TLDR;

This video provides a detailed explanation of offenses, penalties, and procedures under GST law, specifically focusing on sections 122 to 138. It emphasizes key sections like 122, 125, 129, 130, and 132, which are important for exams. The discussion covers administrative and investigative powers of the department, assessment, audit, search, and seizure. It also explains the adjudication process, different types of penalties, and actions against various offenses, including those related to invoices, tax collection, TDS/TCS, ITC, registration, and record maintenance.

- Key sections for exam preparation: 122, 125, 129, 130, 132.

- Focus on understanding the adjudication process and types of penalties.

- Important offenses include invoice-related issues, tax collection failures, and ITC irregularities.

Introduction to Offenses and Penalties [0:05]

The session begins with a focus on offenses, penalties, and procedures under GST, covering sections 122 to 138. Key sections for exam preparation include 122, 125, 129, 130, and 132. The speaker advises remembering these sections from the chart for better understanding and exam performance. This chapter is theoretical, detailing penalties and procedures.

Departmental Powers: Assessment, Audit, Search, and Seizure [1:52]

The discussion covers the administrative and investigative powers of the GST department, including assessment, audit, search, and seizure. The speaker emphasizes the importance of cooperating with the department. Assessment and audit details are available in the audit chart. The speaker advises reviewing these topics, including inspection, search, and seizure, to understand the department's powers and actions.

Assessment and Audit Mechanism [5:54]

The assessment mechanism is explained, starting with the filing of returns by registered persons. The process involves self-assessment, filing GSTR returns, and annual returns. Scrutiny under sections 73 and 74 is initiated based on discrepancies found in the returns. A notification informs the taxpayer before issuing a show cause notice, allowing voluntary payment with interest or penalty. If non-compliance continues, actions under sections 73, 74, or 74A may follow. Audits by the department require a 15-day notice, with actions under 73 or 74 if tax avoidance or wrong ITC claims are detected. Normal inspections, business place searches, and seizures can also lead to actions under 73 and 74.

Actions Under Sections 73 and 74 [8:41]

Actions under sections 73 and 74 can result from short payment or non-payment of taxes, fraud, or excess collection. Taxpayers receive a notice with an intimation of the tax due, encouraging voluntary payment. A show cause notice is issued within a specific time limit (two years nine months or four years). Section 75 states that if penalties are charged under 73, 74, or 74A, no other penalty applies. A penalty of ₹10,000 is mandatory if a notice is sent for self-assessment tax and section 73 is invoked, with an option to pay within 30 days.

Base Judgement Assessment and Penalties [12:25]

Base Judgement Assessment (BJA) under section 62 occurs when a registered person does not file returns. In such cases, notices under section 46 are issued. BJA does not involve checking intentions (bonafide or malafide). If the assessee files returns after the BJA, the assessment is withdrawn, and interest and late fees apply. If no return is filed, penalties are imposed under section 122, as 73 and 74 do not apply here. Similarly, if BJA is done under section 63 for unregistered persons, penalties are imposed under section 122, not 73 or 74.

Adjudication Proceedings and Penalties [18:33]

The adjudication process involves proceedings by a proper official under sections 73, 74, or 74A. Actions are initiated based on audits or inspections, checking for bonafide or malafide intentions. Tax determination includes short payment, non-payment, and erroneous refunds, with mandatory interest under section 75. Penalties vary based on voluntary disclosure and compliance. Proceedings are deemed concluded except under sections 129, 130, and 132. No other penalty is applicable if these proceedings conclude.

Civil and Criminal Proceedings [26:46]

Civil proceedings involve penalties and actions on goods, while criminal proceedings involve arrest. Civil proceedings are divided into actions on persons (penalty under section 122) and actions on goods (detention under 672, seizure under 129, and confiscation under 130). Criminal proceedings under section 132 can lead to imprisonment. Cognizance of offenses and compounding of offenses under section 138 are also discussed, including the grant of immunity upon payment of a prescribed amount.

Section 122: Penalties for Specific Offenses [40:01]

Section 122 outlines penalties for various offenses by taxable persons, registered persons, or any other person liable under GST. These offenses are categorized as:

- Invoice-based offenses: Supplying goods or services without an invoice, issuing incorrect or false invoices, or using another registered person's GSTIN.

- Collection and payment-based offenses: Collecting tax but failing to remit it to the government within three months, or collecting tax in contravention of the Act.

- TDS/TCS-related offenses: Failing to deduct or collect TDS/TCS, deducting or collecting less than required, or failing to remit the deducted/collected amount to the government.

- ITC-related offenses: Availing or utilizing ITC without actual receipt of goods or services, or irregularly distributing ITC.

- Registration-based offenses: Failing to register when liable, or furnishing false information during registration.

- Record-based offenses: Maintaining false financial records, producing fake accounts, or tampering with material evidence.

- Transport and storage-related offenses: Transporting taxable goods without proper documents, or transporting/storing goods liable to confiscation.

- Refund-based offenses: Fraudulently obtaining a refund of GST.

- Obstructing officers: Preventing officers from performing their duties.

