TLDR;

This YouTube video provides an analysis of two upcoming IPOs: Monika Alcobev (an SME) and Smartworks Coworking (a mainboard IPO). The speakers discuss the business models, financials, and potential risks and rewards associated with each IPO, offering insights to help viewers make informed investment decisions.

- Monika Alcobev: High mode business, potential for growth, but expensive valuation and cash flow concerns.

- Smartworks Coworking: Bullish on the co-working sector, but concerns about the company's valuation, profitability, and corporate governance.

Opening Remarks [0:00]

The speakers introduce the IPO review for the week of July 3rd, focusing on four upcoming IPOs. Due to time constraints and prior preparation, they will only cover two companies in this session: Monika Alcobev and Smartworks, with the remaining two to be discussed later. They also express gratitude for the positive feedback on their previous OFS video and share personal experiences from the Indoar OFS. They remind viewers that their opinions are not qualified advice and encourage independent due diligence. They also promote their YouTube channel for more content and knowledge sharing.

Monika Alcobev (SME) [3:58]

Monika Alcobev, incorporated in 2015, is an importer and distributor of luxury alcoholic beverages in India and the Indian subcontinent, managing a portfolio of over 70 premium brands. The IPO is a ₹165 crore issue, with ₹135 crore being a fresh issue and ₹30 crore an OFS. The company has a market cap of around ₹610 crore and is diluting approximately 27-28%. The revenue is ₹238 crore, making the market cap to sales ratio approximately three times. The company operates through hotels, restaurants and caterers.

The company is more than just a distributor, handling sales and marketing for the brands they import, acting as brand owners in the Indian market. They manage logistics through six bonded warehouses, distributing across 20 states. A key aspect of the alcohol industry is its high tax and duty structure, with taxes accounting for 70% of the final cost. The industry is complex due to varying state regulations, distribution challenges, and marketing restrictions. The company focuses on the premium and luxury segment, with an average per bottle realization of ₹17,000. Trade agreements reducing import duties on alcohol are a significant tailwind for the company.

The company's financials show a topline of ₹236 crore with a ₹23 crore profit, representing a 10% margin. The company generally aims for 18-20% EBITDA and 8-10% profit after tax. Cash flows are weak due to the industry's inherent cash cycle, with long import times and inventory holding requirements. The company is projecting around 30% year-on-year growth for FY26, targeting ₹310 crore in revenue. The IPO is priced at 26 P/E, or 13 times EBITDA.

The speaker highlights that the promoter has a background in the liquor business and the company should be viewed as one of a kind, without direct peers. The speaker believes that the company's focus on premium brands and its established distribution network make it a promising investment. The speaker plans to apply for the IPO, hoping for a subdued listing followed by a potential run-up.

Smartworks Coworking (Mainboard) [26:08]

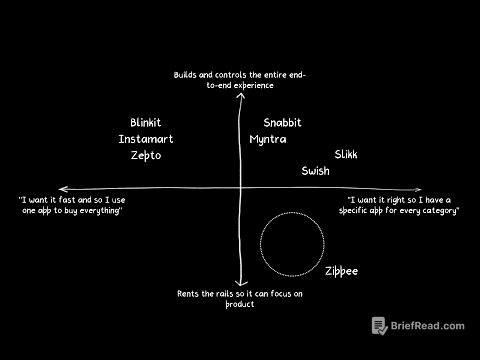

Smartworks Co-working Spaces, established in 2015, offers customized, managed workspace solutions with tech-enabled office environments. The IPO is ₹583 crore, including a fresh issue of ₹445 crore and an OFS of ₹130 crore. The company's market cap is ₹4,600 crore. The company operates 1.84 lakh seats across 54 centers in 15 cities in India. They target institutional clients and HNIs, offering office spaces with amenities like gyms, squash courts, and food courts.

The company is raising ₹445 crore for growth capital, with ₹114 crore allocated for loan repayment. The business model involves leasing office spaces and customizing them for clients, handling all operational aspects. The speaker is positive about the co-working sector due to the increasing number of companies establishing centers of excellence in India.

The speaker expresses concerns about the company, including clauses where promoters receive ₹2 crore cash bonuses upon IPO, which is not tied to execution targets. The company's adjusted EBITDA for FY25 is ₹172 crore, implying a 12.6% margin. Smartworks has lower per-seat realization (₹6,600) compared to its peer, office space (₹8,800), and lower EBITDA margins despite higher occupancy. The company is coming at a premium valuation compared to office space.

The company had a pre-IPO round at ₹450 per share in September, followed by a June round at ₹270, raising questions about the valuation jump. There are also ongoing legal cases against the company, with allegations of funds being routed through shell companies. The speaker will avoid the issue due to the high valuation and governance concerns, suggesting that the IPO is priced too high compared to its listed peer.

Closing Remarks [46:52]

The speakers summarize their reviews of Monika Alcobev and Smartworks. They plan to discuss Farma and Spun Web Nonwoven in a future session, possibly on Tuesday, and will keep viewers updated. They encourage viewers to conduct thorough research and make informed decisions. They thank everyone for joining and conclude the session.