TLDR;

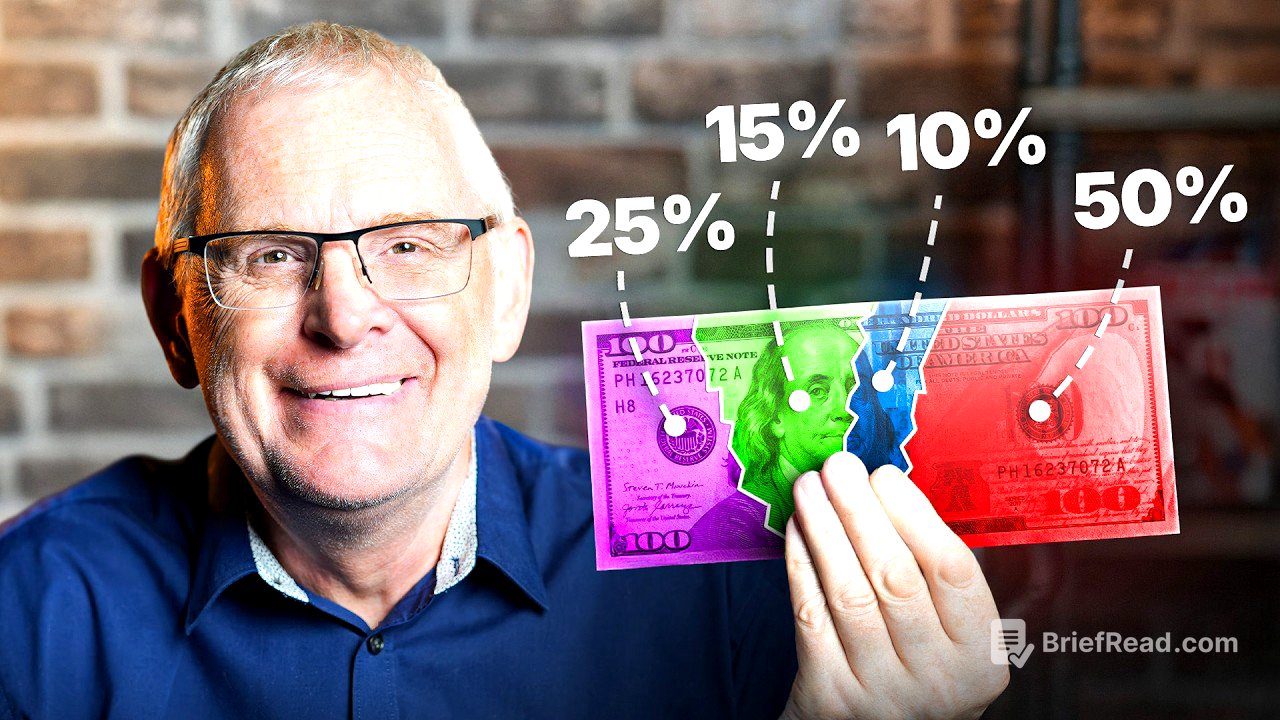

This video explains how to manage your money like the wealthiest 1% by following the 25/15/50/10 rule. This rule allocates your income into four categories: growth (25%), stability (15%), essentials (50%), and rewards (10%). The video provides practical steps for investing in assets, building a stability fund, controlling essential spending, and enjoying guilt-free rewards.

- 25% of income should be allocated to growth assets like index funds, real estate, or skills.

- 15% of income should be allocated to a stability fund to cover 5 months of essential expenses.

- 50% of income should be allocated to essential expenses, focusing on needs over wants.

- 10% of income should be allocated to rewards, such as vacations, hobbies, or gifts.

Introduction: The Secret to Managing Money Like the 1% [0:00]

The key to managing money like the wealthiest people is owning assets rather than being owned by liabilities. The richest people are entrepreneurs, investors, inheritors, athletes, entertainers, and artists. The commonality between these groups is that they own businesses, assets, trusts, or rare skills. The 25/15/50/10 rule is designed to help anyone manage their money like the top 1%, regardless of their income. It's not about how much money you make, but how you manage what you make.