- Failing to furnish information: Not providing required documents or information to an officer.

- Tampering with seized goods: Disposing of or tampering with detained or seized goods.

Quantum of Penalty Under Section 122 [1:05:31]

The penalty under Section 122 is the higher of the following:

- ₹10,000 (₹20,000 for IGST).

- An amount equivalent to 100% of the tax due.

For TDS/TCS-related offenses, ITC irregularities, and fraudulent refund claims, the penalty is 100% of the tax evaded. Section 122(1B) addresses counselors who retain benefits from transactions covered under specific clauses, imposing a penalty equal to the tax evaded. For offenses by e-commerce operators (O), the penalty is ₹10,000 (₹20,000 for IGST) or 100% of the tax involved.

Section 122(2) and 122(3): Penalties for Registered Persons and Other Persons [1:21:36]

Section 122(2) applies to registered persons involved in short payment, non-payment, or erroneous refunds due to reasons other than fraud. The penalty is ₹10,000 or 10% of the tax due, whichever is higher. If the offense involves fraud, the penalty is 100% of the tax due. Section 122(3) covers other persons not covered above, such as those aiding or abetting offenses, dealing in goods liable to confiscation, or failing to appear before an authority. The penalty extends up to ₹25,000 (₹50,000 for IGST).

Case Studies and Application of Penalties [1:35:07]

The session includes case studies to illustrate the application of penalties under GST law.

- Case 1: A company mistakenly includes exempt turnover in its export refund claim, leading to an excess claim. The penalty is determined under section 122(2) due to the inadvertent error, with the higher of ₹10,000 or 10% of the excess refund claimed being imposed.

- Case 2: A registered person collects excess tax but remits only the actual tax rate to the government. If the excess collection is not paid to the government within three months, a penalty under section 122(1) is imposed.

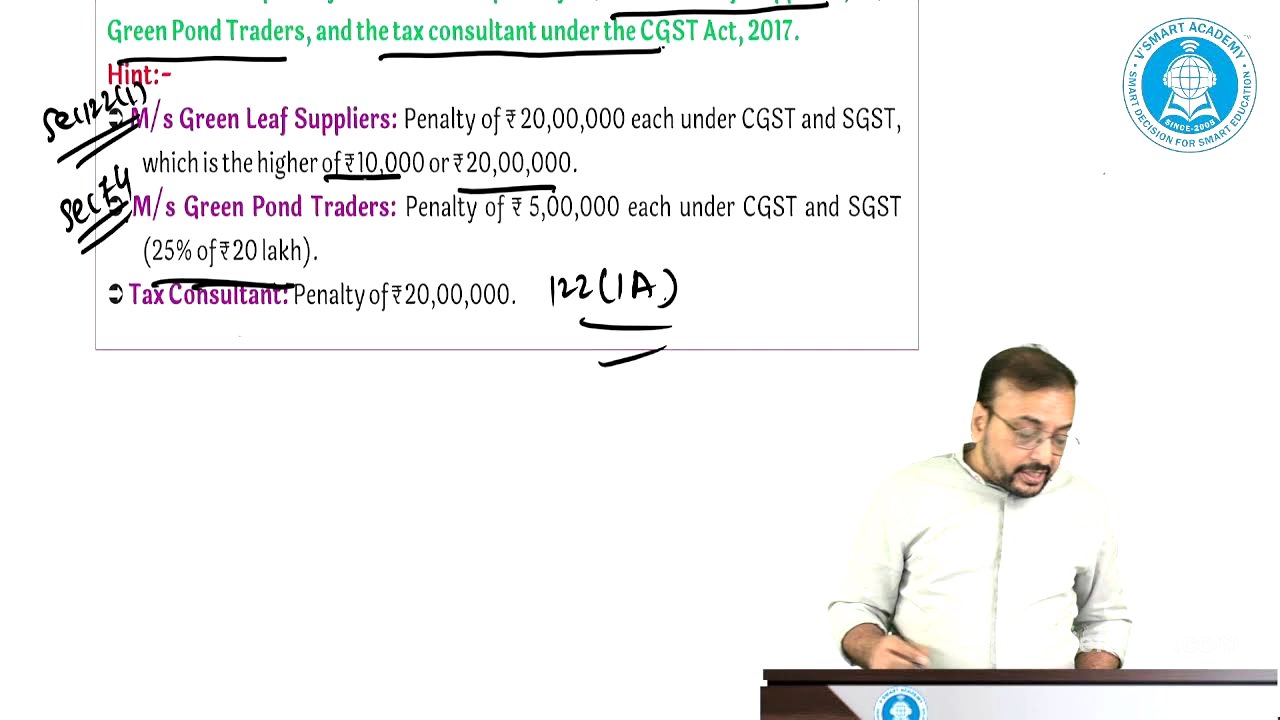

- Case 3: A supplier issues a tax invoice without any actual supply, and the buyer claims ITC based on this invoice. Penalties are imposed on the supplier under section 122(1) and on the tax consultant under section 122(1A), with the penalty for the consultant being equal to the tax evaded.