TLDR;

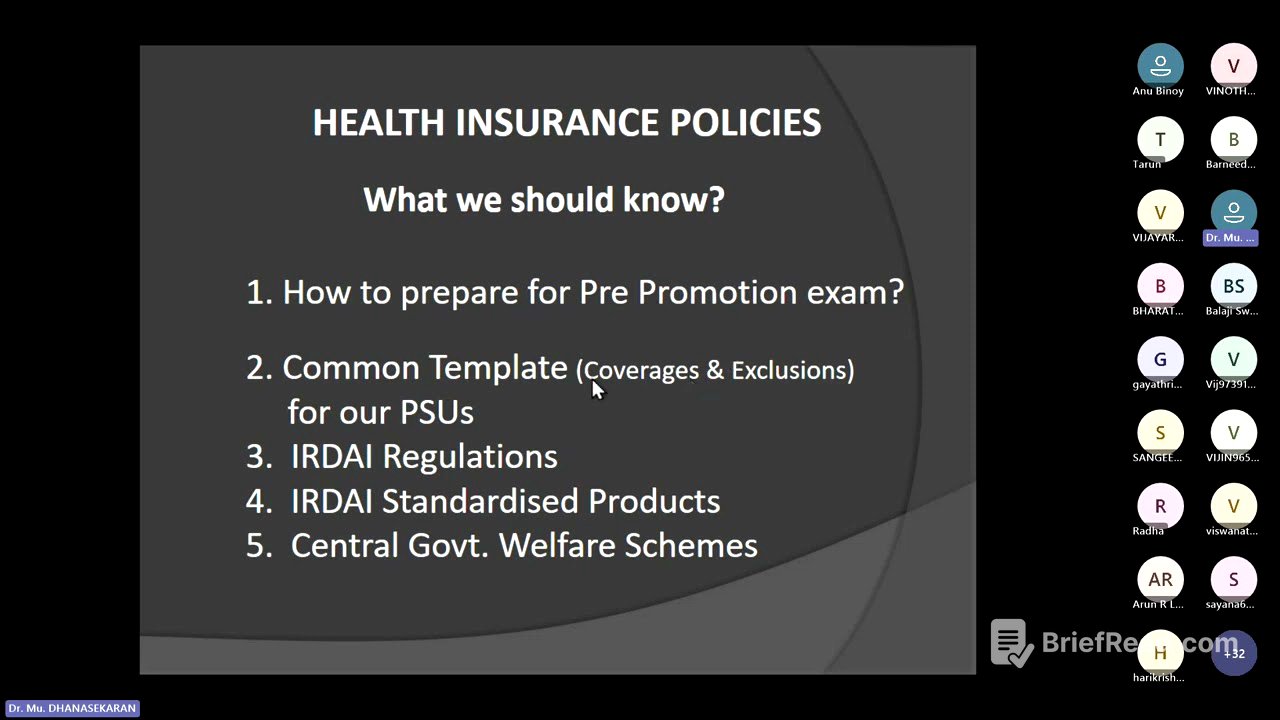

Alright, so this session is all about cracking the pre-promotion exam, especially focusing on health insurance. We'll cover how to read for the exam, some pro tips to excel, and how to stay calm and comfortable during the test. Plus, we'll discuss health insurance policies, common templates applicable to all four public sector insurance companies, IRDA regulations, standardized products, and central government welfare schemes.

- Reading for exams is different than reading for knowledge.

- Stay calm and comfortable during the exam.

- Focus on commonalities across all four public sector insurance companies.

Introduction and Session Overview [0:02]

So, today we're gonna start with health insurance, which is a super important topic. We might see around five to seven questions on it, whether you're a junior or a senior. Then, this afternoon, we can dive into general miscellaneous stuff, and tomorrow we'll tackle liability insurance. This session will be interactive, so feel free to respond when I ask questions. It'll keep things lively and help me keep my energy up.

How to Read and Prepare for the Exam [1:16]

Reading for knowledge is different from reading for an exam. For exams, it's not just about gaining knowledge but also about applying it effectively. Examiners want to see how well you can use what you've learned. When reading for the exam, don't waste time on unnecessary details. You'll have different subjects, but you can choose four to focus on. Be thorough with those four, and keep one as a backup. Exam questions can be long and complex, so having a standby subject can be a lifesaver.

