TLDR;

This webinar discusses the importance of project risk management in the oil and gas industry, especially during periods of fluctuating oil prices. It highlights how effective risk management can significantly reduce break-even costs, potentially making the difference between profitability and loss. The presentation also includes a demonstration of how RiskyProject Enterprise software can be used to identify, assess, and mitigate risks at both the project and portfolio levels.

- Importance of risk management in reducing costs in the oil and gas industry.

- Overview of RiskyProject Enterprise software for project and portfolio risk analysis.

- Practical demonstration of risk identification, assessment, and mitigation using the software.

Introduction [0:02]

The Intaver Institute's webinar introduces project risk management in the oil and gas industry, emphasizing its current relevance. A brief introduction to Intaver Institute and RiskyProject software is provided, highlighting its various versions, including desktop (light and professional) and enterprise solutions. The company's extensive client base, including numerous oil and gas companies and project consulting groups, is also mentioned.

Oil Price Overview and Break-Even Costs [1:41]

An overview of 30-year oil prices reveals significant variance, making future predictions challenging. Experts believe prices will likely remain between $50 and $80 for the next few years. Since many North American production break-even costs are above $60, profitability is at risk. Break-even costs vary across global producing regions due to physical and geotechnical factors, as well as management processes. Companies with effective management practices consistently reduce costs and maintain profitability. North American shale production shows lower variance due to technical efficiencies. If oil prices stay around $60, North American production remains profitable, but a sustained $50 price would require significant cost control efforts.

Components and Impact of Break-Even Costs [4:03]

The components of break-even costs include contingency, differential cost of capital, and planned versus actual expenses. Poorly managed risks escalate break-even costs, potentially leading to lower ROI, project postponement, or shutdown. Implementing robust project and portfolio risk management can actively manage risks, reduce overall impact, and maintain profitability during periods of depressed oil prices. The Harvest Energy Black Oil Sands project is cited as an example where inadequate risk management led to cost escalation and project postponement.

