TLDR;

The video is a recap of a day trading session where TJR analyzes market movements, discusses trading strategies, and celebrates a profitable day. He focuses on identifying key liquidity points, anticipating market reactions, and executing trades based on these observations. He also shares personal moments, including his excitement about being back in Puerto Rico and reuniting with his dog, Boogie.

- Market analysis and anticipation of movements based on liquidity.

- Execution of trades based on identified patterns and confluences.

- Personal anecdotes and interactions with his dog, Boogie.

- Promotion of his free trading course and mentorship program.

Intro and Market Overview [0:00]

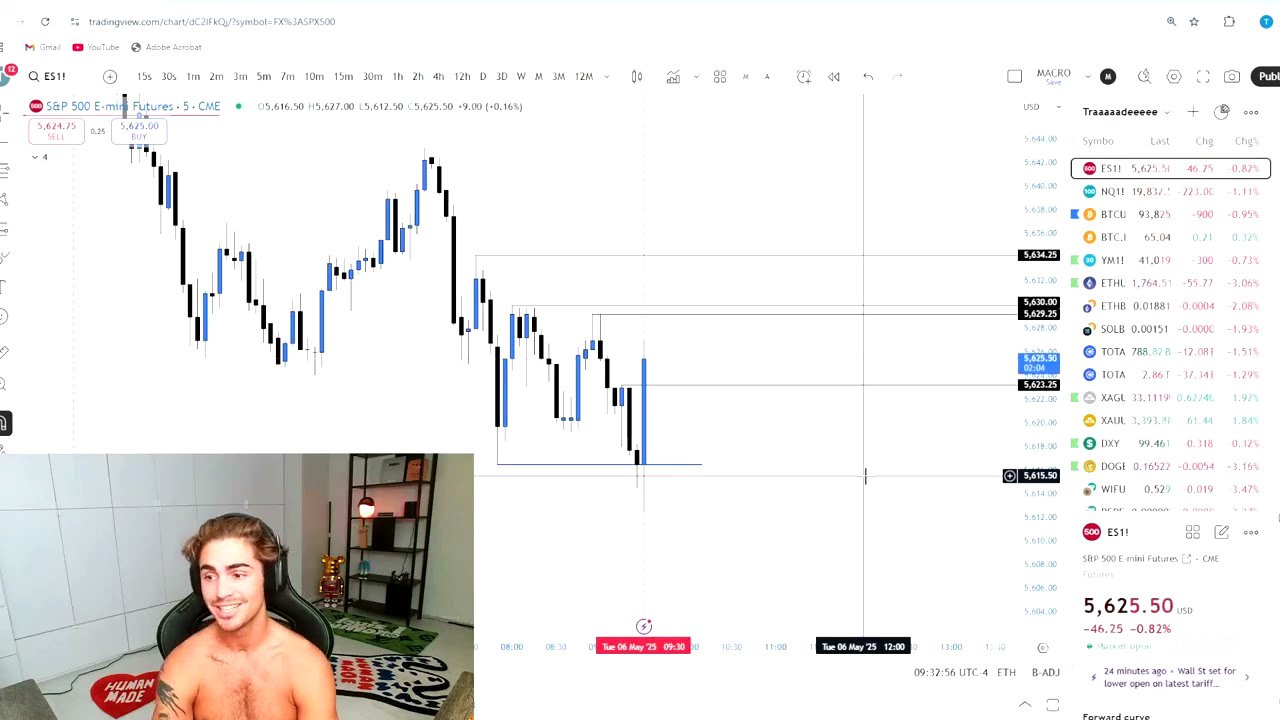

TJR starts by acknowledging the previous day's trading results and then transitions into an analysis of the current market conditions. He notes that the new week opening gap on ES (E-mini S&P 500 futures) has been filled and discusses the rotation to take out low resistance draws on liquidity. He identifies the next area of low resistance liquidity on a higher time frame and points out the lows on NASDAQ. TJR mentions the upcoming FOMC (Federal Open Market Committee) meeting minutes and expresses his enthusiasm about being back in Puerto Rico.