Pro Tips for Exam Excellence [2:48]

Make sure you've gone through the "Pro Tips for Excellence" that were already shared. It'll be super useful. When you start the exam, make sure you're in a comfortable zone. Pick the easy questions first to build confidence. There are three cycles: first, answer the easy questions; second, complete the remaining questions; and third, double-check that you've saved all your answers correctly. Stay calm and relaxed during the exam to avoid mistakes.

Understanding the Question and Selecting the Right Answer [5:23]

In the exam, there will be simple, moderate, and complex questions. Simple ones are usually for juniors, while the others are for seniors. Since we have a mix of people here, some questions might seem tough for juniors and easy for seniors. But the subject matter is the same. Understand what's expected from a junior versus a senior. For example, if you ask a junior about a tomato, they'll say it's a tomato or a fruit. A senior will know it's a tomato and a fruit, but they'll also know it doesn't go in a fruit salad.

Common Template for All Four Companies [6:59]

When preparing, focus on what's common to all four companies. For example, even though United India calls it "Health Your Gold" and New India still uses "Mediclaim," focus on the common template applicable to all four. Whether it's miscellaneous, fire, or anything else, stick to the commonality of the subject matter. Don't focus on specific policies like "Uni Criticare," which is only marketed by United India. Instead, focus on common terms like "Critical Care policy."

Objective Type Questions and How to Approach Them [8:10]

Objective type questions can be one or two sentences, or they can be long. The answer can be direct, indirect, or analytical. You have to pick the best out of the four. When you read the question, be clear about whether it's asking for a direct or negative answer. "Not excluded" means included, and "not included" means excluded. Most of the time, you'll have to know the best out of the four options.

Mental Preparation and Confidence [9:31]

I want everyone here to be mentally prepared and confident. There shouldn't be any confusion. Give me your mind and physical activity, and walk along with me like a child. I'll be careful in teaching you, focusing on the exam point of view. Today, we'll talk about health insurance policies, and this afternoon, we'll cover miscellaneous policies. Tomorrow, we'll finish up with liability policies.

How to Prepare for the Pre-Promotion Exam [11:09]

I'm going to tell you something different, something more practical and useful. We'll cover common templates applicable to all four public sector insurance companies. You'll also learn about regulations, new circulars, and updated information from IRDA. Plus, you should know about IRDA standardized products and central government welfare schemes.

Understanding the Question and Answer - Junior Level [13:30]

First, understand the question. Read it properly. Then, understand the answer. If the question is positive, pick the positive answer. If it's negative, pick the negative answer. For example, "incorrect" means it's a negative, so the right answer is the positive one. Let's take an example: Rahul has a health insurance policy and wants to cancel it on the 20th day. He didn't make any claims. How does the insurer respond?

Free Look Period - Junior Level [14:17]

The question is about the free look period. Some people might think it's only 15 days, but after the 2021 regulations, it's 30 days. So, refund of premium is not possible as it exceeded the stipulated free look period is wrong. Refund amount would be considered in full is also wrong because the risk has commenced. The right answer is refund amount would be considered on a pro-rata basis for the balance of the period.

Free Look Period - Senior Level [17:36]

Now, let's see how this is interpreted for seniors. Rahul has a health insurance policy for one year, paying ₹9,500. He wants to cancel on the 20th day and didn't make any claims, but incurred ₹450 towards pre-medical examination charges. How does the insurer respond? The policy is not short-term, it's a one-year policy. The question includes ₹9,500, so they might ask for a mathematical calculation. He's returning within 30 days, so he's eligible.

Complexities for Seniors and the Correct Answer [18:31]

The question also mentions ₹450 for pre-medical charges. As per IRDA, if the insurer insists on a pre-medical checkup and the proposal is accepted, 50% of the pre-medical exam fees must be returned. So, the right answer is refund amount would be considered on a pro-rata basis for the balance period, excluding the insurer's part cost of the medical checkup after deducting stamp duty.

Mathematical Calculation for Seniors [22:32]

Or, the answers may be like this: by refunding an amount of ₹9,500, by refunding an amount of ₹8,771 minus ₹225 and SD, by refunding an amount of ₹8,996 plus SD, refund and amount is not possible to exceed the stated free period. The correct answer is B. ₹9,500 divided by 365 days is ₹26 per day. He used it for 28 days, so ₹26 into 28 days is ₹728. ₹9,500 minus ₹728 is ₹8,771. Then, deduct 50% of ₹450 (₹225) plus stamp duty.

