TLDR;

This video explains Larry Williams' Volatility Breakout strategy, which turned $10,000 into $1.1 million in 12 months. It uses the Donchian Channels indicator with specific settings on a 5-minute timeframe, along with the LWTI and volume indicators for confirmation. The strategy aims to identify high-quality breakout trades by avoiding false signals during market consolidation. A secret trick involving higher timeframe support and resistance levels is revealed to improve the strategy's performance.

- The strategy uses Donchian Channels, LWTI, and volume indicators.

- It focuses on identifying high-quality breakout trades.

- It incorporates a secret trick using higher timeframe support and resistance levels.

Introduction to Larry Williams' Strategy [0:00]

The video introduces Larry Williams, a professional trader who achieved remarkable returns by turning $10,000 into $1.1 million in just 12 months. The content creator sought to uncover the specific trading strategy Williams used to achieve these gains. The video reveals the exact trading strategy, highlighting its effectiveness and the creator's intention to share it with viewers.

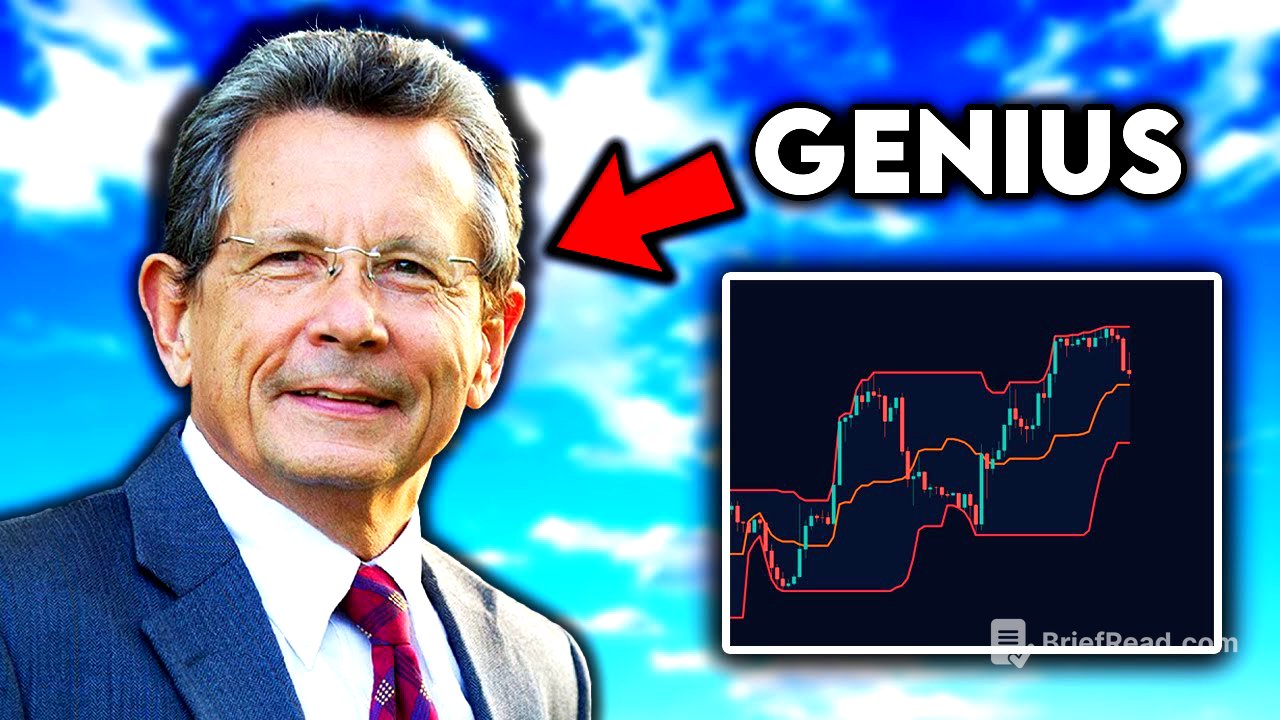

LW Volatility Breakout Strategy: Donchian Channels [0:41]

The strategy is called the LW Volatility Breakout strategy, which relies on the Donchian Channels indicator. To set it up, the Donchian Channels indicator is added to the chart, and its settings are adjusted. Specifically, the length is set to 96, and the line colors are changed to red for better visibility. It's emphasized that these settings are tailored for the 5-minute timeframe, which Larry Williams used.

Understanding Donchian Channels [1:40]

The Donchian Channels indicator consists of three lines: a middle line and upper and lower bands. The middle line acts as a mean reversion point, attracting the price towards it like a magnet and indicating market momentum (bullish above, bearish below). The upper and lower bands serve as potential support and resistance levels, with breakouts above or below these bands signaling potential continuations in that direction.

Addressing False Signals [2:22]

A problem with the strategy is the potential for false signals during market consolidation. When the market moves sideways, the upper and lower bands of the Donchian Channels become close together, leading to breakouts that lack significant momentum. These false breakouts can result in losing trades. To counter this, the video introduces two additional confirmation indicators to filter out low-quality trades.

Confirmation Indicators: LWTI and Volume [4:07]

The first confirmation indicator is the LWTI (Larry Williams Large Trade Index), with its period set to 25 and smoothing period to 20. The second confirmation indicator is a simple volume indicator, with its moving average length set to 30 and the volume moving average color set to white. These indicators help confirm the presence of genuine momentum behind potential breakout trades, reducing the likelihood of false signals.

Long and Short Trade Setups [5:12]

For a long trade, the price must touch the upper red line, the LWTI indicator must be green, and the volume bars must be above the white line and also green. All three criteria must be met to enter the trade. The stop loss is typically set right below the middle orange line, unless there's a large gap between the upper band and the orange line, in which case it's set at the recent swing low. The take profit is set at a 2:1 risk to reward ratio. The process is similar for short trades, but with opposite conditions.

The Secret Trick: Support and Resistance [6:53]

The secret trick involves considering major support and resistance levels on higher timeframes like the 1-hour chart. Trades should be avoided if they occur near these levels, as these levels can cause price reversals. Conversely, if the price is breaking a resistance level and all indicator requirements are met, it presents a high-probability trade due to the confluence of bullish momentum. Pairing the strategy with support and resistance or supply and demand analysis enhances its effectiveness.