25% for Growth: Investing in Assets [1:19]

25% of your income should be allocated to growth, which means buying assets that increase in value over time and generate income. The system is designed to keep people in a cycle of earning and spending, preventing them from accumulating wealth. To break free, invest in assets that work for you in the background, potentially earning more than your day job. Starting early is crucial due to the power of compound growth. For example, investing $200 a month starting at age 20 can result in significantly more wealth than investing $300 a month starting at age 30, even with a lower total investment.

Selecting Growth Assets and Tax-Advantaged Accounts [4:32]

When selecting growth assets, consider the risk and reward scale. Index funds are a relatively safe starting point, while real estate (rental property or REITs) offers another avenue. Skills that generate income, such as copywriting or coding, provide a fast return on investment. Online businesses and individual stocks carry higher risk, and alternative investments like Bitcoin are highly speculative. It's important to invest through tax-advantaged accounts to legally save money. In the UK, a Stocks and Shares ISA allows up to £20,000 a year to be invested tax-free. Workplace pensions also offer tax benefits and employer matching. In the US, Roth IRAs and 401(k)s provide tax advantages.

Investing Strategies and Building a Three-Fund Portfolio [9:36]

To start investing, set up a monthly transfer from your bank account to your investment platform. A popular method is to build a three-fund portfolio consisting of a US stock index fund (e.g., S&P 500), an international stock index fund, and a bond fund. On Trading 212, you can create a pie and allocate percentages to each fund. An aggressive approach involves more stocks, while a less aggressive approach includes more bonds. Automate your investing and focus on increasing your income to increase your investments.

15% for Stability: Building a Safety Net [14:23]

15% of your income should be allocated to stability, creating a financial safety net to protect against unexpected expenses. Many people face financial instability due to a lack of savings. Calculate your stability fund by listing your core expenses (groceries, rent, utilities, transportation) to determine your monthly baseline. Multiply this by five to determine your ideal stability fund. Store your stability fund in an easily accessible, zero-risk account that earns interest, such as a high-yield savings account.

Strategies to Quickly Build a Stability Fund [18:47]

To quickly build your stability fund, use three tactics: the paycheck sweep (automatically transfer 15% of your income), the replacement promise (immediately replace any money you dip into), and the save-by-spending hack (use roundup apps or cashback credit cards). Once your stability fund is fully stocked, you can roll that money into growth or shift it into the final 10% for rewards.

50% for Essentials: Controlling Spending [20:31]

50% of your income should be allocated to essentials, focusing on needs over wants. Many people live paycheck to paycheck due to lifestyle creep. Essentials include rent/mortgage, groceries, utilities, transport, insurance, and basic clothing. Takeout, unnecessary subscriptions, and unused gym memberships are not essentials. Get clear on your essentials and eliminate what you don't need.

Strategies to Reduce Essential Expenses [23:48]

To shrink your essential expenses, focus on housing and transport. Renegotiate your rent, consider house hacking, and limit housing costs. Buy used, reliable cars and avoid car payments. Use rules, not willpower, to control spending. Before buying something, ask yourself if it's an impulse purchase, if you're buying for the brand or the value, and if it will improve your life. Use the 7-day rule to avoid impulse purchases.

10% for Rewards: Enjoying Your Money [28:16]

10% of your income should be allocated to rewards, allowing you to enjoy your money and stay motivated. This is a strategy, not an excuse, to make your financial diet sustainable. Make it guilt-free by spending on valuable categories like vacations, hobbies, nights out, and gifts for loved ones.

Maximizing the Impact of Rewards [31:31]

To maximize the impact of your rewards, preload the fun by opening a separate bank account called your joy jar and setting up an automatic transfer of 10% of your income. Prioritize experiences over material possessions. Spend your 10% on things you'll actually remember, such as trips, outings, and social activities.