Key Takeaways from the Free Look Period Example [24:07]

What did you learn? What is the free look period? What is the duration? What type of policy is it applicable to? It's not applicable to short period policies. It's applicable for one year or three years policies. How does the insurance expect to act to refund if the risk is not commenced? If the risk is commenced? If claimed? You should not simply skip because you know the right answer. You must sit there and think why the other three are wrong.

Model Question: Claim from Multiple Insurance Companies [26:02]

Here's another question: UIC policy period is 1/1/2019 to 31/12/2019 for ₹3 lakhs. NI policy period is 1/7/2018 to 30/9/2019 for ₹5 lakhs. Admitted on 1/12/2019, discharged on 16/2/2019. Claim amount is ₹3.8 lakhs plus non-medical expenses of ₹20,000. How does the insured make a claim? The claimant has the right to choose the first and second insurer based on the benefit that he likely gets reimbursed.

Model Question: Minimum Beds Criteria for AYUSH Hospital [28:41]

As per IRDA guidelines, an AYUSH hospital must comply with the minimum beds criteria. Is it 10 beds in rural, 15 in urban? Five beds in rural, 10 in urban? Five beds irrespective of rural or urban? Or no minimum number applicable? The answer is C: five beds irrespective of rural or urban.

Model Question: IRDA Guidelines on Telemedicine [30:39]

IRDA guidelines on telemedicine stipulate: insurance cannot cover telemedicine procedures, insurance can cover telemedicine on a pilot product basis, insurance is advised to allow telemedicine but approval of pilot is required, or insurance is advised to allow telemedicine but no approval of pilot use required. The answer is D: insurance is advised to allow telemedicine, no approval of pilot use required.

Understanding Telemedicine and IRDA's Stance [31:21]

Telemedicine is a facility where doctors contact patients without physical appearance over video. IRDA introduced this during COVID. Insurance is advised to allow telemedicine, no approval and file are required. All other products need file and approval, but telemedicine can be added by any insurer without file and use.

Model Question: Diseases Not Covered by Standard Health Insurance [35:26]

Which of the following disease conditions is not covered by standard health insurance policy? Hyperacute disease that is insidious and life-threatening, acute condition that is abrupt onset quick recovery, chronic disease condition existing before the policy, or chronic disease condition that acquired after certain policies policy period. The answer is C: chronic disease condition existing before the policy.

Understanding Different Disease Conditions [36:12]

Hyperacute means immediately life-threatening. Acute means abrupt onset, quick recovery. Chronic means existing before the policy. Any disease that is pre-existing is generally not covered. A disease acquired after taking the policy is covered.

Model Question: Picking the Odd One Out - Health Insurance Coverage [38:44]

With regard to health insurance coverage, pick the odd one out: pacemaker, prosthetic leg, cochlear implant, or intraocular lens.

Analyzing the Options and Finding the Odd One Out [39:21]

Pacemaker, prosthetic leg, cochlear implant, and intraocular lens. Anything that gets inside the body is payable, except one thing: cochlear implant. Anything that goes outside the body is not payable, except one thing: prosthetic leg. So, pacemaker is payable, prosthetic leg is payable, intraocular lens is payable, but cochlear implant is not payable. The right answer is C.

Clarifying the Confusion About Cochlear Implants [43:49]

Odd one out means three are similar in one aspect, and one is different. Pacemaker is payable, intraocular lens is payable, prosthetic leg is payable, cochlear implant is not payable because it's excluded.

Model Question: IRDA Standardized Health and PA Insurance [45:51]

With regard to IRDA standardized health and PA insurance coverages, pick the odd one out: Arogya Sanjeevani, Corona Kavach, Health Insurance Gold, or Mashak Raksha.

Identifying the Odd One Out Among Standardized Policies [46:31]

The odd one out means there are three similarities and one is odd. Arogya Sanjeevani, Corona Kavach, and Mashak Raksha are standardized policies introduced by IRDA. Health Insurance Gold is not an IRDA policy; it's a word given by public sector organizations. So, C is the right answer.

Common Template of Four PSU Health Insurance Products [48:30]

Now, we'll get into the subject: common template of four PSU health insurance products. This is common; there's no odd one. You should know the basics of this.

