TLDR;

This video summarizes the most significant moves from the recent 13F filings of top investors. It covers Warren Buffett's continued reduction of his Apple stake, Berkshire's new investment in United Health, Li Lu's substantial purchase of Pinduoduo, Bill Ackman's new position in Amazon, and Seth Klarman's increased stake in Google. The video also touches on the reasoning behind these moves, considering factors like valuation, tariffs, and long-term growth potential.

- Warren Buffett reduced his Apple holdings, possibly due to tariff concerns.

- Li Lu invested heavily in Pinduoduo, a Chinese e-commerce company.

- Bill Ackman acquired a significant stake in Amazon, capitalizing on a price dip.

- Seth Klarman increased his investment in Google, despite concerns about its long-term competitive advantage.

The 13Fs are Released! [0:00]

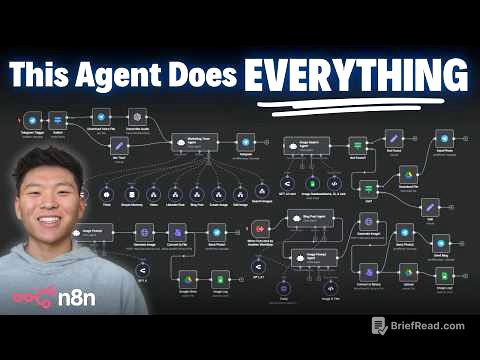

The video introduces the concept of 13F filings, which are quarterly reports that large money managers must submit to the SEC, revealing their stock holdings. These filings offer insights into the investment strategies of top investors, acting as a kind of "investing cheat code" by showing what these experts have been buying and selling. The presenter notes that recent filings reveal significant moves by notable investors in prominent companies.

Buffett's Apple Decision [0:45]

Warren Buffett's Berkshire Hathaway has further reduced its stake in Apple by selling another 20 million shares, representing 6.67% of their remaining Apple holding. This continues a trend that began in Q1 2024, where Buffett sold over 605 million Apple shares, reducing Apple's portfolio weight from 50% to 25%. While previous sales were attributed to concerns about corporate tax rates, a desire for more cash, and Apple's high valuation (PE of 38), the reason for this latest sale is less clear, especially since Apple's stock price has fallen since Buffett's previous sales. One speculation is that Buffett may be reacting to potential tariff headwinds, as Apple's Q2 earnings call indicated a potential $900 million per quarter impact from tariffs. In other moves, Berkshire Hathaway initiated a $1.5 billion position in United Health, increased its stake in Chevron by 3%, and reduced its positions in Bank of America and DaVita Healthcare by 4%.

Li Lu Buys a Big Chinese Tech Stock [3:20]

Li Lu's Himalaya Capital made a significant new investment in Pinduoduo (PDD), a Chinese e-commerce company, purchasing 4.6 million shares worth $482 million. This position immediately became the second-largest in the portfolio, accounting for almost 18%. Pinduoduo competes with companies like JD and Alibaba, using a group buying model where users get discounts by inviting friends and family to join purchases. The company primarily generates revenue through advertising services, where merchants pay to promote their products. Pinduoduo is also known for launching Teeu in 2022, bringing a low-cost, factory-direct model to the global market. Li Lu likely favors Pinduoduo due to its competitive advantage in e-commerce, focusing on low-cost models and building a network effect. However, Pinduoduo experienced a 38% year-over-year drop in operating profit in the most recent quarter due to substantial investments in its platform ecosystem.

Bill Ackman's Ecommerce Investment [6:00]

Bill Ackman's Pershing Square has made a new $1.3 billion investment in Amazon, making it their fourth-largest position at 9.31% of the portfolio. Ackman disclosed this position in May, citing Amazon as a "fantastic franchise" acquired at an "extremely attractive price" after a 30% dip in shares earlier in the year. The share price decline was primarily due to short-term fears about the generative AI boom and US tariffs. Pershing Square believes Amazon can work through any slowdown, expecting the company to continue delivering over 20% earnings per share growth. Amazon CEO Andy Jasse has stated that the company has not seen any significant impact from tariffs, with no attenuation of demand or appreciable increase in retail item prices. Since Ackman's investment, Amazon's stock has rebounded by approximately 40%.

Seth Klarman Doubles Down [8:48]

Seth Klarman's Baupost Group increased its stake in Google by nearly 27%, making it the largest position in their portfolio at 11.36%, worth $467 million. This move is notable because other investors, like Li Lu, have been selling Google shares. There are two perspectives on Google: one views it as an exceptionally profitable company with a monopoly in internet search, generating significant revenue. In the most recent quarter, search revenue grew almost 12% year-over-year, with the Google services business generating $33 billion in profit and Google Cloud generating $2.8 billion in profit. The business is producing $24 billion in free cash flow year-to-date. The other perspective questions Google's long-term competitive advantage in internet search due to the rise of chat GPT. While Google's financial performance remains strong, some investors are starting to doubt the strength of its long-term moat in search. Klarman sees Google as a business with a $95 billion cash cushion, making almost $63 billion in profit and $24 billion in free cash flow every six months, with a dominant advertising business and a growing cloud segment, all at a PE ratio of 22.