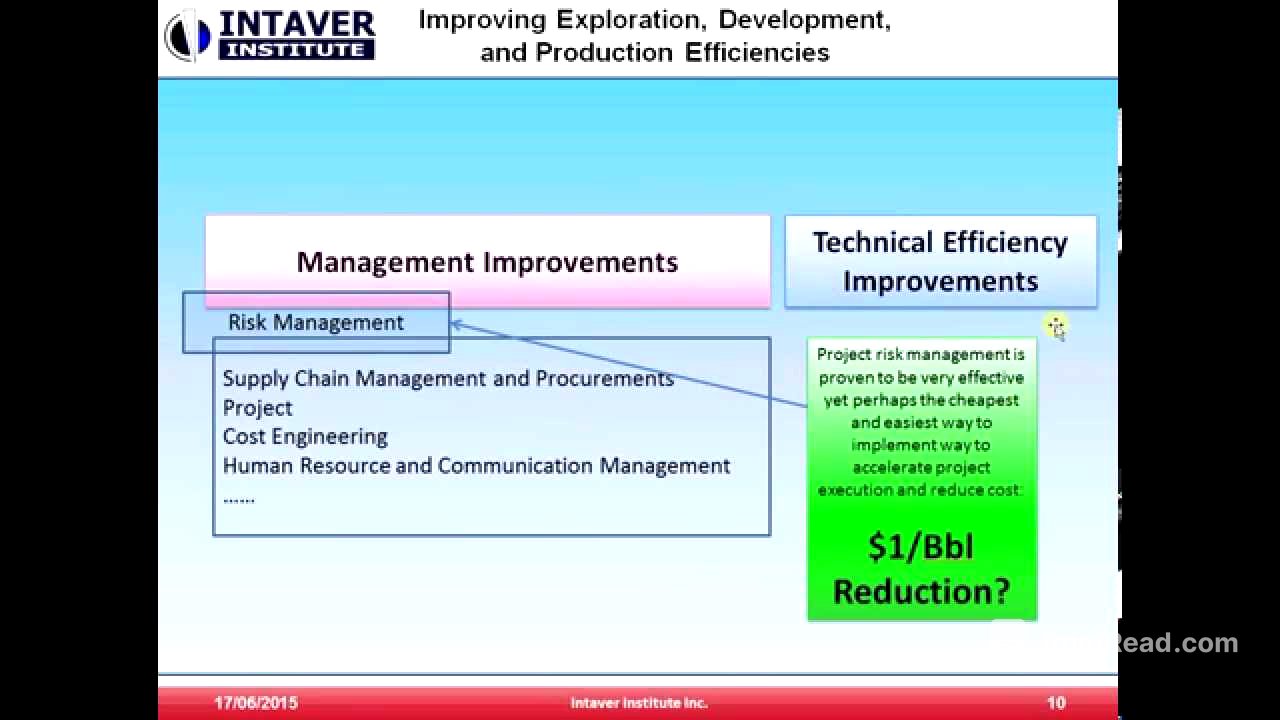

North American Fields and Efficiency Improvements [5:52]

Break-even costs vary considerably among North American fields due to geophysical and geotechnical factors, as well as differing management capabilities. Some producers consistently maintain lower costs through effective management practices. Wood Mackenzie forecasts a 33% reduction in exploration costs, partly due to lower labor and material costs, but significantly from efficiency improvements. Efficiency improvements encompass management and technical aspects, with risk management overseeing supply chain management, procurement, project cost engineering, human resources, and communication management. Effective risk management accelerates projects and minimizes costs, potentially reducing costs by up to a dollar a barrel, which can be the difference between profitability and loss.

Project Risk Management Process [8:15]

To assess projects, it's important to create a project plan, identify project risks, assign risks to projects and activities, calculate the impact of these risks, assess the impact of risks on the project and portfolio, and create risk response plans to manage risks during the project.

RiskyProject Enterprise Overview [8:51]

RiskyProject Enterprise is used to analyze an oil and gas project portfolio to determine the risks each project faces, their impact on project cost and schedule, and how they affect the overall portfolio. The goal is to assess risks at the project level and roll them up to understand their portfolio-wide impact, helping to prioritize or postpone projects based on risk levels.

Project Plan and Risk Register [10:05]

A project plan includes a schedule with activities, resources with rates, and fixed costs, all of which can have uncertainties. Each project has its own risk register where risks are identified and assigned to activities, with probabilities and impacts assessed. Risks can be dragged and dropped onto activities, and their potential impacts on cost, schedule, reputation, safety, and quality can be defined using triangular distributions.

Risk Impact and Project Analysis [13:39]

After assigning risks, the software calculates their impact on the project. The resulting Gantt chart shows how risks and uncertainties can cause project delays. The project summary provides charts, statistics, and percentiles, offering an overview of the uncertainty in the system. Cost analysis reveals that time-dependent costs increase as the project runs longer due to risks.

Portfolio Analysis and Risk Identification [15:01]

The project portfolio view displays estimates for duration and risk scores. A risk projects bubble chart identifies projects with higher relative risk based on cost or duration. The project risk portfolio risk register identifies the risks driving the results, allowing users to examine how risks are assigned across the portfolio.

Risk Mitigation and Planning [16:51]

Planning is essential to manage critical risks. Mitigation charts allow users to input activities that reduce probabilities and impacts, showing a waterfall chart of how risks are managed. Pre- and post-mitigation costs are compared, and the expected loss is calculated. By mitigating risks, break-even costs can be significantly reduced. The risk matrix helps plan and visualize pre- and post-mitigation risks.

Conclusion [20:10]

Reducing break-even costs through effective risk management is crucial, especially when oil prices are low. Risk management is a significant tool for impacting project profitability and feasibility. Contact information for Michael Trumper at Intaver Institute is provided for further inquiries. The Intaver Institute website offers white papers, articles, tutorials, and information on published books, including the award-winning "Project Think."