Science of Medicine and Hospitalization [48:56]

What are the sciences of medicine covered by public sector organizations? Allopathy, ayurvedic, unani, siddha, homeopathy, yoga, and naturopathy. Hospitalization means a minimum period of hospitalization not less than 24 hours required for basic hospitalization covers.

Domiciliary and Daycare [50:08]

Domiciliary means the patient is not able to go to the hospital, and there are some criteria. He can get treated at home. There's a limited sum insured for domiciliary. Daycare means because of the advancement of medical science, doctors are not admitting the patient for 24 hours.

Critical Care, Specific Illness, and Travel [51:30]

Critical care is a life-threatening condition. Specific illness policies are there. Travel for all four companies is not the same. Even though we use the word overseas medical policy, the coverages and conditions are common for all four companies.

Government Schemes and Product Marketing [53:44]

You must know government schemes like RSBY and PMJAY. There are a lot of questions coming every year because it's connected to our central government. The products are marketed by all the insurance companies: hospitalization product, domiciliary hospital product, daycare product, critical care product, specific illness product, travel product, and government skill product.

Policy Issuance: Individual, Floater, Stop Loss, Group, Specific Risk [54:20]

How are the policies issued? Individually, floater, stop loss, group policy, or specific risk policy. Individual includes family, proposer, and dependents. Floater means a single sum insured will be floated, and the premium will be paid. Claim will be shared among all the members in the family.

Stop Loss and Group Policies [56:28]

Stop loss is a top-up policy. If the basic policy is not enough to reimburse the loss, there must be one more additional policy which will take care of the difference of loss incurred by the customer. Group is given to more number of people. As per IRDA, seven and more is considered a group.

Individual vs. Group Policies: Key Differences [57:28]

There's a difference between individual and group policies. Individual policies are eligible under ATD income tax benefit. Under group, it is taken by the organizer or employer, so there is no ATD. In group, some facilities are there, like maternity add-on cover. Individual has a waiting period; after three years, the fourth year, free medical checkup they can avail the facility. That is all not there in group.

Maternity Benefit Clarification [58:33]

Maternity benefit is not at all covered in individual. In group, it is an add-on cover. In a group of a thousand people, if there are only 200 female members, out of 200, only 50 are newly married, then for the 50 people, they are only eligible for the maternity benefit, but the premium must be paid for the entire group.

Common Differences Between Individual and Group Policies [59:52]

Individual has a benefit of ATD; group does not have. Individual has pre-medical checkup after three years; group does not have. Individual has a bonus class; group has both bonus and manage class. Individual has no add-on covers; in a group, you can have a lot of add-on covers.

Claim Settlement: Indemnity, Benefit, Fixed Benefit, Excessive Loss [1:00:46]

How are claims settled? Indemnity basis, benefit basis, fixed benefit basis, or excessive loss basis. Indemnity means actual loss incurred as per the policy condition. Benefit means no question will be asked once it is proved that you are suffering from the disease. The entire amount will be paid to you without any deduction.

Understanding Sum Insured vs. Sum Assured [1:02:53]

Sum insured means it's a maximum amount by which whatever you're eligible, that will be paid. Sum assured means this is the amount; no question will be asked. The total entire amount will be paid.

Fixed Benefit and Excessive Loss Policies [1:05:13]

Fixed benefit policy: in individual policy, there are some policies in the end they have given Hospital benefit. Excessive loss: when your basic policy is not able to compensate your loss, that is excess of your loss.

Tax Benefits Under ATD [1:06:52]

If you pay a premium in an insurance company, what is the ATD eligibility for a non-senior citizen who has got an age below 60 years? Who has got above 60 years, senior citizen? Who is a super senior citizen who is above 80? A non-senior citizen is eligible for only ₹25,000. If the parents are also below 60, they can have a maximum of ₹50,000 under tax deduction.

Tax Benefits for Senior Citizens and Changes in ATD [1:08:56]

For a senior citizen, it's ₹50,000. If both are senior citizens, they can avail a maximum of ₹1 lakh from ATD. For a senior citizen, the ₹50,000 need not be the premium paid. They have given a provision for senior citizens: premium, preliminary checkup, and any medical expenses incurred more than the policy amount.

