TLDR;

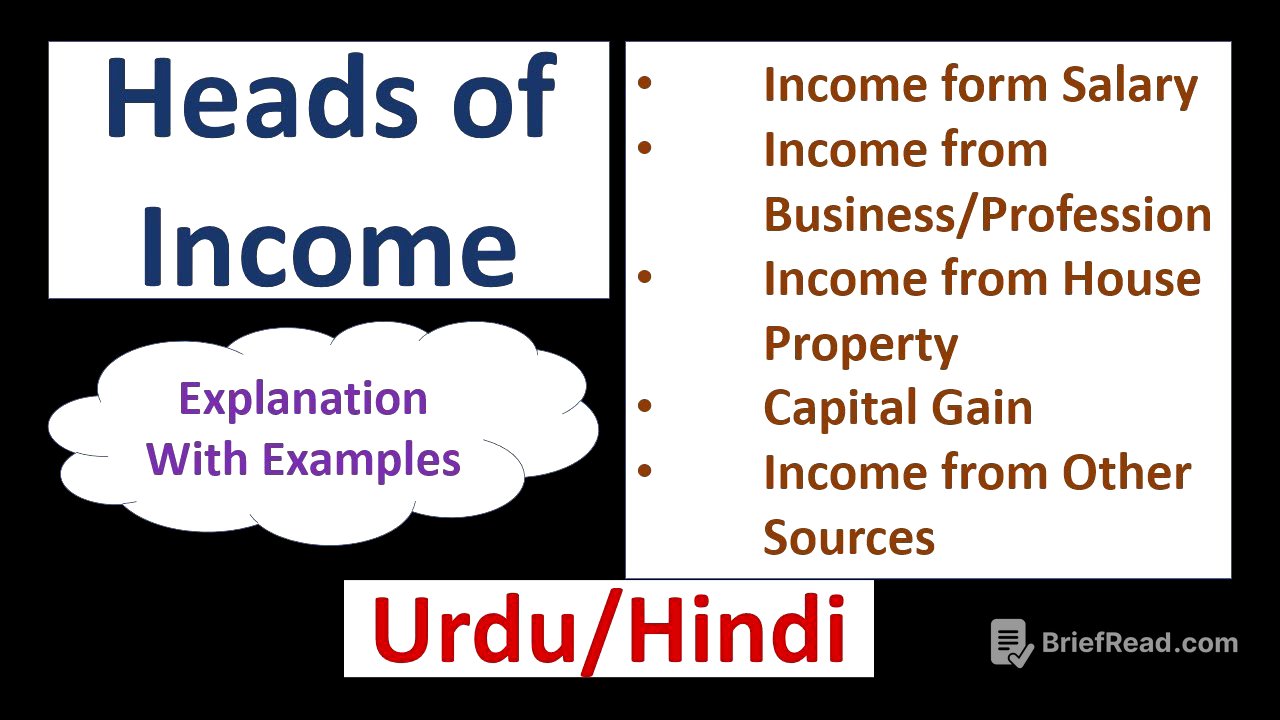

This video explains the five heads of income in the context of income tax calculation. It details how income tax is calculated, the complexities of computing income from various sources, and how the government categorises these sources into five heads for taxation purposes. The video uses a story of five friends with different income sources to illustrate these categories.

- Income tax is a tax levied on an individual's income from any source.

- Computing income is complex due to the variety of income sources.

- The government groups income sources into five categories called "heads of income" for taxation.

Introduction to Heads of Income [0:00]

The video introduces the concept of income tax, which is a tax imposed by the government on an individual's income, regardless of its source. Calculating income tax involves determining the taxable income, a process that can be complex because income can originate from various sources. The government simplifies this by grouping all possible income sources into five categories, known as "heads of income". Each head of income has its own rules, regulations, and methods for calculating taxable income, and is treated independently.

The Five Friends Story: An Illustrative Example [3:55]

To illustrate the five heads of income, the video presents a story about five childhood friends who reunite after many years and discuss their sources of income. One friend works as a business manager at a bank and earns a salary. Another owns a logistics company, generating income from his business. A third friend lives off rental income from inherited properties. The fourth friend buys and sells items for profit, resulting in capital gains. The fifth friend earns income from gambling, horse racing, and bank interest. This story serves as a practical example of the different ways individuals can earn income and how these earnings fall into different heads of income.

Income from Salary [10:06]

The first head of income is "Income from Salary". This refers to the monetary compensation an employee receives from their employer in return for services rendered. A key requirement for income to be classified under this head is the existence of an employer-employee relationship. The salary includes basic pay, allowances, commissions, bonuses, and incentives. Not all salary components are taxable, as some allowances and portions of the salary may be exempt from income tax. Tax exemptions are deducted before calculating the taxable income. Government employees, as well as those in private and joint ventures, are subject to income tax if their income exceeds a certain threshold defined by the government (e.g., £5,00,000).

Income from Business or Profession [13:00]

The second head of income is "Income from Business or Profession". This includes income derived from various business activities such as manufacturing, distribution, logistics, hotels, and retail stores. To calculate taxable income, expenses are deducted from the gross income. This category also covers income from professions such as technical services, medical practice, engineering, architecture, and call centres. Income from these professional services is also subject to tax.

Income from House Property [14:25]

The third head of income is "Income from House Property". This refers to income earned from property, typically through rental income. If an individual owns a building or house and rents it out, the rental income is taxable under this head. Even if the property is not rented out and is used by the owner, the potential rental income (the amount that could be earned if it were rented out) is still subject to tax. The tax must be paid by the individual in whose name the house property is registered.

Capital Gains [16:05]

The fourth head of income is "Capital Gains". This refers to the profit earned from investments when they are sold. Capital gains tax is levied on this profit. Capital assets, which can be movable or immovable, include properties, jewellery, antiques, mutual funds, high-value paintings, bonds and shares. Capital gains arise when these assets are transferred or sold. There are two types of capital gains: short-term and long-term. Short-term capital gains apply to assets held for less than 36 months (or less than 12 months for listed securities), while long-term capital gains apply to assets held for longer periods.

Income from Other Sources [18:23]

The fifth head of income is "Income from Other Sources". This category includes any income that does not fall under the other four heads. Common examples include interest earned on bank deposits, lottery winnings, and income from gambling. The story of the fifth friend, who earns money from horse racing, gambling, and bank interest, exemplifies this category.