momentum, presenting potential trade opportunities.

Deep Pullbacks Versus Shallow Pullbacks [16:00]

Deep pullbacks, which retrace roughly 50% or more of the current leg of a trend, are the best types of pullbacks for trade entries, especially when paired with a key level. These entries offer a great area of value within a moving trend. Shallow pullbacks, retracing about 25% to 30% of the current leg, are still viable but less favorable than deep pullbacks.

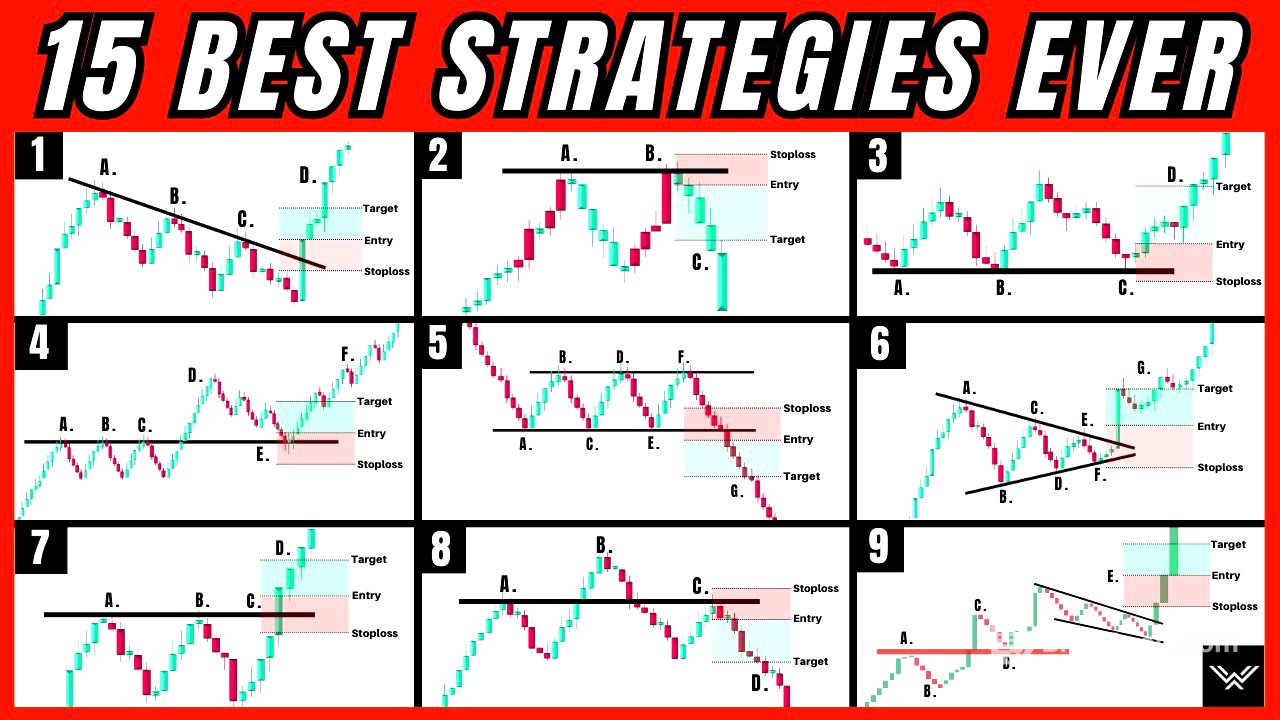

Chart Patterns [16:56]

Chart patterns, or consolidation patterns, help identify trend continuations versus trend reversals. When a pattern breaks in the same direction as the larger trend, it signals a trend continuation. Conversely, if a pattern breaks in the opposite direction of the larger trend, it signals a trend reversal. Chart patterns represent indecision and infighting between buyers and sellers, with the breakout direction indicating the winning side.

Looking at Where Price Is Coming From [18:59]

When considering a trade setup, it's crucial to look at the recent price action and overall momentum. Entering a short trade at a key resistance level might seem logical, but if recent price action indicates strong bullish momentum from a key support level, the short trade could be counter-trend and less likely to succeed. Similarly, entering a long trade at a key support level against strong bearish momentum could lead to a failed trade.

Stacking High-Quality Traits [20:13]

The best trade setups have multiple high-quality traits, increasing the probability of success and larger gains. These traits include trading with the trend, identifying trend reversal patterns, key levels with multiple reactions, trend lines with recent reactions, shrinking candles indicating momentum loss, longwick candles at areas of confluence, and bullish or bearish momentum confirmation candles with candle color changes.

Trigger Event and Continuation Entry [23:12]

A trigger event, such as a double bottom or a longwick candle at support followed by a bullish momentum candle, confirms a directional bias and provides momentum for a trade. After identifying a trigger event, traders can take continuation trades to ride the momentum. Two options for entering continuation trades include looking for continuation patterns within the moving trend or identifying intraday long trade setups.

Time Frame Confluence [24:43]

Time frame confluence involves aligning the price action across three core time frames to trade in the same direction, resulting in highly accurate trades. The specific time frames depend on the trader's speed of trade. Confluence occurs when the weekly, daily, and intraday time frames all indicate the same directional bias through patterns and key levels.

Trade Exits and Stop-Loss Management [28:06]

Proper trade management is essential for maximizing profits and minimizing losses. Traders should know where to initially place their stop-loss orders, how to move them to protect positions and lock in gains, and how to manage positions to maximize gains while avoiding premature exits.

![[위대한수업] 나와 세상을 연결해주는 진화의 메커니즘! 위대한 수업 폴 너스 4강 요약해드려요. 진화의 메커니즘, 자연선택. great minds](https://wm-img.halpindev.com/p-briefread_c-10_b-10/urlb/aHR0cDovL2ltZy55b3V0dWJlLmNvbS92aS9EWlBWR3E3bUhtcy9ocWRlZmF1bHQuanBn.jpg)