ATDD and ATDDB: Additional Tax Deductions [1:10:31]

ATDD: tax deduction on expenses incurred towards treatment of specific diseases. Section 80 DD: tax deduction on medical treatment of dependent who is a person with disability.

Key Points to Remember About Tax Benefits [1:11:30]

Non-senior citizen: ₹25,000. Senior citizen: the ₹25,000 includes the cost of medical expenses also. In the case of a senior citizen, the ₹50,000 includes premium, medical expenses, and preliminary checkup.

Hyperacute, Acute, Chronic, and Pre-Existing Conditions [1:12:05]

Hyperacute, acute, chronic, and pre-existing: I explained to you.

Any One Illness Clause [1:12:11]

A person has taken a policy, and it is expiring on the 25th of December. This person got admitted on the 20th of December and underwent treatment for typhoid. His policy expired on the 25th of December. He got discharged after the expiry of the policy. Will the claim be paid? Yes, the claim will be paid because the claim has occurred during the policy period.

Relapse of the Same Illness Within 45 Days [1:13:24]

He got back the same disease within 45 days, even though he has not renewed the policy in time. If he has to get admitted again for the same illness, if there's a balance of sum insured there, he can avail the facility under any one illness clause.

Clarification on the Any One Illness Clause [1:15:14]

Even if the policy is expired, then also it is payable. This is the only exception under AYUSH. It is common for all four companies. It is not there in any private companies. It is a class in the policy. A disease reoccurring, relapse of the same fever occurring within 45 days, even though the policy is expired, but he has got eligibility to make a claim within 45 days of the discharge.

Waiting Period: A 360-Degree Analysis [1:16:45]

When I ask you about the waiting period, what is the waiting period common for everything? You will say, "Sir, waiting, we know it's only 30 days." No, my dear friends, don't read like that. If you know 30 days, okay, it's applicable for all standard policies. But there are some waiting periods: 15 days, 90 days.

Different Waiting Periods and Their Applicability [1:17:20]

Where does 15 days waiting period come from? Corona policy. Where does 90 days waiting period come from? Critical Care.

Free Look Period, Portability, and Loading [1:18:18]

Free look period is 30 days. Portability: an individual policy can be floated to a group, and a group to individual at the same company. If it is a different company, from company A to company B also can be gone. Loading: why do we load the premium? If there is any medical condition what we regard as adverse medical conditions.

Adverse Medical Conditions and Adverse Claims Ratio Loading [1:20:36]

Adverse medical conditions: excessive cholesterol, hyperlipidemia, diabetes, high blood pressure, hypertension. If anyone has got it at the time of taking the policy, insurance has a right to load the premium towards adverse medical condition, maximum of 30%, provided if they got it approved by the IRDA at the time of file and use. Adverse claims ratio loading: you can load a bad client provided you should also got approved to load at the time of file and use.

Other Features Common to All Four Companies [1:23:11]

Now, we'll go to the other features that are common to all four companies. Each and every feature, maybe you may be knowing, but some intricacies I, whatever what all you I think you know, I'll rush. What all I think you know the intricacies, I'll take a little time and explain.

Age, Sum Insured, and Policy Period [1:34:55]

Age means what is the age at entry? What is the age at exit? Whom can we cover at what age? For a standard health insurance policy, the age at entry is 18 years to 65. We can also cover a child provided that it completed 90 days or 3 months, provided one of the parents must have been covered. There is no age limit. As long as we are continuing, till our life, we can continue.

Hospital Definition and Medical Practitioner Qualifications [1:37:03]

Hospital means it must be a recognized hospital, registered hospital with the local authorities. It must be registered with the Rogini. It must have the minimum number of beds. It should have a qualified registered medical practitioner.

Family Discount, Cumulative Bonus, and Health Checkup [1:38:30]

If a family is covered, we normally give discounts: family discount 5 to 10%. If he has not made any claim every year, the cumulative bonus goes up, maximum 50% of the sum insured. If he has not made any claim for 3 years, after completion of three years, 1% of the sum insured of positive policies.

Tax Benefit, Hospitalization, and Pre/Post Hospitalization [1:40:11]

Tax benefit we already discussed. Hospitalization science of medicine we already discussed. Waiting period already we discussed. 24 hours condition. Prehospitalization and post hospitalization: any expenses incurred before admission into the hospital is prehospitalization. After discharge, the doctor is advising you have to take the medicine for some time.