Trading Strategy and Market Predictions [1:45]

TJR maps out the London session and suggests a potential New York manipulation followed by a reversal. He anticipates NQ (Nasdaq 100 futures) taking out high time frame lows and discusses the possibility of ES forming a high time frame SMT (Smart Money Technique) before a downward rotation. He emphasizes the importance of understanding market dynamics and avoiding the expectation of V-shaped recoveries after taking out draws on liquidity. TJR also shares his strategy for low time frame trades, focusing on predicting short-term price action and identifying potential profit-taking opportunities.

Market Open and Initial Analysis [6:18]

TJR checks his sleep score and expresses how much he misses his dog, Boogie. He promotes his free trading course and mentorship program, encouraging viewers to utilize the free content before considering paid coaching. He mentions that he needs a shower and expresses his enjoyment of being back in Puerto Rico. He notes that he puts on headphones because it makes him feel safer.

Liquidity Sweeps and Market Movements [12:13]

TJR observes that the market has taken out five-minute highs and expresses his desire to see further sweeps. He mentions needing advice on how to get rid of under eye bags. He notes that ES and NQ have taken out highs, but he wants better price action than the previous day. He anticipates Boogie's arrival and expresses his excitement about seeing him.

Pre-Macro Analysis and Strategy [20:14]

With seven minutes until the macro open, TJR discusses his bias towards sweeping low resistance liquidity and looking for short opportunities. He mentions his recent focus on more aggressive, scalping entries and shares that he has been teaching his blueprint students this approach. He acknowledges that he has been too reckless with his entries and plans to be more cautious. He notes a potential SMT forming on the one-minute chart.

Macro Open and Initial Reactions [25:21]

TJR observes a significant market drop and expresses his desire to understand the cause. He anticipates a reaction off the five-minute bullish order flow and hopes for profit-taking to allow for short entries. He notes the invalidation of a five-minute gap and anticipates a five-minute retrace before targeting lows.

Market Consolidation and SMT Formation [30:26]

TJR discusses the potential for a high time frame SMT and observes NASDAQ sweeping lows. He emphasizes the need for a significant push past these lows to confirm the sweep. He notes big moves up off the sweep and the market entering a five-minute order block and breaker.

Boogie's Arrival and Trade Setup [36:39]

Boogie arrives, interrupting TJR's trading session. He puts on a shirt and prepares to greet his dog. He notes that NASDAQ has moved past the lows again, which is what he wanted. He mentions the potential for a low time frame SMT and prepares to grab Boogie. He enters a light risk position on ES, planning to look for a continuation confluence on the one-minute chart after greeting his dog.

Trading with Boogie and Market Analysis [41:40]

TJR is overjoyed to see Boogie and spends time cuddling and greeting him. He manages his trade while interacting with his dog. He notes that the gap has been filled and enters with a little bit more risk. He monitors NASDAQ and ES, looking for opportunities to take out highs.

High Time Frame SMT and Market Intuition [45:57]

TJR discusses the potential for a high time frame SMT, noting NASDAQ's sweep of the lows. He reflects on his intuition regarding market movements and the difficulty of explaining such insights. He emphasizes the role of market experience in developing this intuition.

Trade Management and Profit Taking [49:08]

TJR emphasizes the importance of avoiding bearish reactions to bearish confluences. He notes that the indexes are disrespecting bearish signals, which is favorable for his trade. He waits for his take profit to be hit, hoping for no unexpected news or market crashes. He manages his positions, taking profits and leaving runners.

Closing Trades and Celebrating Profits [54:00]

TJR observes the market taking out highs and debates closing his entire position. He manages half of his position as take profit one is hit, leaving runners. He continues to manage his positions, taking partial profits as the market moves in his favor. He ultimately closes all positions, securing a $78,000 profit for the day.

Final Thoughts and Outro [1:01:15]

TJR celebrates the successful trading day, highlighting that he made back the previous day's losses and secured a $45,000 profit for the week. He thanks viewers for tuning in and welcoming Boogie back. He promotes his free course and mentorship program, providing links in the description. He expresses his appreciation for his audience and signs off, looking forward to the next session.