TLDR;

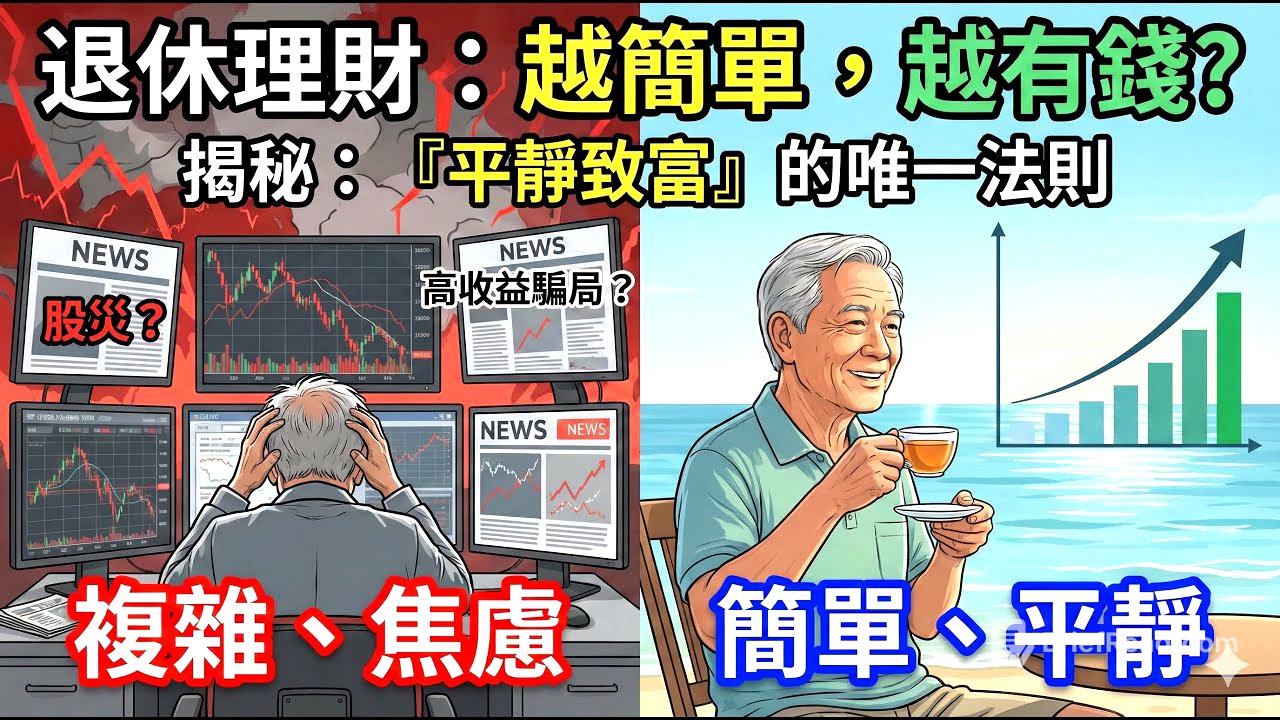

This video explores the paradox of retirement, where immense wealth doesn't guarantee happiness, and true financial freedom lies in inner peace and contentment. It emphasizes the importance of understanding "enough" and avoiding common pitfalls in investing and life. The key takeaways include:

- Financial success isn't solely about accumulating wealth but achieving inner peace and freedom from financial anxiety.

- Simplicity and understanding are more powerful than complex strategies in investing.

- Knowing what to avoid is as crucial as knowing what to do in managing finances and life.

Introduction: The Paradox of Wealth [0:00]

The video starts by questioning why some wealthy individuals are more anxious in retirement than those with modest savings. It contrasts a retired CEO, consumed by market fluctuations despite his wealth, with a retired teacher who enjoys a peaceful life on a modest pension. The key difference isn't the amount of money but their mindset and definition of success.

The Retirement Paradox: A Final Exam [1:49]

Retirement is portrayed not as a finish line but as a final exam that tests whether one has learned the concept of "enough." Many wealthy individuals remain anxious because they are trapped by the belief that their money must continually grow, driven by a fear of loss and a need to keep up with others. This fear leads to a cycle of anxiety and potentially destructive investment decisions.

The Biggest Enemy: Yourself [2:51]

The video asserts that the greatest enemy in investing is not external factors like market crashes or inflation, but oneself. Top investors understand the simple yet counterintuitive principle that doing less is often more profitable. Most people fail in investing because they cannot remain patient, a difficult task as it goes against human nature.

The Five Wealth Demons [3:51]

The video identifies five internal "demons" that sabotage financial well-being: fear of boredom, admiration of complexity, FOMO (fear of missing out), the compulsion to act, and the desire to prove oneself. These traits drive people to make unnecessary and often harmful financial decisions.

The Power of Simplicity [4:30]

The most effective and stable financial strategy for retirement is simplicity. This involves investing in assets that allow one to sleep soundly at night and can be sustained for decades. While this approach may not be exciting or boast-worthy, it is effective because the ultimate winner is the one who survives in the long run.

Five Simple Principles for Financial Peace [5:36]

The video outlines five simple principles for financial peace: invest only in what you truly understand (explainable to a 10-year-old in 3 minutes), choose assets with stable cash flow (prioritize dividends over volatile stock prices), never borrow money to invest (avoid leverage), concentrate understanding rather than diversify ignorance (focus on 3-5 well-understood companies), and buy and hold for at least 10 years (true wealth is built over time, not through trading).

Seven Traps to Avoid [7:09]

The video lists seven traps to avoid, especially in retirement: complex financial products (designed to enrich the seller), promises of high returns with low risk (guaranteed scams), frequent trading (benefits brokers through fees), assets that cause anxiety (peace of mind is invaluable), chasing trends (the real gains are already made), any investment requiring borrowing (sacrifices freedom), and blindly trusting financial advisors (rely on personal research and judgment).

Redefining Financial Freedom [8:52]

The video shifts from financial techniques to life philosophy, stating that the ultimate goal of wealth accumulation is not a number but a feeling of inner peace. True wealth is freedom from financial anxiety, where one's heart is not swayed by market fluctuations. Financial freedom is redefined as having less fear, not more money.

The Essence of Enough [9:57]

The video concludes by emphasizing the concept of "enough." It is not a specific number but a turning point where one stops chasing more and recognizes that what they have is sufficient for a stable, peaceful, and dignified life. Achieving this understanding makes one wealthier than 99% of the world's rich. The video ends by prompting viewers to reflect on what "enough" means to them.