Pre and Post Hospitalization Limits [1:41:50]

Our liability is restricted to a maximum of 30 days prehospitalization, 60 days discharge. Their amount put together, both pre-hosp and post-hosp, should not exceed more than 10% of the sum insured.

Any One Illness Clause and Waiting Period [1:42:46]

Any one illness already we discussed. Living with the disease already we discussed. Waiting period: what is the waiting period common for everything? If you know 30 days, okay, it's applicable for all standard policies. But there are some waiting periods: 15 days, 90 days.

Hospital Definition and Pre-Existing Disease [1:43:53]

Under Hospital definition, they have made it 10 inpatient beds in places having a population of less than 10 lakhs people and 15 impatient beds in all other places. Pre-existing disease: the condition which the patient or the customer or the client is aware of even before taking the policy.

Adverse History Loading and Two Years Waiting Period [1:45:11]

Adverse history loading: diabetes, hypertension, elevated cholesterol, maximum 30%. Two years waiting period: cataract, benign prostatic hypertrophy, hysterectomy, hernia, hydrosil, piles, sinusitis, GBL stones, gout, rheumatism, car.

Congenital Internal Disease and Four Years Waiting Period [1:47:37]

Congenital internal disease: congenital means a defect existing at the time of birth. Congenital disease cannot be covered. Four years: all joint replacement.

General Exclusion: 30 Days, Pre-Existing, and Chronic Conditions [1:51:11]

General exclusion: 30 days waiting period, pre-existing 36 months, chronic even before taking policy that's not at all covered.

Moratorium Period: A New Condition by IRDA [1:52:16]

Moratorium period: after 5 years, if a person is making a claim, the insurance company cannot repute the claim for the reason that he is aware he has not told the insurance company.

Cosmetic Surgery, Circumcision, and Dental Treatment [1:53:36]

Cosmetic: changing face lifting, body lifting that is not covered. Circumcision: removal of tissue from the male reprod organ. Dental treatment of any kind is not payable unless otherwise it necessitates hospitalization.

Routine Eye Checkup, Supportive Debility, and Irrelevant Diagnosis [1:55:26]

Routine eye checkup, general checkup is not payable. Supportive debility: I just go to a doctor, doctor, I'm weak, give me B prescription, that is not payable. Irrelevant diagnosis: the person goes for a small problem in the foot, but he was asked to take an entire scan of the body, that is all not payable.

STD, Maternity, and Naturopathy [1:58:38]

STD: sexually transmitted diseases and any AIDS, all these not payable. Maternity is not at all payable under individual policy. Naturopathy is excluded only in allopathy.

Intoxication and War/Nuclear/Invasion [2:01:41]

Intoxication: if it creates a problem like alcoholic gastritis, that is not payable. War, nuclear, and invasion: it's a very, very common explosion for any policy.

Domiciliary Hospitalization: Eligibility and Exclusions [2:03:04]

Domiciliary hospitalization: the disease must be there for more than 3 days. The condition of the patient necessitates he or she cannot remove to the hospital. Lack of accommodation. Under domiciliary hospitalization claim, pre and post hospitalization are not covered.

Diseases Not Payable Under Domiciliary Hospitalization [2:05:39]

Asthma, bronchitis, chronic nephritis, gastro entries, diabetes, epilepsy, hypertension, cough, cold, influenza, mental illness, PUO, urinary tract infection, tonsillitis, laryngitis, arthritis, gout, rheumatism.

Maternity Benefit: An Optional Cover [2:09:25]

Maternity is an optional cover, normally given only along with the group policy, wherein 10% premium should be paid by everyone. Standard liability is ₹50,000.

Waiting Period and Exclusions Under Maternity Benefit [2:10:40]

Waiting period under maternity benefit is 9 months. Any medical recency miscarriage due to accident, legal termination, everything is automatically covered under normal policy as maternity policy. No pre and postnatal expenses.

IRDA Regulations: A Historical Overview [2:13:13]

IRDA regulations: the first regulation started in 2013. Subsequently, master circulars came in 2016, 19, 20, and the latest is 24.

IRDA Standardized Policies and Key Changes [2:19:39]

IRDA created standardized policies because individual insurance companies were simply confusing the people. Telemedicine is automatically allowed.