TLDR;

This video introduces the concept of working capital, its management, and methods to estimate its requirement. It explains why managing working capital is crucial due to its cost and its use in routine operating activities. The video also covers how to manage working capital by maintaining it at an optimum level and introduces two methods for estimating working capital requirements: the Operating Cycle Period (OCP) method and the Net Current Asset method.

- Working capital is defined as the capital used in a business's routine operating activities.

- Managing working capital is essential because of its cost and its direct impact on day-to-day operations.

- The key to managing working capital is maintaining it at an optimum level, avoiding both over and under investment.

- Two methods to estimate working capital requirements are the Operating Cycle Period (OCP) method and the Net Current Asset method.

Introduction [1:06]

The lecture begins by addressing any pending doubts from the previous chapter, emphasizing the importance of clarifying concepts early on. The instructor then transitions to the new topic: working capital.

Working Capital and its Significance [5:50]

The chapter on working capital is categorized as "C" based on past exam analysis. Although questions from this chapter appear frequently, its extensive content across six units results in a lower priority compared to shorter, high-coverage chapters. Despite its categorization, the instructor emphasizes that it should not be skipped but approached strategically after covering more critical topics. The instructor estimates that this chapter may require 20-25 lectures to cover thoroughly.

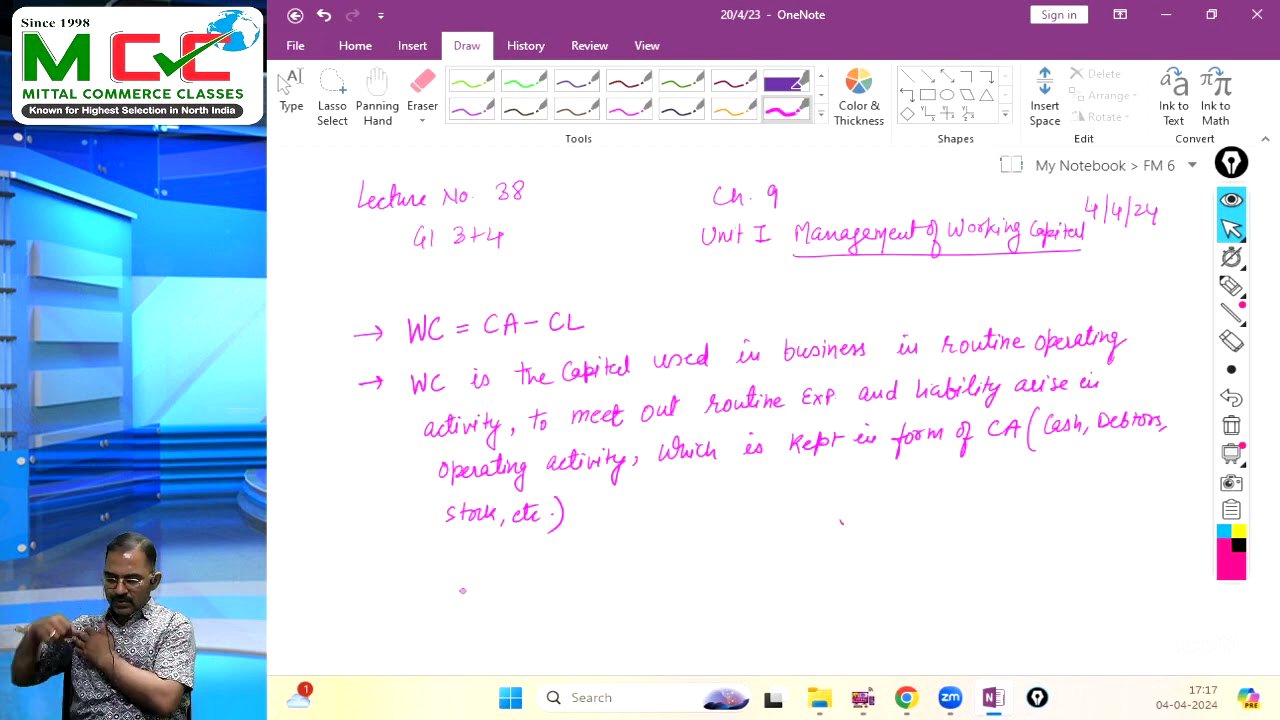

Defining Working Capital [8:21]

Working capital is defined as the capital used in routine operating activities of a business, such as purchasing, sales, and meeting routine expenses and liabilities. It is typically kept in the form of current assets like cash, debtors, and stock. Another definition describes working capital as the portion of total capital invested in current assets, which has a cost associated with it.

Understanding Working Capital Through Balance Sheet [13:08]

The instructor explains working capital using a balance sheet format, distinguishing between capital employed and current liabilities. Capital employed includes equity plus long-term debt, as well as items like short-term loans and bank overdrafts, which are sometimes kept in current liabilities. Current liabilities mainly include items arising from routine business activities, such as creditors and outstanding expenses, but exclude short-term debt capital.

The Necessity of Managing Working Capital [22:36]

Managing working capital is essential because it has a cost, and mismanagement can increase this cost, threatening the business's survival. Additionally, working capital is used in routine operating activities, and mismanagement can disrupt these activities, leading to opportunity losses.

How to Manage Working Capital [26:21]

The key to managing working capital is to maintain it at an optimum level, avoiding both over and under investment. Over-investment can increase the cost of capital, wastage, and carrying costs, while under-investment can lead to an inability to make payments on time, damage goodwill, disturb sales, and result in a loss of profit.

Determining the Optimum Level of Working Capital [30:18]

Determining the optimum level of working capital involves estimating future working capital requirements based on past experiences, market surveys, and other relevant information.

Methods to Estimate Working Capital Requirement [33:35]

Two primary methods to estimate working capital requirements are the Operating Cycle Period (OCP) method and the Net Current Asset method. The lecture then focuses on explaining the Operating Cycle Period method.

Operating Cycle Period (OCP) Method Explained [35:16]

The operating cycle refers to the business activities that start from a point and end at the same point, forming a cycle. This cycle includes converting money into raw materials, manufacturing, finished goods, sales, and then back into money. The Operating Cycle Period (OCP) is the time taken to complete this cycle.

Calculating Working Capital Requirement Using OCP Method [41:11]

The OCP method is used to determine the working capital requirement. The steps involve:

- Calculating the operating cycle period using the formula: A + P + D - C (where A is the time for raw materials, P is the time for manufacturing, D is the time for debtors, and C is the time for creditors).

- Calculating the number of operating cycles by dividing the number of days or months in a year by the operating cycle period.

- Calculating the working capital requirement using the formula: Total cost of sales / Number of operating cycles.

Example of OCP Method [44:29]

The instructor provides an example of a new business projecting sales of ₹5 crore with a cost of sales of ₹3.6 crore and an operating cycle period of two months. The working capital requirement is calculated as ₹3.6 crore divided by 6 (number of operating cycles), resulting in a requirement of ₹60 lakhs. This example illustrates how the money is used on a rotational basis throughout the year, emphasizing the importance of understanding the operating cycle period to manage working capital effectively.