TLDR;

This video presents a Stoic trading system designed to simplify trading and improve discipline. It emphasises the importance of simplicity, clarity, and consistency in trading, advocating for a system built on one timeframe, one market bias, one setup, and a binary outcome. The system uses the 20 and 200 simple moving averages to identify market trends and a 61.8% Fibonacci retracement for entries, combined with the SBS (manipulation) pattern. The video also highlights the need for journaling and continuous review to refine execution and maintain emotional stability.

- Simplicity over complexity

- Discipline and consistency are key

- Use of 20 and 200 SMAs and 61.8% Fibonacci retracement

- Importance of journaling and review

Introduction: Embracing Simplicity in Trading [0:03]

The presenter describes the chaotic experience of many traders, overwhelmed by conflicting advice and complex indicators, leading to losses and stress. He introduces a Stoic trading system designed to bring simplicity and repeatability to trading, acting as a "mental reset button". The system aims to provide clarity and confidence, contrasting with the anxiety caused by overcomplicated approaches. The presenter also promotes the Stoic Traders community for those seeking deeper analysis and support.

The Pitfalls of Complexity [2:24]

The speaker argues that complexity in trading, such as using numerous indicators and following many concepts, leads to confusion and anxiety rather than clarity. He shares his personal experience of cluttering charts with various tools and setups, which ultimately slowed him down and made him a worse trader. Drawing on Stoic philosophy, he advocates for simplicity and repeatability in trading systems, emphasizing that if a system isn't simple, it shouldn't be traded.

The Complexity Tax: Costs Beyond Capital [5:02]

The presenter outlines the costs associated with complexity in trading, extending beyond monetary losses to include time wasted chasing elusive strategies, capital depleted by inconsistent results, and impaired mental well-being due to doubt and stress. He introduces the concept of the "DJ gambler" who chases quick wins and is addicted to the rush, leading to poor decision-making and account blow-ups. The speaker stresses that the market is indifferent to individual traders' feelings and urges viewers to avoid donating further "tuition payments" to the market.

Gains from a Bounded System [7:30]

Committing to a simple, well-defined trading system brings several advantages, including faster decision-making, statistical clarity, emotional stability, and scalability. A bounded system allows traders to quickly assess the market environment and act decisively, build a data set to replace hope with expectancy, and grow confidence through rule-following. The speaker shares examples of traders in the Stoic Traders community who have transformed their trading by adopting these principles.

The Importance of Journaling and Review [8:53]

The video stresses the importance of journaling every trade, grading execution, and refining the system weekly. Rule following, whether the trade wins or loses, is considered a victory, while rule breaking is seen as debt. The speaker likens his weekly trade reviews to looking in a mirror, revealing areas for improvement. He encourages viewers to start journaling immediately as a key habit that distinguishes successful traders.

Stoic Trading System Checklist [9:51]

The presenter introduces a Stoic system checklist, available via a link in the description, designed to act as an anchor and keep traders grounded amidst market chaos. He emphasises that guard rails outperform raw willpower and encourages viewers to print the checklist and keep it visible as a constant reminder of the system's rules.

The Complete Stoic Trading System: Identifying Trends with Moving Averages [10:18]

