TLDR;

This YouTube transcript features a series of presentations from the Traders Corner Investor Summit, focusing on actionable strategies for stock and options trading. Key topics include shorting penny stocks, QQQ option strategies, price action analysis, and risk management. The speakers share their experiences, methodologies, and tools to help traders improve their skills and profitability.

- Shorting penny stocks using funded trader strategies.

- QQQ option strategy for doubling investments.

- Price action trading with a three-step strategy.

- Avoiding funded account blowouts through disciplined trading.

- Using Hakanashi candles for clearer price action.

Introduction to the Traders Corner Investor Summit [0:03]

The Traders Corner Investor Summit is an annual event featuring experts in trading. The summit aims to provide attendees with actionable and proven strategies for smarter trading and greater control over their financial futures. The event covers various topics, including price action mastery, options plays, reversal setups, chart geometry, and gap trading systems. Each speaker offers exclusive, limited-time deals for summit attendees.

How I Short Penny Stocks Using Our Funded Traders Playbook [1:12]

Michael Katz, CEO of Trade the Pool, shares his experience of shorting penny stocks using strategies employed by the firm's funded traders. He usually trades large-cap stocks but challenged himself to trade penny stocks for a week. He analysed the approaches of top traders like Sabrina, William, and Luke, focusing on setups like delusion plays, post-financial announcement shorts, pump and dumps, and technical breakouts. He used real money to document the process and identify both successes and mistakes. Key elements of the strategy include scanning for setups, understanding the catalyst behind news, analysing volume and price action, identifying resistance and support levels, and using indicators like MACD to spot divergences. He also shares examples of successful trades on stocks like DRE, XXI, VLCN, and SBAT, explaining the catalyst and technical analysis behind each.

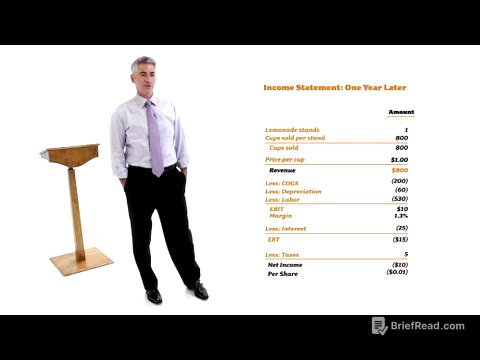

How Our QQQ Option Strategy Has Been Doubling in a Day, the 2025 Playbook [51:52]

Price Headley introduces a QQQ option strategy designed for quick gains, aiming to double investments within 24 hours without day trading. The strategy focuses on the NASDAQ 100, leveraging its liquidity and daily options expirations. Trade alerts are sent in the last half-hour of the trading day, targeting a double in a day or two, with a 50% stop-loss. The system uses Larry Wind's Percent R indicator to identify strong trends, buying calls when the market finishes strong. The strategy involves buying options three days out from expiration to manage time risk and avoid holding into the final day. He shares success stories, including a July 2nd trade where 550 strike calls doubled in value by the next day. He also discusses a bearish pattern using the bottom 20% of Percent R readings, buying puts when the market tests this level. The strategy aims for consistent capital allocation, allocating a fixed amount per trade (e.g., £1,000) and rolling over profits into the next trade.

Price Action is King. How I Crack the Code to More Profits with a Simple Three-Step Strategy [1:31:24]

Silas Peters presents a simple, mechanical three-step strategy for profitable trading, emphasising price action over complex indicators. The strategy, called the 15-minute trading blueprint, is designed to be repeatable across various markets and time frames. It involves identifying a low, a higher high, and a higher low for long positions, and the inverse for short positions. The strategy aims to capture trends and can be applied to scalping, intraday trading, swing trading, and position trading. He shares examples of successful trades in various markets, including stocks, futures, and forex, highlighting the importance of volume, capitulation, and key price levels. He also discusses common mistakes, such as not leaving a runner, entering too soon, and going too heavy at the beginning, and offers tricks to train the brain to avoid these errors. The presentation also touches on position sizing, hard stops, liquidity awareness, and the importance of understanding the catalyst behind news events.

Number One Reason for Funded Account Blowouts and How to Avoid It [2:24:13]

Norman Howlett discusses the primary reason for funded account blowouts in prop trading and how to prevent it. The key issue is the tight drawdown limit, where open trade equity is counted against the trader. He explains that traders must respect open trade equity and avoid giving it back to maintain a buffer from the red line. He recommends scalping to secure profits and using a combination of scalping and running to maximise gains while managing risk. He also stresses the importance of having frequent, reliable triggers that provide a pop in the desired direction. He advises traders to start small, master one setup, and document everything to build a unique trading style.

Learn to Trade Master Trader W Reversals on All Time Frames [3:01:35]

Dan Gibby shares a strategy for trading W reversals, a bullish pattern that can be applied across various time frames and instruments. The strategy involves identifying a momentum move down, a retracement of less than one-third, and a potent reversal near the prior low. He emphasises the importance of waiting for a potent reversal, rather than a simple one or two-bar reversal, to confirm the turn. He also discusses the significance of trading with the trend and managing risk effectively. He provides examples of successful trades, highlighting the key parameters and indicators to look for. He also touches on the bearish pattern, noting that it's proven to be breaking down.