TLDR;

This video presents a high win-rate MACD trading strategy that is easy to use and applicable across various markets. It explains the components of the MACD indicator and how to use it to identify market trends. The video also addresses the limitations of using the MACD indicator alone and introduces the use of a 200-day moving average and price action analysis (support and resistance levels) to improve the strategy's reliability.

- The MACD indicator is composed of the MACD line, signal line, histogram and zero line.

- Using a 200-day moving average helps confirm market trends, filtering out false signals.

- Combining MACD with price action at key support and resistance levels increases the strategy's win rate.

Introduction to the MACD Strategy [0:00]

The video introduces a MACD strategy touted as having a high win rate, ease of use, and broad applicability across different markets. The Moving Average Convergence Divergence (MACD) indicator is a popular technical indicator that uses moving averages to identify trends in markets. The presenter notes that while the MACD indicator is useful, it performs better when combined with other indicators.

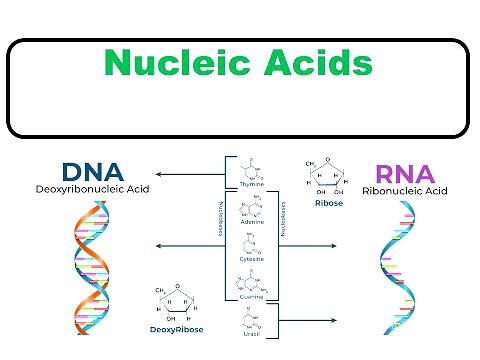

Understanding the MACD Indicator [0:58]

The MACD indicator consists of four components: the MACD line (typically a 12-day moving average), the signal line (typically a 26-day moving average), the histogram (representing the difference between the MACD and signal lines), and the zero line (the centre of the indicator). A cross upwards between the MACD line and the signal line indicates upward momentum, while a cross downwards indicates downward momentum. The histogram's size reflects the strength of the momentum. For a long trade, the lines should cross upward below the zero line; for a short trade, the lines should cross downward above the zero line.

Addressing the Limitations of the MACD [2:52]

The MACD indicator works best when the market is trending, but it can produce false signals in sideways or ranging markets. To counter this, the presenter suggests confirming the market trend using a 200-day moving average. If the price is above the 200-day moving average, the market is in an uptrend; if it's below, the market is in a downtrend.

Combining MACD with the 200-Day Moving Average [4:15]

To improve the MACD strategy, traders should only consider long trades when the MACD lines cross upward below the zero line and the current price is above the 200-day moving average. Conversely, for short trades, the price should be below the 200-day moving average, and the MACD lines should cross downward above the zero line. A stop loss can be set below the 200-day moving average, with a profit target at a 1.5 profit ratio.

Enhancing the Strategy with Price Action [5:17]

The MACD strategy combined with the 200-day moving average is less reliable when the market lacks price movement. To address this, the presenter advises incorporating price action analysis by identifying key support and resistance levels. Traders should wait for the price to hit a key support level, ensure the price is above the 200-day moving average, and then wait for the MACD lines to cross upward below the zero level before entering a long trade. This combination of MACD, moving average, and support/resistance levels is said to provide a high win rate.

![BEST MACD Trading Strategy [86% Win Rate]](https://wm-img.halpindev.com/p-briefread_c-10_b-10/urlb/aHR0cDovL2ltZy55b3V0dWJlLmNvbS92aS9yZl9FUXZ1Yktsay9tYXhyZXNkZWZhdWx0LmpwZw==.jpg)