TLDR;

The speaker believes the dollar is likely to turn bullish due to stabilizing U.S. economy and prices, the potential for trade negotiations to favor the U.S., and the delayed economic recovery in Asia. They discuss market trends, including record highs for the SMP, stabilizing market volatility, and the potential for Asian currencies to weaken. The speaker also shares their investment positions, including being long on the KOSPI effect and holding dollars, with an expectation of further strengthening.

- The U.S. economy and solid prices are stabilizing, potentially drawing assets back into the U.S.

- Trade negotiations could favor the U.S., impacting Asian currencies.

- Asia's delayed economic recovery and delayed monetary easing policies may weaken Asian currencies.

Introduction [0:00]

The speaker, Kim Seong, starts by stating his opinion that the dollar is turning bullish. He emphasizes the importance of performance and refers to Trump's hard-line stance on tariffs the previous week. Despite this, the SMP had reached record highs five times, although there was a bear market last Friday due to medical bills. The dollar experienced its best week since February, while tariff reduction measures are ongoing, with potential tariffs for all countries likely to be between 15 and 20 percent.

Reasons for a Stronger Dollar [1:19]

Kim presents three reasons supporting his bullish dollar outlook. First, the U.S. economy and solid prices are stabilizing, potentially drawing back assets that had moved out of the U.S. due to concerns. Second, the impact of tariffs and trade disputes may be more detrimental to other countries, potentially leading to negotiation outcomes favorable to the U.S. He notes that expectations for the U.S. to strengthen Asian currencies have not materialized, which could lead to a weakening of these currencies and a rise in the dollar. Third, Asia's economic recovery is still delayed, and domestic monetary easing policies are also being postponed due to concerns about housing prices.

Market Analysis and Charts [2:40]

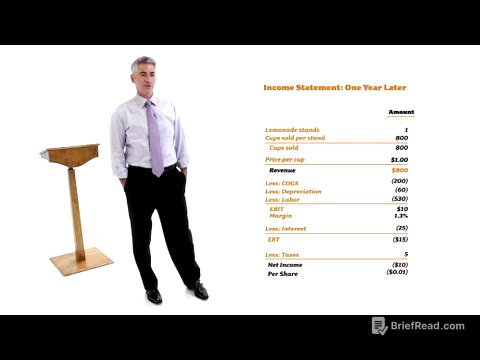

The speaker analyzes market charts, noting that the SMP is at a record high, having risen from 5,000 in April despite negative news. He believes it will not be easy for the SMP to decline from its current level. The VIXX, a measure of market volatility, has fallen to around 18, indicating market stability. Volatility related to US Treasury bonds has also decreased significantly. Reviewing the long-term exchange rate, he recalls the strong dollar phenomenon after the start of the coronavirus pandemic and suggests that the dollar may be poised to move back up to a higher range.

Dollar and Investment Positions [4:43]

The speaker discusses the dollar and notes that the dollar is a particular case. He suggests that if the expectation of the U.S. exerting upward pressure on Asian currencies does not materialize, the dollar could revert to previous levels. He shares his investment positions, including being long on the KOSPI effect and the same amount of Nasdaq and SP, although the results have not been favorable. He also holds dollars bought on June 10th, which are currently profitable, and plans to hold them longer, anticipating further strengthening.

Current Positions and Outlook [6:07]

The speaker details his current positions, mentioning a loss on the won bond side. He notes that his portfolio is almost like money in stocks. He made some money on the foreign side and suffered a small loss on the main side, resulting in an overall profit of about 33.8% for the week. He concludes by reiterating his belief that the dollar weakness may be turning around and expresses anticipation for the developments in the coming week.