TLDR;

This video provides a comprehensive introduction to accounting principles and practices, designed for individuals with little to no prior knowledge. It covers fundamental concepts such as assets, liabilities, equity, income, and expenses, and explains the rules of debit and credit. The video also details the accounting principles, the flow of accounting entries from the general journal to financial statements, and includes practical examples to illustrate key concepts.

- Accounting is the language of business, recording financial transactions with debit and credit entries.

- Assets, liabilities, equity, income, and expenses are the five key categories in accounting.

- Financial statements, including the balance sheet, income statement, and cash flow statement, are prepared based on accounting entries.

Introduction [0:00]

The video introduces a comprehensive guide to accounting basics, aiming to equip viewers with the knowledge to prepare financial statements and understand their meaning. It encourages viewers interested in accounting careers or those seeking to clarify accounting concepts to watch the video in its entirety. The presenter also invites feedback and questions in the comments section.

What is accounting? [1:02]

Accounting is defined as the language of business because it records every business transaction using specific rules, procedures, and principles. These rules are essential for maintaining accurate financial records, also known as bookkeeping. Every financial transaction, such as a fast-food restaurant purchasing buns or paying for electricity, involves money and requires a specific method of recording.

What are debits and credits? [2:30]

Every transaction in accounting has two consequences: a debit and a credit. Unlike non-accounting entries that record a single line, accounting uses a double-entry system. For example, purchasing buns would be recorded as a debit to the buns inventory (an asset) and a credit to cash paid (another asset). The total of debits always equals the total of credits, reflecting an increase or decrease in assets, liabilities, expenses, income, or equity.

Rules of Debit and Credit [5:14]

The rules of debit and credit dictate how increases and decreases in assets, liabilities, equity, income, and expenses are recorded. Assets increase with a debit and decrease with a credit, while liabilities, equity, and income increase with a credit and decrease with a debit. Expenses follow the same logic as assets, increasing with a debit and decreasing with a credit. Assets, liabilities, and equity are part of the balance sheet, while income and expenses are part of the income statement.

Default balance position [8:38]

Assets and expenses typically have a debit balance, while liabilities, income, and equity usually have a credit balance.

What is an Asset in Accounting [9:04]

An asset is something you own or possess and expect to use or benefit from in the future, such as a house, money in the bank, or a car. According to International Financial Reporting Standards (IFRS), an asset is a present economic resource controlled by the entity as a result of past events, with the potential to produce economic benefits.

What are International Financial Reporting Standards (IFRS) [10:23]

IFRS are accounting standards developed to ensure that business entities across the globe follow similar accounting practices, allowing for internationally comparable financial statements. These standards are required in over 100 countries, but not in the United States or India, which have their own accounting standards. The goal of IFRS is to provide consistent principles for financial reporting, enabling investors and decision-makers to compare companies from different countries.

Examples of Assets [15:24]

Common examples of assets include cash at hand or in the bank, buildings, computer hardware, furniture, inventory, vehicles, machinery, land, accounts receivable, prepayments, investments, computer software, goodwill, trademarks, patents, and copyrights. These assets are controlled or owned by the business and can be utilized to receive future benefits.

Types of assets in Accounting [18:50]

Assets are broadly categorized into current assets, non-current assets, and intangible assets. Current and non-current assets are distinguished by the time frame in which they are expected to be realized, while intangible assets are differentiated by their physical nature.

Current assets in Accounting [19:12]

Current assets include cash, cash equivalents, and assets expected to be converted into cash within 12 months or the normal operating cycle of the business. Examples are cash at hand, inventory, accounts receivable, and short-term investments. These assets are typically found on the balance sheet.

Non-current assets in Accounting [22:10]

Non-current assets are those expected to be utilized or converted to cash over more than 12 months. Examples include buildings, computer hardware, furniture, vehicles, machinery, land, long-term investments, computer software, goodwill, trademarks, patents, and copyrights. These are also listed on the balance sheet.

Intangible assets [23:20]

Intangible assets are non-physical assets that can be created or acquired. Examples include computer software, goodwill, trademarks, patents, and copyrights. These assets can have a definite or indefinite period of benefit.

What is a Liability in Accounting [24:45]

A liability is a present obligation of the entity to transfer economic resources as a result of past events. Key points include that it is a present obligation arising from a past event.

Types of Liabilities [28:54]

Liabilities are classified into current (short-term) liabilities, non-current (long-term) liabilities, and contingent liabilities. Current liabilities are due within a year, non-current liabilities are due beyond a year, and contingent liabilities depend on an uncertain future event.

What is Equity [30:49]

Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing ownership. It includes ordinary shares, preference shares, and accumulated retained earnings. The balance sheet equation states that assets are equal to liabilities plus equity.

Income and expenses [34:31]

Income increases assets or decreases liabilities, resulting in increases in equity, excluding contributions from equity holders. Expenses decrease assets or increase liabilities, resulting in decreases in equity. Income is money received from sales, services, or investments, while expenses are costs incurred in exchange for something.

Accounting principles [40:34]

Accounting principles guide the preparation of financial statements and accounting entries. Key principles include the accrual principle (recording transactions when they occur, not when cash is exchanged), the matching principle (matching revenue and expenses in the same period), the cost principle (recording assets at their purchase price), the going concern principle (assuming the business will continue operations), materiality (omissions are not material if they don't influence decisions), revenue recognition (recording revenue when goods or services are delivered), and consistency (applying accounting principles consistently).

