TLDR;

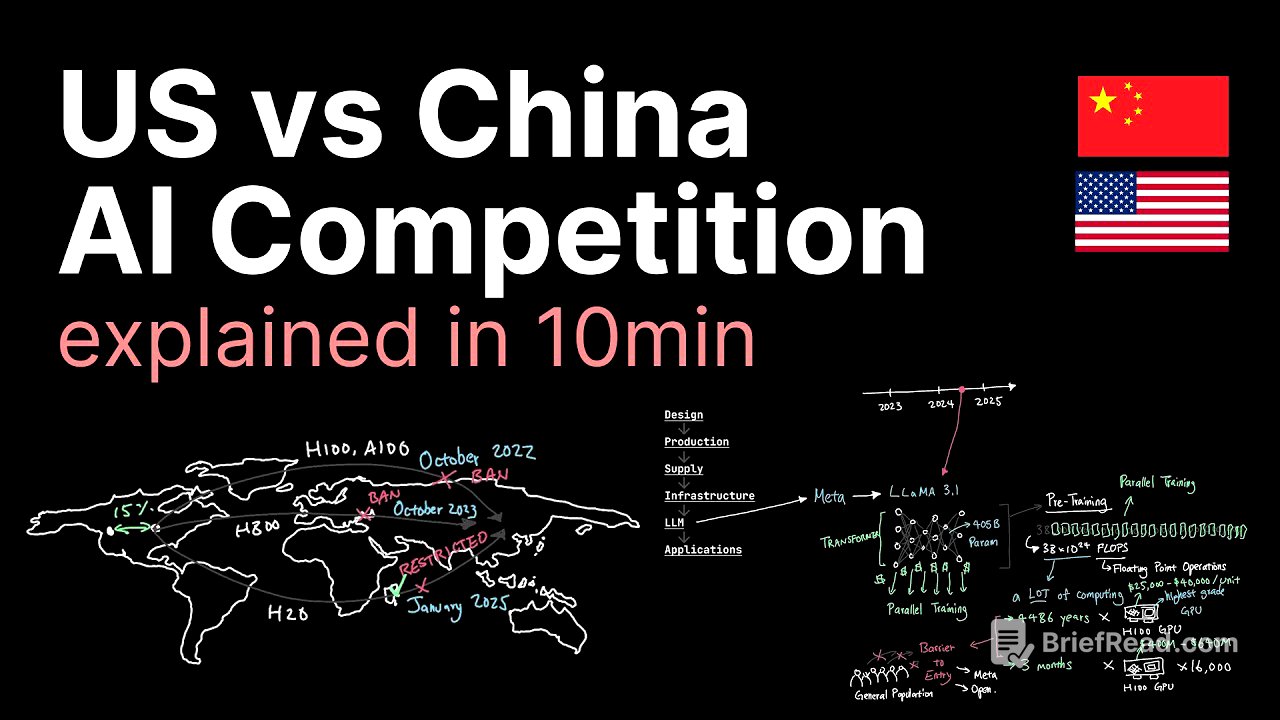

This video breaks down the US and China's competition in AI across several layers: applications, large language models (LLMs), server infrastructure, chip supply, semiconductor production, and advanced design. It highlights the varying levels of government intervention at each layer and explains why the intense competition isn't always visible at the application level. The video emphasizes the high barriers to entry in LLM development and chip manufacturing, the impact of US restrictions on China's access to advanced chips, and China's surprising ability to innovate with fewer resources. Ultimately, the competition boils down to advancements in the application layer, where AI's potential in sectors like healthcare, military, and finance will justify the massive investments in the underlying layers.

- Competition in AI between the US and China spans multiple layers, from applications to chip manufacturing.

- US restrictions on chip exports have created barriers for Chinese companies, but they've shown an ability to innovate with fewer resources.

- The ultimate goal is to drive advancements in AI applications across various sectors, justifying investments in the underlying infrastructure.

AI Competition: Application Layer [0:33]

The application layer, where AI applications like ChatGPT and Cloud Code are created and used, has the highest competition due to low barriers to entry. Anyone can create AI applications relatively easily, but competing with major LLM providers like OpenAI, Anthropic, and Meta is much more difficult. Meta's Llama 3.1 model, for instance, required massive computing power to train, costing hundreds of millions of dollars and months of work, illustrating the high barrier to entry in LLM development.

LLM and Infrastructure Layers [2:26]

China has several companies like Alibaba and Deepseek that can compete at the LLM level, but they need access to many GPUs. The training time for LLMs increases significantly with fewer GPUs. Companies like Meta and OpenAI have invested heavily in infrastructure with hundreds of thousands to millions of GPUs. However, US restrictions on chip exports to China have created a barrier to entry, limiting their infrastructure capabilities compared to US counterparts.

Supply Layer: Chip Restrictions and Innovation [4:36]

The US is throttling China's chip supply, weakening its infrastructure. Despite these restrictions, Deepseek used the H800 GPU to train its V3 model, demonstrating China's ability to innovate with less. Deepseek's V3 model required significantly fewer GPUs and operations than Meta's Llama 3.1, challenging the notion that more resources are always necessary. This could undermine US investments in massive infrastructure projects if efficient LLM training becomes the norm.

Manufacturing Layer: Semiconductor Production [6:32]

China aims to reduce its reliance on foreign countries in the semiconductor layer through its "Made in China 2025" policy. However, chip manufacturing is expensive and technically challenging, with Taiwan's TSMC being the primary producer. China faces barriers to entry, including a lack of equipment like EUV lithography, which is essential for producing high-performance GPUs. The US has also banned ASML from selling EUV equipment to China, further hindering its chip production capabilities.

Competition and the Application Layer [8:45]

China is proving its ability to compete with less by releasing open models like Deep Seek 3, despite US restrictions. Ultimately, the competition hinges on the application layer, where AI's potential in sectors like healthcare, military, and finance will justify the investments in the underlying layers. The breakthroughs in each layer above should be leveraged to unlock more automation and innovation, transforming how we do things.

![This Crypto Crash Will NOT End Here! [Here's Why]](https://wm-img.halpindev.com/p-briefread_c-10_b-10/urlb/aHR0cDovL2ltZy55b3V0dWJlLmNvbS92aS9EbUdyNzlUemp4TS9ocWRlZmF1bHQuanBn.jpg)