TLDR;

This video explores the story behind Minimalist, a beauty brand acquired by HUL for ₹3,000 crore, marking the largest all-cash D2C deal in India. It examines the brand's origins in Jaipur, its focus on transparent ingredient-first formulations, and its unique marketing strategies that led to rapid growth and a strong customer base. The video also discusses Minimalist's financial performance, its decision to prioritize product quality over higher profit margins, and the strategic reasons behind its acquisition by HUL, including the entry of its inspiration, The Ordinary, into the Indian market.

- Minimalist was founded in 2020 in Jaipur by two brothers, Rahul and Mohit Yadav.

- The brand focuses on transparent, science-backed skincare formulations, challenging the "organic" and "natural" narrative prevalent in the Indian beauty market.

- Minimalist achieved rapid growth through word-of-mouth marketing and high customer repeat rates, reaching ₹100 crore in revenue within eight months.

- The acquisition by HUL was driven by the need to scale offline, compete with the entry of The Ordinary in India, and leverage HUL's extensive distribution network.

Intro [0:00]

HUL recently acquired the beauty brand Minimalist for ₹3,000 crore, the largest all-cash D2C deal in India. Minimalist, founded just four years ago during the pandemic, has made a significant impact. The brand was built in Jaipur, a tier-2 city, with the founders retaining a 60% stake, earning them ₹1,700 crore in cash. Minimalist succeeded in a highly competitive sector dominated by established giants like HUL and Unilever. The video aims to explore how Minimalist achieved this and the reasons behind HUL's acquisition.

Early Days [1:09]

In 2018, brothers Rahul and Mohit Yadav started their entrepreneurial journey with Freewill, a customized haircare brand. Freewill created personalized solutions based on individual hair types, a fresh approach compared to generic beauty brands. This innovative idea led to their participation in Sequoia Capital’s Surge program in 2019. Freewill sold 2.5 lakh products and received high user ratings, indicating a promising start. However, Freewill was shut down within two years due to scalability issues, as personalized, on-demand beauty products were time-consuming and expensive to produce, hindering the potential to scale into a large brand.

Origin of Minimalist [2:54]

While building Freewill, the brothers recognized that the beauty market was driven more by marketing than effective products. The Indian market was filled with brands exaggerating "organic" and "natural" claims, a practice known as greenwashing. Mohit, inspired by The Ordinary, a Canadian brand known for its transparent, science-backed formulations, saw an opportunity. In 2020, they launched Minimalist with a simple Instagram post, focusing on clean beauty and educating consumers about effective chemicals, producing only 1,000 bottles of a single face serum to test the market. Minimalist highlighted ingredients on the front of their packaging, explaining their benefits and challenging the myth that all chemicals are harmful.

Crazy Growth [5:35]

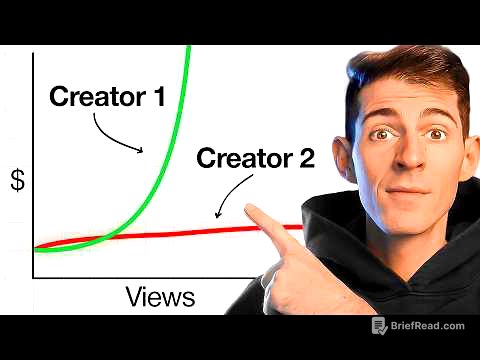

Minimalist sold out its initial 1,000 bottles in just a few days, surprising the founders. A beauty YouTuber's positive review led to increased attention from other influencers, resulting in rapid growth. Despite some accusations of copying The Ordinary, Minimalist openly acknowledged the brand as its inspiration. Instead of investing heavily in marketing, Minimalist focused on gathering real customer reviews and testimonials, using them as authentic influencer marketing. This approach saved money, with marketing spend at 25% of revenue compared to the industry standard of 40-50%. Minimalist's high repeat rate of 60%, nearly three times the industry average, and a ROAS of 4, contributed to hitting ₹100 crore in revenue in just eight months.

Financials: breaking down profitability [8:21]

Minimalist's revenue has doubled almost every year, but its profit margins decreased from 20% to 3% between FY21 and FY24. This decline isn't due to marketing costs, which are lower than industry standards, but rather the Cost of Goods Sold (COGS). Minimalist's COGS stands at 35%, resulting in a 65% gross margin, lower than competitors like Mamaearth and SUGAR. Minimalist prioritizes product quality and control by owning its production facilities, using premium ingredients, and investing in R&D. This strategy, similar to Tesla's, focuses on product excellence to drive customer loyalty and word-of-mouth marketing. Additionally, Minimalist maintains a tight product range, with only 66 products, leading to lower inventory costs and efficient operations.

3,000 Crore Exit and Road Ahead [11:10]

Minimalist initially focused on online sales, allowing for better customer education and quality control. While 90% of their revenue still comes from online channels, the company is slowly expanding offline. To compete with major players like HUL and Nestle, an offline presence is necessary. The acquisition by HUL, valued at ₹3,000 crore, provides Minimalist with access to HUL's extensive distribution network. Another reason for the acquisition is the entry of The Ordinary into the Indian market. With The Ordinary now in India, Minimalist needs the financial and distribution muscle of a player like HUL to stay competitive.