TLDR;

This podcast episode features a discussion on the current state of the equity market, potential bubbles, and investment strategies. The speaker touches on the upcoming conference with notable figures like Dario Amini and Ken Griffin, and the "Pick a Ticker" contest benefiting Robinhood. The conversation covers topics such as market leverage, the performance of gold and Bitcoin, inflation concerns, and the US's dependence on rare earth minerals. The speaker expresses caution about market concentrations and government intervention, while remaining optimistic about potential market growth towards the end of the year.

- Upcoming conference with key speakers and "Pick a Ticker" contest.

- Analysis of market bubbles, leverage, and potential risks.

- Investment strategies involving stocks, gold, and Bitcoin.

- Concerns about inflation, rare earth mineral dependence, and market concentration.

- Optimistic outlook for market growth by year-end.

Upcoming Conference and "Pick a Ticker" Contest [0:00]

The speaker mentions an upcoming conference featuring interviews with Dario Amini, CEO of Anthropic, and appearances by Ken Griffin and Jamie Dam. The conference aims to be informative and educational. Additionally, they discuss the "Pick a Ticker" contest, a six-month competition where participants select one long and one short stock. This year, participants can change their picks a few times during the contest. The entry fee of $10,000 will go to charity, with 75% benefiting Robinhood to support those in need in New York City, which has a high poverty rate. The speaker emphasises the importance of New York's success, given Wall Street's significant role in financial wealth.

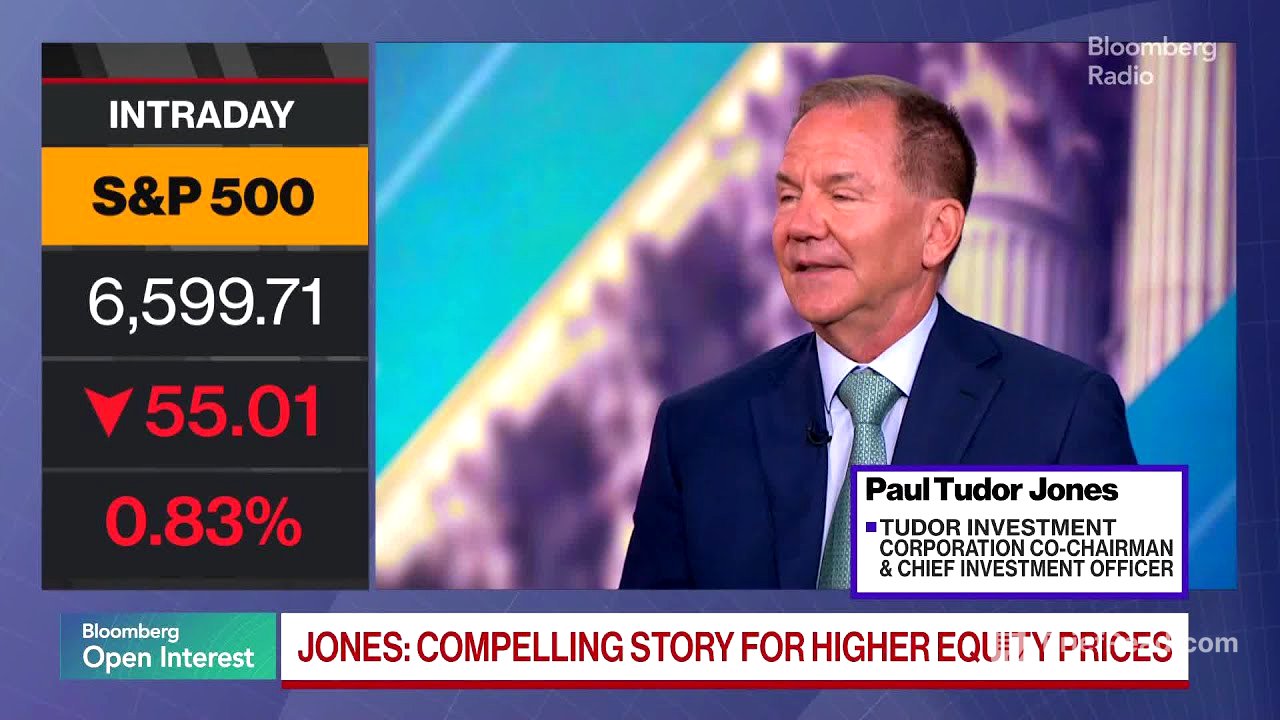

Market Bubble Analysis and Comparison to 1999 [1:45]

