TLDR;

This video explains fair value gaps (FVG) as footprints of institutional money, crucial for smart money trading strategies. It covers FVG identification, the psychology behind them, and how to use them for trading. The video emphasizes that understanding and correctly identifying FVGs can significantly improve trading outcomes.

- Market movement is influenced by liquidity zones and fair value gaps.

- Fair value gaps are formed within a three-candle sequence where the wicks of neighboring candles do not overlap the body of the middle candle.

- The price tends to return to fill the gaps and then continue its momentum with even greater strength.

- Key rules for using FVGs include waiting for a break of structure, focusing on premium zones for shorts and discount zones for longs, prioritizing FVGs at market extremes, and considering FVGs as one-time use areas.

Introduction [0:00]

The video introduces the concept of fair value gaps (FVG) and their importance in trading. It highlights that FVGs are often overlooked but represent the footprint of institutional money in the market. The video aims to explain various Candlestick FVG types, the psychology behind them, and associated price actions, as well as key criteria for identifying winning trades using FVGs.

Psychology Behind the Market Movement [1:13]

Market movements are driven by two key factors: liquidity zones and fair value gaps. The market seeks to sweep liquidity to generate momentum, with liquidity serving as the lifeblood. The market consistently fills and rebalances gaps. For example, price drops with inefficiency, leaving a fair value gap, then moves back up to fill it while clearing external liquidity. This cyclical pattern reflects the market's tendency to clear liquidity and fill FVGs.

Candlestick FVG Identification [2:48]

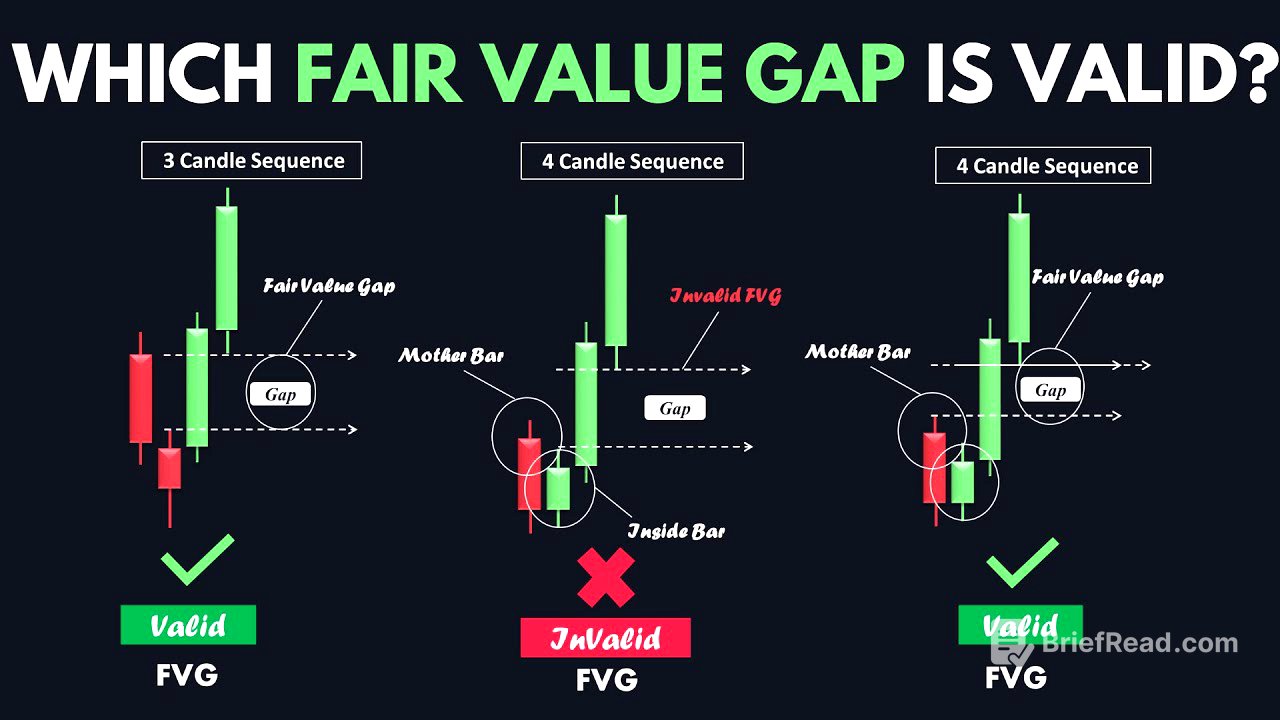

Fair Value gaps are typically formed within a three candle sequence, where the upper and lower Wicks of the neighboring candles do not completely overlap the body of the middle candle. An exception occurs when the first candle is an inside bar within a mother candle, requiring a four-candle sequence analysis. Without considering the mother candle, the identified FVG Zone will not be optimized or valid. These principles apply across various time frames and price action-based charts.

Theory Behind The Fair Value Gap [4:06]

A bullish Candlestick sequence creates an imbalance in the market. Zooming into a lower time frame reveals a bullish structure. The market tends to fill and rebalance gaps. The price creates a successive bullish structure with high buying pressure and a lack of sellers. Traders often place buy limit orders below key zones, creating a liquidity pool. Fair value gaps are filled with buy or sell orders, creating a substantial liquidity pool, attracting the price back to fill the void before resuming its trend.

Candlestick FVG Identification Example [8:13]

The video provides examples of identifying fair value gaps within bullish candle series. It demonstrates how to draw lines from the upper wick of the first candle and the lower wick of the third candle to identify gaps. The price tends to push back down to fill the liquidity voids in these fair value gaps and then continue its bullish momentum. The same concepts can be applied to bearish scenarios.

Real Chart Example! [10:36]

Using a euro dollar 1-hour chart, the video demonstrates how to utilize the fair value Gap concept in Market structure mapping. In a bearish market, analysis starts from top to bottom. After identifying a valid break of structure, potential fair value gaps resulting from recent bearish momentum are identified. The price retraces back up to fill the gaps before continuing its bearish momentum.

Essential criteria to identify & use fair value gaps to execute trades [13:12]

Several rules are essential for using fair value gaps to execute trades. First, the price must lead to a break of structure or a change of character in the market. Second, in a bearish market, focus on Fair Value gaps in the premium Zone for short positions, while in a bullish Market, focus on fair value gaps in the discount area to execute long positions. Third, fair value gaps at Market extremes hold higher priority. Fourth, unmitigated fair value gaps are considered one-time use areas.