TLDR;

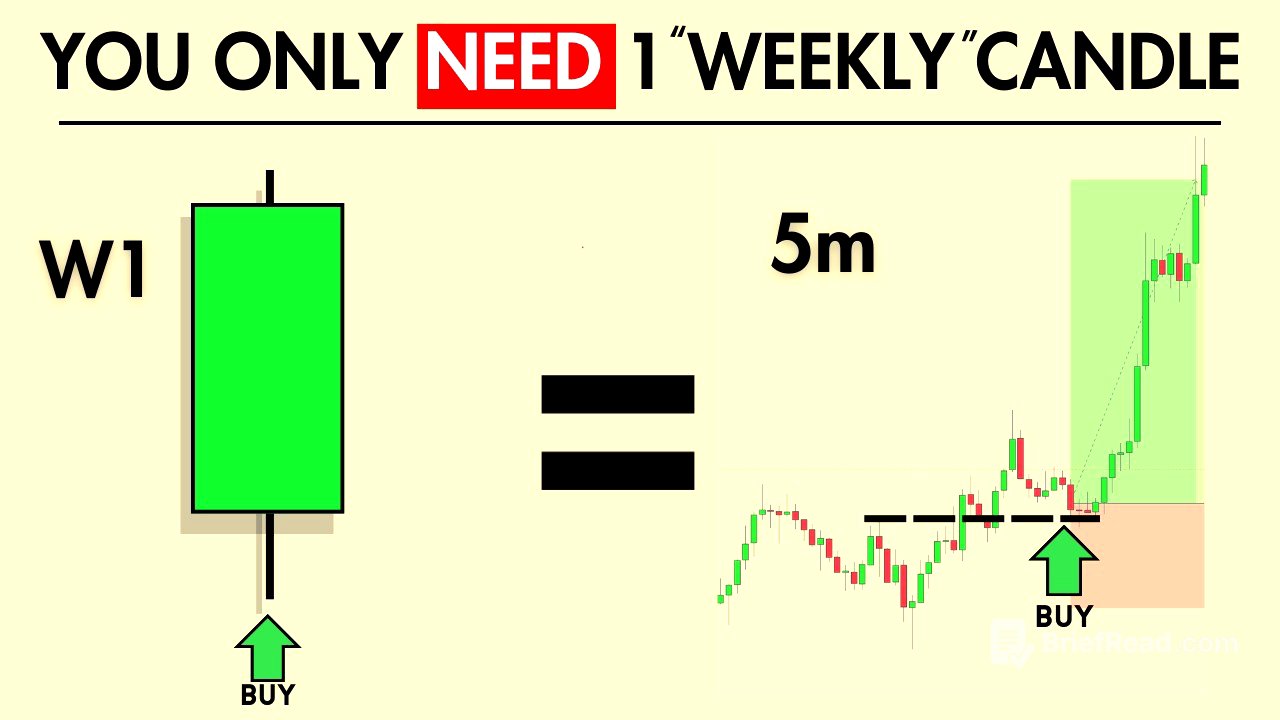

This video explains the Candle Impulse Theory (CIT) for trading, focusing on weekly candle movements, previous week's high and lows, and weekly candle closes. It covers candle mechanics to predict the next day's movements, understanding weekly bias for lower time frame trading, and live chart examples. The video also touches on using volumetric info to time reversals.

- Understanding weekly candle movements

- Trading previous week's high and lows

- Trading weekly candle closes

- Using volumetric info to time reversals

Intro - Understanding The Candle Impulse Theory (CIT) [0:00]

The video introduces a strategy based on the previous week's high and low to predict daily candle movements. The course will cover weekly candle movements, trading the previous week's high and lows, trading the weekly candle close, weekly candle mechanics to predict the next day, opening week gaps, understanding weekly bias for lower time frames, and live chart examples. Prerequisites include watching videos on the daily time frame with the previous day's high and low strategy and the 4-hour candle close. A bonus is the Nova Legacy five steps to becoming a profitable trader booklet.

Candle Anatomy [1:00]

The anatomy of a bearish weekly candle starts with price fluctuating around the previous week's closing price, followed by a retracement to tap into previous PD arrays, then a distribution to the downside creating the major body. The previous bullishness is left as a wick. The candle ends with exhaustion, tapering off at the low. Bullishness at the start of the week creates the high, and the close occurs at the end of the week, with a major wick created midweek near exhaustion.

Candle Mechanics [1:41]

The presenter explains the standard formation of bearish and bullish weekly candles, including variations like opening gaps due to Sunday movements. A bearish candle typically starts with a flat line, retraces to previous PDAs, and then distributes downwards, with the midweek seeing large spikes to create the week's wick, often breaking above Monday and Tuesday's highs. Bullish candles start with a flat line or gap, retrace to PDAs, and then distribute upwards, creating a wick to show former bearish presence. An indecisive week may still exhibit traits of an impulsive week, with Wednesday sweeping the lowest point of the week.

Mastering The Candle Impulse Theory (CIT) [7:30]

The Candle Impulse Theory (CIT) helps determine the weekly bias. For an impulsive previous week, mark the high and low with a Fibonacci box, focusing on the 25% and 50% retracement levels. Price often makes a short retracement before continuing towards higher time frame liquidity. In a bearish scenario, after the opening retracement to the 50-25% level, look for a major distribution to trade the downward movement, aiming to exit trades near Friday's exhaustion. The opening of the week is consolidated, and the midweek makes the highest point before reversing, resembling the power three or four concepts: accumulation, manipulation, distribution, and exhaustion.

Calculating Weekly Reversal [11:50]

The CRT (Candle Reversal Theory) involves two to three weekly candles. If the previous week's price sweeps a major point of liquidity and closes back, a bearish bias is indicated for the entire week. Another scenario involves the high and low of the previous week being swept, suggesting an initial trade on the wick followed by distribution. Closing back below indicates a reversal, which can be confirmed on lower time frames. Adaptability and following the market flow are crucial. A weekly candle starting with a gap indicates previous Sunday price action not fully registered until Monday. Price will likely return to fill this gap, indicating whether the week will be impulsive or reverse.

How to enter Flawlessly on the lower-timeframe [16:51]

To enter trades, the presenter uses the break block and change state delivery, entering off the break block to the downside or trading off the rebalancing of a previous fair value gap after a change in delivery.

LIVE Trade Examples [18:15]

The presenter reviews live trade examples, referencing documentation in the Nova Legacy Discord. The examples are based on weekly candle mechanics. One example shows a bullish week where Monday pushes up, suggesting a potential reversal on Tuesday or Wednesday. Another example shows a week starting with an opening gap, with price action shifting from bullish to bearish on Wednesday, eventually filling the gap.

Trade Executions [23:33]

The presenter reviews specific trades on NASDAQ and gold, explaining the rationale behind each. For NASDAQ, trades were based on the 4-hour CRT (Candle Reversal Theory), using the 5 AM candle's high and low points as reference. For gold, trades involved capitalizing on the CRT of the high, trading towards the lows, aligning with the weekly candle's bearish direction.

[BONUS]How To Time Every Reversal using volumetric info

The presenter uses the Price Action Toolkit by Flux Charts to time reversals, utilizing volumetric info of PD arrays like fair value gaps, order blocks, and break blocks. The indicator shows the volume at each zone, providing an edge. A key factor is the difference between selling and buying volume. The presenter uses this tool within the context of the weekly candle's bearish distribution, focusing on selling volume. A change in state delivery is created as price closes below a certain point, and trades are entered as price balances off the zone.