The speaker addresses concerns about a potential market bubble, referencing a past interview and comparing the current situation to October 1999. While 54% of fund managers believe there is a bubble, the speaker suggests it's a small one compared to past bubbles like the 1989 NASDAQ, the 1999 dot-com bubble, and the 2008 financial crisis, which saw gains of 400-600%. The Nasdaq is currently up 200% off the bottom. The speaker notes that the Fed funds rate is expected to be around 2.5% in a year, which could drive higher equity prices. The speaker also points out that current companies are more profitable than in 1999, with 95% of the S&P 500 expected to post earnings growth next year, averaging 16%.

Market Leverage and Derivative Products [4:20]

The speaker acknowledges that while corporate balance sheets may not show excessive leverage, the equity ecosystem does. There has been a significant increase in derivative products, with leveraged ETFs up 250% since the 2022 bottom and hundreds more in the pipeline. Options activity, particularly in single stocks, is also exploding. This increased leverage in the equity infrastructure is driven by a rise in retail trading. While margin debt is not as prevalent, leverage is evident in options markets and leveraged ETFs, which could pose issues down the road.

Investment Portfolio: Stocks, Gold, and Bitcoin [5:52]

The speaker discusses their investment portfolio, which includes stocks, gold, and Bitcoin. They highlight that gold has seen a 22% gain, with all assets performing above zero. The speaker believes the last week of October will be critical for stocks, coinciding with big tech earnings and clarity on the US-China conflict resolution. If the Nasdaq is higher by early November, there's potential for a significant rally in the last two months of the year. The speaker notes that $40 billion has flowed into Bitcoin and Ethereum ETFs since Liberation Day, matched by similar inflows into gold and silver. However, gold has outperformed Bitcoin, suggesting retail investors may have misjudged the debasement trade.

Inflation Concerns and Future Economic Outlook [8:57]

The speaker anticipates future inflation, driven by the need to reduce debt to GDP through lower interest rates and nominal growth exceeding interest rates. They believe the market is looking ahead to a potential resurgence of inflation in 18 months. With $370 trillion in global financial assets, even small allocations to markets like gold (12 trillion) and Bitcoin (2-3 trillion) can significantly impact prices. The speaker expects a new Fed chair to lower the funds rate to 2.5%, potentially leading to a drop in the dollar. Currency debasement is occurring globally, with central banks and populism pushing for hot economies, turning the currency debasement trade into gold and crypto trades.

Rare Earth Minerals and US Dependence on China [14:15]

The speaker addresses the issue of rare earth minerals and the US's dependence on China. They acknowledge the US military's reliance on these minerals and the depletion of reserves. The speaker does not have a solution to this problem. They comment on the White House's strategy of taking stakes in companies like MP Materials and Lithium Americas to ramp up mining. However, they express concern about the US government picking winners and losers, as it contradicts free market principles.

Market Concentration and Government Intervention [15:30]

The speaker voices concerns about concentration risk in various areas, including individual investors' high equity allocation, the concentration of the S&P 500 in seven stocks, and government decision-making. They believe diversification is crucial, drawing a parallel to the founding fathers' creation of a democracy. The speaker worries that even if current decisions are correct, they could embolden future leaders to make similar decisions, potentially leading to negative consequences.

Current Market Position and "Pick a Ticker" Strategy [17:06]

The speaker states they are not currently long on stocks, preferring to wait and see how events unfold in the coming weeks. However, they believe the market will be substantially higher by the end of the year. For the "Pick a Ticker" contest, starting November 1, the speaker would likely go long on the Nasdaq. They note that the last 12 months of a bull market typically see gains double, but it's also the most dangerous period. The speaker is still considering what their short position would be, possibly the bond market.