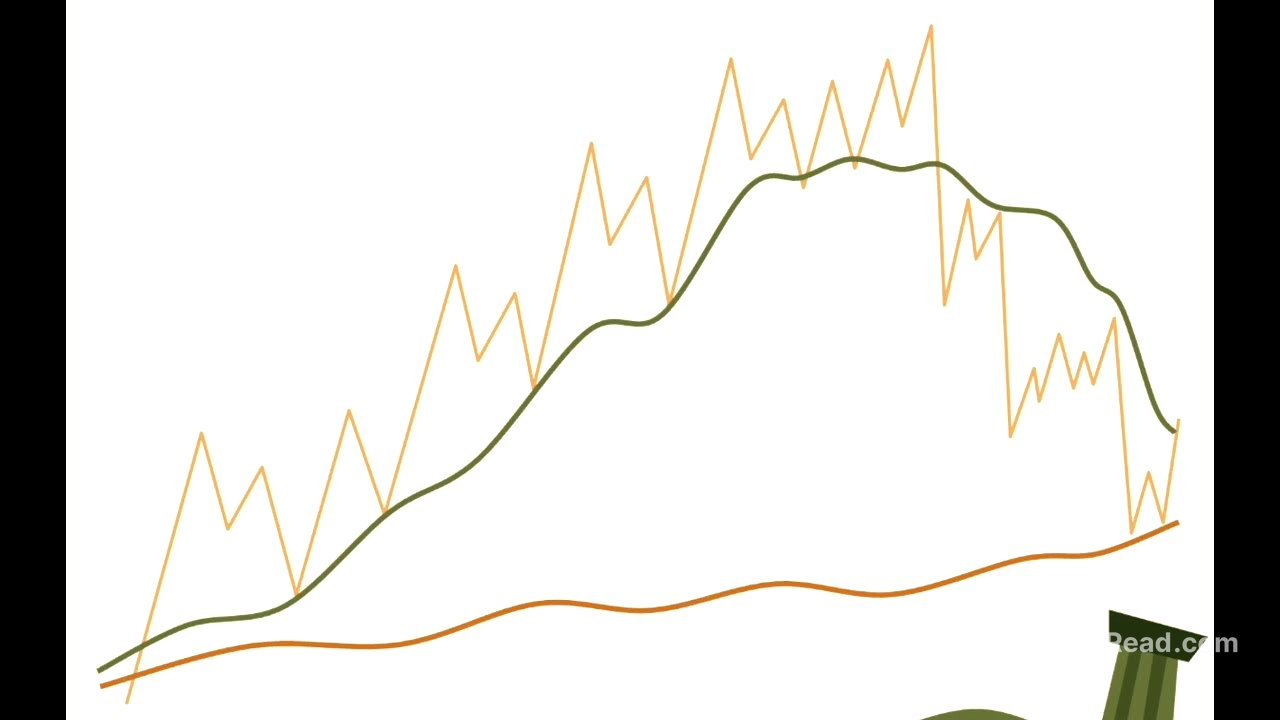

The speaker introduces the complete Stoic trading system, noting that it's possible to build your own. The system uses the 20 and 200 simple moving averages (SMAs) to determine market trends. If the price is above both moving averages, the market is likely trending upwards; if below, it's likely trending downwards. The presenter explains that this simplicity allows even a child to analyse the market bias.

Analysing Historical Data with SMAs [13:38]

The presenter reviews historical data, including periods during the Biden administration and the COVID-19 pandemic, to illustrate how the 20 and 200 SMAs can be used to identify market trends and potential warning signs. He explains that while breaking below the 200 SMA doesn't always indicate a bear market, it serves as a caution. He also notes the importance of observing price behaviour around the 200 SMA, looking for breaks and retests.

Fibonacci Retracement and SBS Pattern [16:30]

The next component of the trading system involves using the 61.8% Fibonacci retracement level to identify potential entry points. The presenter explains how to anchor the Fibonacci tool from the start of a significant move and look for pullbacks to the 61.8% level. He also discusses the SBS (manipulation) pattern, which often occurs after a break of structure and involves price revisiting previous levels to liquidate early entrants.

Real-World Examples and Trade Recaps [20:19]

The presenter recaps a bearish trade example, highlighting the confluence of a break below the 200 SMA, an SBS pattern, and a 61.8% Fibonacci pullback. He explains that entries are taken at the 61.8% level with stop losses placed above the swing high. He also stresses the importance of self-management and consistent execution, regardless of the system used.

Further Examples and Bias Confirmation [22:09]

The presenter provides additional examples of trades, reinforcing the use of the 20 and 200 SMAs to confirm bias and the 61.8% Fibonacci retracement for entries. He notes that even when the price appears bullish, staying below the 200 SMA indicates continued bearish sentiment. He also explains that the system can be applied to any timeframe, from five-minute charts for day trading to daily charts for long-term investments.

Adapting to Different Setups and Market Conditions [25:51]

The presenter discusses how to adapt the system to different setups and market conditions, noting that not all pullbacks will be perfect. He explains that sometimes the price may only retrace to the 50% level or bounce off the 200 SMA. He also highlights the importance of waiting for confirmation after a flip in bias and looking for resistance to become support before entering bullish trades.

Checklist and Conclusion: Embracing Simplicity and Discipline [30:18]

The presenter summarises the trading strategy with a checklist: identify bias using the 20 and 200 SMAs, look for impulsive moves and SBS patterns, enter on the 61.8% pullback, and target a risk-reward ratio that suits your personality. He concludes by reiterating the importance of simplicity and discipline, urging viewers to commit to the Stoic trading system and avoid the distractions of overly complex approaches. He encourages viewers to download the checklist, test the system, journal their trades, and join the Stoic Traders community for further support.