TLDR;

This video features Priyank Sharma sharing a trusted intraday scalping strategy using the Relative Strength Index (RSI) on a 1-minute chart. The strategy focuses on identifying potential reversal points by combining overbought/oversold RSI levels, divergence, and market structure shifts. Key points include:

- Using RSI to detect price manipulation through divergence.

- Combining RSI with market structure shifts for higher probability trades.

- Importance of risk management, win rate, and position sizing.

Introduction [1:17]

Priyank Sharma introduces an intraday scalping strategy suitable for quick trades, addressing the demand for fast-paced strategies. The strategy is designed to provide rapid target and stop-loss levels, allowing traders to manage their positions efficiently. This approach is particularly relevant in today's fast-moving market, where traders seek to capitalize on short-term opportunities.

What is RSI and how does it work [4:10]

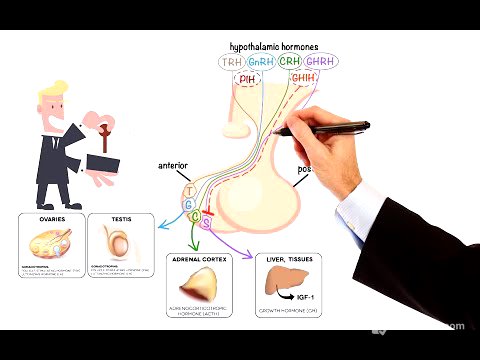

The Relative Strength Index (RSI) is a tool that measures the strength of a trend by comparing the relative strength of price movements. It indexes the strength of a trend, indicating whether it is gaining or losing momentum. RSI helps detect price manipulation by identifying divergences between price action and RSI movements. A divergence occurs when the price makes new highs, but the RSI fails to make corresponding highs, signaling potential weakness in the trend. The RSI indicator oscillates between 0 and 100, with levels above 70 indicating overbought conditions and levels below 30 indicating oversold conditions. These levels can be adjusted based on the volatility of the asset being traded.

Common mistakes people make with RSI and how to fix them [13:30]

A common misconception is that RSI should be used to sell when overbought and buy when oversold. The correct interpretation is that RSI indicates the strength of a trend, not necessarily a buy or sell signal. An overbought condition simply means the uptrend is strong, and the price can remain overbought for an extended period. RSI is more effective at identifying potential reversal setups by looking for divergences between price and RSI.

How to build a trading strategy using RSI [16:55]

To build a trading strategy using RSI, first, identify overbought (above 70) or oversold (below 30) conditions. Then, look for divergence between the price and RSI, indicating potential price manipulation. Finally, wait for a market structure shift, such as a break of the last swing low in an uptrend, to confirm the reversal. The market structure shift acts as a confirmation signal, increasing the probability of a successful trade.

Step by step chart setup explained [26:15]

On a 1-minute chart, identify swing highs and swing lows. A swing high is formed when a candlestick's high is higher than the highs of the candlesticks on its left and right. A swing low is formed when a candlestick's low is lower than the lows of the candlesticks on its left and right. Wait for the price to move above or below the 70/30 RSI levels and then look for divergence between these swing points and the RSI. After identifying divergence, wait for a break of the market structure, such as the last swing low, to confirm the trade entry.

Where and when to use this RSI strategy [36:20]

This strategy can be used in various markets, including stocks, indices, and commodities, and is applicable across different time frames. The key is to adjust the time frame to your comfort level and trading style. The strategy works because it is based on the underlying concept of price manipulation and trend strength, which are universal across markets and time frames.

More discussion on how the strategy performs in different situations [42:10]

The strategy is best suited for trending markets where intraday movements occur. Avoid using this strategy for BTST (Buy Today Sell Tomorrow) trades, as the setup may occur late in the trading day and not accurately reflect the next day's opening gap. In sideways markets, directional trading strategies may not be effective. Instead, consider using option selling strategies with spreads to capitalize on time decay.

Conclusion and key takeaways [45:15]

The key takeaways from this strategy are to combine RSI with market structure shifts for higher probability trades, manage risk effectively, and understand the market conditions. It is crucial to backtest and paper trade the strategy to determine its suitability for your trading style. Remember that no strategy guarantees 100% success, and it is essential to continuously adapt and refine your approach based on market dynamics.