TLDR;

Dr. Eli discusses dental school debt and loan repayment strategies, providing insights into managing student loans for both general dentists and orthodontists. He uses realistic scenarios, including his own projected debt, and suggests investment strategies to mitigate the financial burden. The video emphasizes the importance of financial planning, living within one's means, and considering the long-term value of a dental education.

- General dentists can manage $500,000 in debt with a $200,000 salary by budgeting and making smart financial choices.

- Orthodontists can handle $900,000 in debt with a $500,000 salary by investing a portion of their income.

- Investing in assets like the S&P 500 can significantly offset the burden of student loan debt over time.

Introduction [0:00]

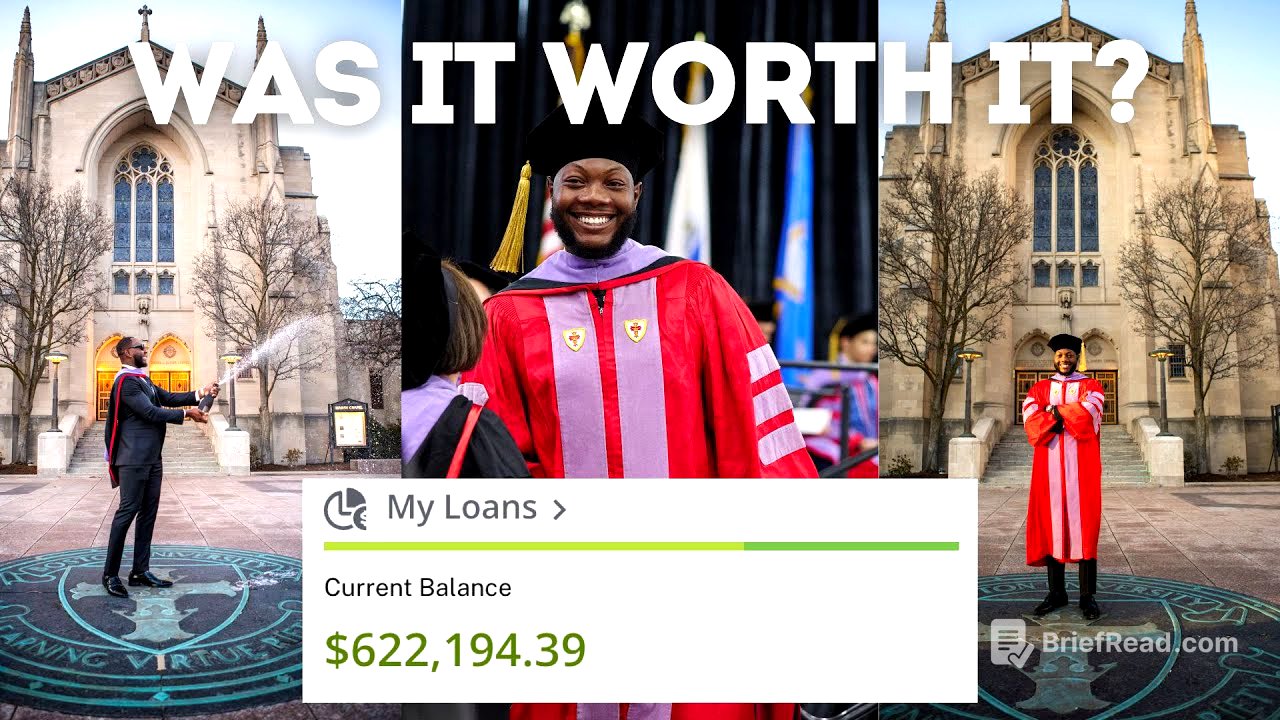

Dr. Eli introduces himself and the channel's focus on his life and journey through dental school and residency. He aims to address the hot topic of dental school debt, sharing his research and strategies for managing student loans, especially with a projected debt of $900,000 after residency. The goal is to ease concerns about debt by presenting realistic repayment scenarios for general dentists and specialists.

General Dentist Debt Repayment [2:23]

Dr. Eli starts with a scenario for a general dentist who graduates with $500,000 in student loan debt. Assuming a 7% interest rate, the monthly payment to pay off the loan in 10 years would be approximately $5,805. With a gross salary of $200,000 in Texas (which has no state income tax), the take-home pay would be around $147,000 per year, or $12,384 per month. After the loan payment, this leaves about $6,500 per month for other expenses.

Living Within Your Means [4:37]

Dr. Eli emphasizes that while $6,500 per month might not seem like a lot, it equates to a $78,000 annual salary, which is good money if one lives within their means. He suggests budgeting, avoiding unnecessary expenses, and driving a modest car to manage finances effectively while paying off loans. This approach makes the debt manageable and allows the dentist to keep up with peers financially.

Orthodontist Debt Repayment [6:18]

Dr. Eli discusses his situation, projecting $900,000 in student loan debt after completing his orthodontics residency. He plans to refinance his loans at a 5% interest rate. To pay off $900,000 in 10 years at this rate, the monthly payment would be $9,545. He notes that orthodontists can earn around $500,000 per year. In Texas, this would result in a take-home pay of about $340,000 per year, or $28,000 per month.

Investment Strategy [9:11]

After paying the $9,545 monthly loan payment, Dr. Eli would have $18,000 per month left. He plans to invest $3,000 to $5,000 per month in the S&P 500, which has historically provided an average annual return of 10%. By investing $5,000 per month while paying off his student loans, he would still have about $13,000 per month for living expenses. After 10 years, his investment account could grow to over $1 million, while the student loan debt would be cleared.

Long-Term Financial Planning [11:47]

Dr. Eli concludes that managing student loan debt is about making proper financial decisions, budgeting, and seeking financial advice. He suggests that after 6 or 7 years, the investment account might have enough funds to pay off the remaining student loan balance, saving on interest. He argues that dentistry is still a good profession, especially for those passionate about it, and that financial concerns can be mitigated with careful planning and a long-term perspective.