Practice accounting entries (Examples) [53:58]

The video provides several examples of accounting entries to illustrate the application of debit and credit rules. These examples include a business owner depositing equity, purchasing furniture with cash, buying furniture on credit, settling accounts payable, paying rent, receiving dividend income, and buying and selling bicycles. Each example demonstrates how to identify the impacted accounts, determine whether they are increasing or decreasing, and apply the appropriate debit and credit entries.

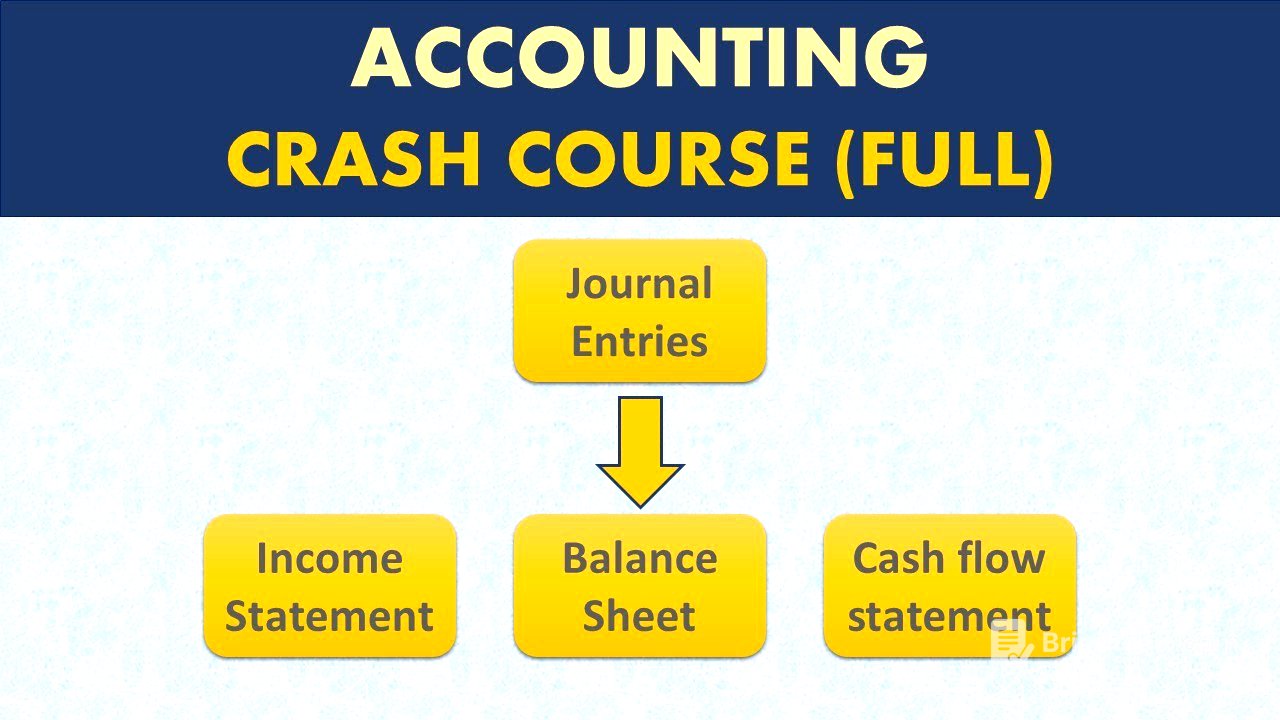

Flow of Accounting entries [1:09:47]

The flow of accounting entries starts with the journal entry, which is summarized in the general ledger, then transferred to the trial balance, and finally used to prepare the financial statements. The general journal records all business transactions in chronological order, while the general ledger summarizes these transactions based on the account number. The trial balance lists all accounts with their balances, and the financial statements include the balance sheet, income statement, and cash flow statement.

General Journal [1:11:04]

The general journal records all business transactions or double entries in chronological order. Each entry includes the date, accounts affected, and a description of the transaction.

General Ledger [1:12:38]

The general ledger summarizes all accounting transactions based on the account number or GL account type. It provides a summary of all transactions that took place in each account, including the date, description, debit, credit, and final balance.

Trial balance [1:16:00]

A trial balance is a list of all accounts with their balances, summarizing the debit and credit balances from the general ledger. It is used to ensure that the total debits equal the total credits, providing a summary of all the accounts in the books and their balances at a given point in time.

Financial statements [1:17:28]

Financial statements include the balance sheet, income statement, cash flow statement, changes in equity, and comprehensive income. These statements are prepared using the information from the trial balance.

Balance sheet [1:18:07]

The balance sheet reflects assets, liabilities, and equity at a specific point in time. It follows the accounting equation: assets = liabilities + equity.

Income statement [1:19:30]

The income statement, also known as the profit and loss statement, summarizes income and expenses for a specific period. It shows the company's financial performance over that period, calculating net income by subtracting total expenses from total revenues.

Cash flow statement [1:22:37]

The cash flow statement reports the movement of cash both in and out of an organization during a particular period of time. It is divided into three sections: cash flow from operating activities, investing activities, and financing activities. The statement can be prepared using either the direct method or the indirect method, with the direct method being the recommended approach.